On Monday, the National Association of Corporate Directors (NACD) released the results of its quarterly survey of public company directors. The Board Confidence Index (BCI) is designed to provide a snapshot of sentiment about the economy from the perspective of the corporate boardroom. In each quarterly survey, directors are asked to score their attitudes about the economy on a scale that ranges from "substantially worse" (assigned a value of 0 points) to "substantially better" (100 points). Their responses are averaged for each question, so that scores above 50 points indicate a positive outlook, scores below 50 indicate a negative outlook, and scores around 50 indicate uncertainty or neutrality.

On Monday, the National Association of Corporate Directors (NACD) released the results of its quarterly survey of public company directors. The Board Confidence Index (BCI) is designed to provide a snapshot of sentiment about the economy from the perspective of the corporate boardroom. In each quarterly survey, directors are asked to score their attitudes about the economy on a scale that ranges from "substantially worse" (assigned a value of 0 points) to "substantially better" (100 points). Their responses are averaged for each question, so that scores above 50 points indicate a positive outlook, scores below 50 indicate a negative outlook, and scores around 50 indicate uncertainty or neutrality.

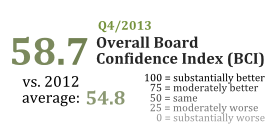

The latest BCI results indicate that corporate directors expect the economy to continue improving, but to do so slowly and steadily. The average overall BCI score for Q4/2013 was 58.7. Not only does this indicate a generally positive outlook on economic conditions in the United States, but it's almost 4 points higher than the average 2012 score of 54.8. "The continued improvement in boardroom confidence, though not a dramatic change from years past, points to a positive outlook for 2014," says Ken Daly, president and CEO of the NACD.

Respondents to the NACD survey were asked to rate the current condition of the economy in comparison with other time periods, both past and future. When comparing with one quarter ago, the directors gave today's economy an average rating of 55—a number that's modestly positive. But when they considered how today's economy compares with conditions a full year ago, the directors raised the score to 64. Looking forward, respondents followed a similar pattern. They gave their confidence in the economy one quarter from now an average rating of 54, but rated their confidence in conditions a year from now at 63.

Respondents to the NACD survey were asked to rate the current condition of the economy in comparison with other time periods, both past and future. When comparing with one quarter ago, the directors gave today's economy an average rating of 55—a number that's modestly positive. But when they considered how today's economy compares with conditions a full year ago, the directors raised the score to 64. Looking forward, respondents followed a similar pattern. They gave their confidence in the economy one quarter from now an average rating of 54, but rated their confidence in conditions a year from now at 63.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world case studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.