Insurance analysts say modest rate increases for property and casualty risks will extend into 2013, as the overall economic environment is not expected to change dramatically in the coming year.

In a research note, Keefe, Bruyette & Woods says the P&C insurance market environment is expected “to be pretty much the same as what we've seen in 2012—modest rate increases but not much improvement in underlying underwriting profitability and persistent low interest rates that continue to weaken investment returns.”

In a research note, Keefe, Bruyette & Woods says the P&C insurance market environment is expected “to be pretty much the same as what we've seen in 2012—modest rate increases but not much improvement in underlying underwriting profitability and persistent low interest rates that continue to weaken investment returns.”

In its “Nine Month 2012 P&C Industry Review,” ALIRT Insurance Research, LLC, says it expects “gentle premium increases,” but notes there are factors at play that “may well moderate price increases going forward.”

“A market that experiences gentle premium increases may be the best outcome for all stakeholders as carriers' financial stability is sustained, capacity/coverage remains plentiful, and buyers do not face painful 'sticker shock' at renewal,” says ALIRT.

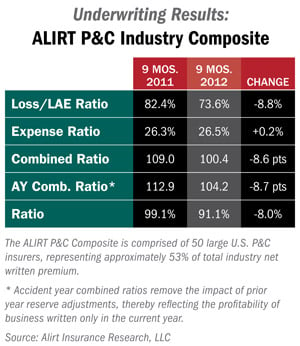

Examining its composite index of 50 P&C insurance companies representing 51 percent of the market, ALIRT says composite surplus rose close to 9 percent over the first nine months of this year due partly to operating earnings of $12 billion and net capital gains of $15 billion. The composite surplus stands at $312 billion.

The combined ratio improved to 100.4, nine points better than the same period last year. The accident-year combined ratio was 104.2, also nine points better than 2011, reflecting lower catastrophe losses over the first nine months of this year.

ALIRT says Superstorm Sandy will certainly have an impact on fourth-quarter results, especially for mid-Atlantic regional insurers. The analysts also expect the U.S. government to reexamine risk in the face of losses due to this year's drought.

“Catastrophe risks will be more-carefully evaluated as underwriters grapple with less-predictable weather patterns across the entire U.S.,” says ALIRT.

However, the P&C industry's balance sheets are strong and surplus is “well above pre-2008 levels,” the year the financial crisis began. ALIRT also notes that after seven years of a soft market, there is “clear momentum behind price firming.”

In its analysis, KBW says that while insurers can expect their investment results to “remain under pressure for the foreseeable future,” underwriting results will “slowly improve” due to “modest rate increases.” But KBW says the “long sought after hard market will remain elusive.”

This will be the case, says KBW, until excess capital is eliminated and the industry faces balance sheet pressure.

“The income statement-driven market firming we see today should keep things moving in the right direction, but we believe the industry needs to see significant balance-sheet erosion for P&C market conditions to truly harden,” says KBW.

KBW adds that “current market conditions may persist for years…”

Adding its thoughts, Swiss Re released its “Global re/insurance review 2012 and outlook 2013/14” study that generally mirrored the comments of ALIRT and KBW.

Rates are expected to modestly increase next year, says Swiss Re. However, rate increases of this year are “not enough to compensate for decreasing investment yields.”

Reserve releases are expected “to dry up” next year “supporting a stronger pace of price increases, particularly in the casualty lines.”

“The expected price increases in the casualty lines will likely be gradual due to weak economic environment and fierce competition,” says Thomas Holzheu, one of the authors of the Swiss Re report in a statement.

PropertyCasualty360

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world case studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.