Many companies are looking at merger and acquisition (M&A) activity as a wise way to put their cash to work. Before they move forward, however, corporate executives need to be aware of some dramatic shifts in the global landscape for strategic transactions. Compared with a decade ago, there is greater potential today for unseen and underappreciated risks that could hinder an otherwise sound merger or acquisition.

Many companies are looking at merger and acquisition (M&A) activity as a wise way to put their cash to work. Before they move forward, however, corporate executives need to be aware of some dramatic shifts in the global landscape for strategic transactions. Compared with a decade ago, there is greater potential today for unseen and underappreciated risks that could hinder an otherwise sound merger or acquisition.

In the aggressive timelines that companies often adopt for the closing of transactions—which are more compressed now than they were in the past—due diligence may be abbreviated. This accelerates the M&A process but also increases the risks that the acquiring company will not fully identify the target company's historical and ongoing liabilities. Among these liabilities are environmental liabilities, exposures faced by directors and officers, and other legacy exposures.

Regulators in various jurisdictions have heightened their awareness of the legal and financial risks accompanying M&A transactions. Economic uncertainty has led both the Securities and Exchange Commission (SEC) and watchdog groups to become increasingly vigilant in pursuing their concerns about the anti-competitive implications of potential M&A deals. And the implementation of the Dodd-Frank Act and the JOBS Act will require target companies to provide their prospective acquirers with more financial statements from more years. These are significant hurdles that M&A participants 10 years ago did not face. It is crucial for companies to respond.

Recommended For You

Unearthing the Risks

Following a merger or acquisition, the buyer—a company or private equity firm—typically absorbs the liabilities of the acquired entity. If the target company has itself acquired numerous organizations through the years, tracking down and mitigating all of the successor liabilities can be daunting from a risk management standpoint. Legacy exposures may include ongoing legal claims made against an entity acquired years ago; environmental liabilities that extend back several decades; or exposures faced by the organization's directors and officers. In some cases, the current target may have acquired businesses that no longer exist in any form—but their liabilities live on.

If these successor liabilities are not identified, assessed, and mitigated, they may create latent issues for the acquirer down the road. They also may create surprises that were not accounted for in the purchase price and sale agreement.

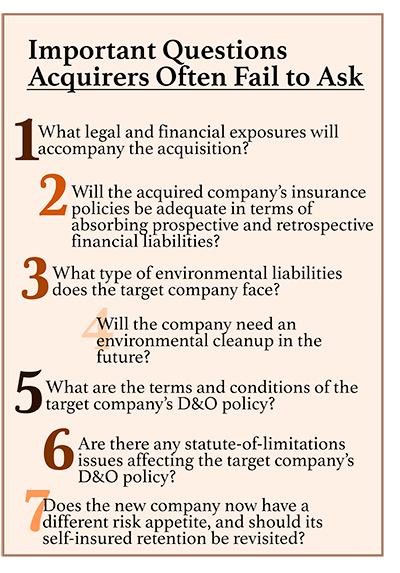

Potential liabilities are often overlooked in the due diligence phase, amid timelines that are more compressed than ever before. Don't be afraid to ask tough questions of the target entity's management team. (See Important Questions Acquirers Often Fail to Ask, below.) Testing management's existing assumptions often yields valuable insights into the organization's competitive, legal, and liability risks. Also note that it's critically important for each member of the due diligence team to share findings with the full group. All decision-makers in the acquiring company need to be fully aware of the liabilities that might exist.

Potential liabilities are often overlooked in the due diligence phase, amid timelines that are more compressed than ever before. Don't be afraid to ask tough questions of the target entity's management team. (See Important Questions Acquirers Often Fail to Ask, below.) Testing management's existing assumptions often yields valuable insights into the organization's competitive, legal, and liability risks. Also note that it's critically important for each member of the due diligence team to share findings with the full group. All decision-makers in the acquiring company need to be fully aware of the liabilities that might exist.

Hidden exposures are especially problematic because the acquired company's insurance policies may cease to provide coverage upon the closing of the transaction. Or they may convert into run-off mode, under which they continue to provide coverage but only for a short period of time. A buyer does not want to discover after the close that the acquired company's insurance policies are inadequate in terms of absorbing prospective and retrospective financial losses. If dealmakers in the buying company complete their due diligence process, yet still have concerns about hidden liabilities that may exist in the acquisition target, they may consider a number of insurance options to manage their risk exposures.

Successor Casualty Liability: How Long Is the Tail?

For a buyer, understanding the self-insured/deductible obligations, accruals, and collateral requirements of the target company is essential. Are there any allocation issues around sharing, among multiple separate companies, a liability insurance policy that has been in place for a while? Acquirers should consider retaining an independent actuarial firm to assess the target's workers' compensation, general, and automobile liabilities. The buyer may also want to take measures to limit its liability for losses incurred prior to the transaction that would not be covered by the target company's insurance policies.

One option is a loss portfolio transfer (LPT), which is a retroactive insurance program that transfers future payment obligations—obligations of an unknown size, which are related to known past liabilities, either from current operations or discontinued businesses—to a specialized M&A insurer. For instance, an LPT can be structured to absorb the financial liabilities of the deductible obligations within the target company's insurance policies. Target companies that will have multiple captive insurers post-acquisition, or that are looking to exit self-insurance, will find benefits in an LPT. The LPT can be used as a mechanism to close out the captive(s) or exit self-insurance for already-incurred liabilities. An LPT can also be essential to reducing burdensome collateral requirements/costs following a merger or acquisition, where the target company's financials may have changed.

Umbrella and excess casualty insurance are two other risk transfer solutions addressing M&A-related liabilities. High financial limits of protection can come into play either as umbrella insurance attaching above the primary layer of coverage, or as excess insurance attaching at different layers in a tower above the umbrella.

Umbrella and excess casualty insurance are two other risk transfer solutions addressing M&A-related liabilities. High financial limits of protection can come into play either as umbrella insurance attaching above the primary layer of coverage, or as excess insurance attaching at different layers in a tower above the umbrella.

Questions often abound about future liabilities that may arise from products that the target company currently sells, or from products that were discontinued years before but still carry potential liabilities. If these financial exposures are not well understood and addressed in the pre-transaction phase, the acquirer may incur additional costs down the line, and the transaction price might end up higher than it should have been. In any due diligence process, it is important to ask the right questions. An acquiring company needs to partner with its insurance brokers and carriers to identify, in collaboration, the areas into which it should dig deeper. Potential buyers and sellers must make themselves more aware of their risk management exposures.

There are other risk considerations for liability policies in an M&A context. In the past, some insurance policies were underwritten on a so-called "claims made" basis. This form of insurance coverage limits liability to only those claims that arise from incidents that are reported to the insurance company while the policy is in force. This raises the possibility that the policy may not absorb some future claim, particularly if the claim's "tail" was not resolved adequately. Legacy liability insurance is a broad risk transfer solution that can absorb successor liabilities for both retrospective and prospective claims arising from prior acts by the target company. A legacy liability policy is especially effective for severity-related products liability and general liability claims in the primary or excess layers. It addresses the risk of future claims from discontinued products and may include laser-like coverage for specific products that pose a greater risk of potential hazard.

Overseas M&A transactions can house both known and unknown successor liabilities, and challenges around legal due diligence may be compounded by language and cultural barriers. The use of claims-made policies, and the risk of discontinued products causing future losses, can seem daunting to an acquiring company. Many countries also require businesses operating within their borders to buy local or "admitted" insurance, raising questions about the adequacy of the coverages and the financial limits of protection, not to mention the solvency of the insurer that wrote the policy.

For liabilities that may be inherited in a global merger or acquisition, acquirers may want a controlled master program (CMP). This type of insurance addresses the potential inadequacies of the target company's local or admitted insurance policies. Are there certain international exclusions in the current program that need to be addressed? The master insurance policy closes perceived gaps in coverage and/or financial limits, while simultaneously maintaining the local insurance policies in force. A CMP also ensures the efficient coordination of foreign insurance policies under one roof, with potential premium savings and additional cost-effectiveness from economies of scale.

Two additional insurance products that may prove beneficial in an M&A context are representations and warranties insurance and tax indemnity coverage. Often, the purchase and sale agreement stipulates that these products are required. Representations and warranties coverage will indemnify the acquirer if the seller's representations and warranties prove inaccurate down the line. Examples involve representations and warranties made around compliance with local regulations, such as employment laws, or the accuracy of financial disclosures such as seller's inventory levels. Likewise, tax indemnity insurance can be used to indemnify the insured for uncertain tax consequences related to the target company, including the tax treatment of the M&A transaction itself. This product is considered effective when the buyer wants certainty about tax obligations but has not procured (or could not procure) a private letter ruling from the U.S. IRS regarding the tax treatment of the acquisition.

Environmental Liability: What Lies Beneath?

All businesses, no matter where they operate, are confronting increasingly strict environmental regulations. Thus, businesses are facing greater environmental-liability exposures than ever before. In some cases, an acquiring company inherits the target organization's pollution exposures, going back many decades, via the target company's operations or previous mergers and acquisitions. These liabilities may be unknown at the time of the M&A transaction. They may also be the result of previously unregulated practices that have since been deemed impermissible. These types of successor liabilities challenge even the most thorough due diligence process and present a risk of tremendous financial losses. Indeed, few issues have greater potential to derail a deal from a liability standpoint.

Environmental liabilities encompass a broad range of perils, including pollution, contamination, mold, hazardous waste, and toxic chemicals in water, in air, or on land. Identifying these exposures and then assembling an effective insurance strategy to transfer the liabilities is a vital element of the M&A transaction process.

To fill the coverage void created by pollution exclusions in general liability products and to protect against the financial exposure of pollution losses, the insurance industry created environmental impairment liability insurance. In this arena, various products are available to provide protection for the high costs associated with cleaning up accidental spills or leaks of pollutants. In circumstances in which the target entity had facilities that generated or used hazardous substances, the buyer should consider premises pollution liability (PPL) insurance, which provides coverage for first-party liabilities for onsite and off-site environmental cleanup and remediation, and for third-party liabilities arising from lawsuits brought by others for bodily injury, property damage, or environmental cleanup. The liability protection afforded by PPL coverage can be tailored to the needs of the acquiring company, including exposures related to gradual pollution, or sudden and accidental pollution. Since a target company's environmental liability policies typically will expire with the transaction, or will be placed in a runoff mode, it is imperative for acquirers to address environmental liability voids with new policies before the deal closes.

In addition, if the target company might require a pollution cleanup in the future, the acquiring company should consider issues such as the possibility of cost overruns during the cleanup effort. One option for dealing with this is risk remediation cost containment insurance, which is available from specialized M&A insurance carriers. By minimizing the risks that a cleanup project will cost the company more than anticipated, the coverage mitigates the financial uncertainty associated with acquiring a site and undertaking its redevelopment.

Directors and Officers Liability: Will You Be Protected?

Securities class-action lawsuits represent some of the most costly and complex cases against directors and officers, and M&A activity is a key driver of securities class actions. Class-action suits are typically brought by investors and shareholders in the target corporation; they name the acquiring company and, by extension, the board of directors as defendants. These suits are filed very soon after a merger or acquisition, not leaving the organization much time to manage insurance issues. Directors' and officers' liability insurance (D&O) policies can provide key protections for executives embroiled in such litigation. However, coverage must be in place and carefully managed prior to the transaction because of the speed and complexity of the litigation.

Most D&O policies have terms of one year, yet claims may be brought as long as six years after a transaction, depending on the statute of limitations. As a result, most target companies purchase a non-cancellable, pre-paid policy for a six-year period, which is known as run-off or tail coverage. It can be critical. Most acquiring companies' policies will not provide D&O coverage for the executives of the target company prior to the merger or acquisition. The target company's D&O and run-off policies may be all that they have to protect them. This is why many companies will buy an additional layer of insurance devoted to the directors and officers, popularly known as Side A, or CODA, insurance.

Most D&O policies have terms of one year, yet claims may be brought as long as six years after a transaction, depending on the statute of limitations. As a result, most target companies purchase a non-cancellable, pre-paid policy for a six-year period, which is known as run-off or tail coverage. It can be critical. Most acquiring companies' policies will not provide D&O coverage for the executives of the target company prior to the merger or acquisition. The target company's D&O and run-off policies may be all that they have to protect them. This is why many companies will buy an additional layer of insurance devoted to the directors and officers, popularly known as Side A, or CODA, insurance.

At the same time, directors and officers of the target company who become executives of the acquiring company will need to become protected under the acquiring company's D&O policy. The policy of the company that was acquired will provide coverage only for events that happened when they were executives of the target company, prior to the M&A transaction. They will need new coverage for future events that occur when they're acting as executives of the acquirer. However, whether to add them to the corporate D&O policy depends on the form and the facts. The acquiring company needs to review its D&O policy to see whether the target's executives will gain coverage automatically, or whether specific acts must be taken to add them to the policy.

The key to addressing D&O liabilities in an M&A context is to leave no ambiguities on the table. Post-transaction, the risk profile of the combined entity is different from that of the separate organizations pre-transaction. In some cases, it's substantially different. Share price volatility is usually a serious threat in the months after a transaction closes, and stock price swings may incite shareholder or acquirer lawsuits against the target company's directors and officers for misrepresentations, breaches of fiduciary duties, or violations of securities laws.

Now that the M&A market is again on the uptick, private equity firms and strategic corporate dealmakers—in the competitive landscape to complete deals quickly—must exercise proper due diligence given the wide range of post-transaction successor liabilities they may assume. Such liabilities create the potential for unanticipated financial consequences, which may result in an acquisition or merger that costs more than was originally anticipated or may incite shareholder litigation.

Risk managers should suggest assembling a deal team to review such potential liabilities. The complexity inherent in addressing a target company's D&O liabilities, environmental exposures, product risks, and other complex liabilities usually requires assistance from insurance carriers that understand the M&A process. A coordinated insurance program will provide the required responsiveness to facilitate the closing of transactions within set timetables, minimizing the possibility that unexpected and uninsured post-transaction liabilities will emerge.

—————————————

Seth Gillston is senior vice president and global practice leader of the Mergers & Acquisitions Practice at ACE USA. He is based in New York and has been with ACE for more than 13 years in a variety of underwriting and management roles.

Seth Gillston is senior vice president and global practice leader of the Mergers & Acquisitions Practice at ACE USA. He is based in New York and has been with ACE for more than 13 years in a variety of underwriting and management roles.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.