The upward climb in property insurance rates has suddenly reversed course thanks to abundant capacity and continued light catastrophe losses, says Willis North America.

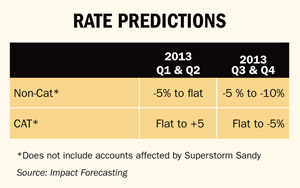

The insurance broker, a unit of Willis Group Holdings, revised its property rates forecast for the second half of this year predicting prices will decrease by 5-10 percent for non-catastrophe exposed accounts and remain flat or decrease up to 5 percent for catastrophe accounts.

Willis says its previous report, published in April, found rates for catastrophe exposed accounts were flat or increasing by 5 percent.

David Finnis, National Property Practice Leader at Willis North America, says increased capacity that was not there a few months ago accounts for the change in course. Rates will continue their downward slide unless there is a large loss event, he adds. However, this scenario does not apply to accounts affected by Superstorm Sandy, especially where flood limits are reduced or restructured.

The report notes several new players in the marketplace—Berkshire Hathaway Specialty and two China insurers, plus two new broker facilities—Aon/Berkshire Hathaway and Willis Global 360.

The report says insurers renewing their reinsurance treaties in 2013 for property risks are seeing decreases of 10-15 percent before their July renewals. Those with separate reinsurance programs for Florida Catastrophe risk see decreases of 15-20 percent due to the low level of losses since 2005.

Outside of the EF5 tornado that hit Moore, Okla., loss activity for 2013 has been light, producing profits for underwriters and combined ratios between 75 and 85 for many insurers.

A report released earlier this week by Guy Carpenter, underscored the impact financial investors are having on the insurance marketplace, pouring money into alternative risk vehicles such as catastrophe bonds, side cars and collateralized reinsurance. The effect is dampening price increases for property risks and that is spilling-over to some casualty accounts.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world case studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.