In 2011, the primary concern of most CFOs was to help the organization survive the financial crisis and manage the challenges presented in its aftermath. Today most companies have left the economic downturn behind, and growth is finally returning to the corporate agenda. As a result, the CFO must not only continue to manage the business in terms of traditional finance responsibilities, but also to develop and deliver growth strategies for the organization overall.

In 2011, the primary concern of most CFOs was to help the organization survive the financial crisis and manage the challenges presented in its aftermath. Today most companies have left the economic downturn behind, and growth is finally returning to the corporate agenda. As a result, the CFO must not only continue to manage the business in terms of traditional finance responsibilities, but also to develop and deliver growth strategies for the organization overall.

In our recently released High Performance Finance study, Accenture explores the evolution of the CFO's role and the position's ever-widening agenda. The project surveyed 617 senior finance executives across 10 industries and from 28 countries. The resulting report confirms that CFOs have increased their strategic influence over the past several years, and the trend shows no signs of stopping. (See Figure 1, below.)

One of the key findings of our research is that CFOs have made extraordinary strides in dealing with external forces that engulfed companies right after the downturn—for example, regulation. Just 39 percent of this year's survey respondents said regulations are having a strong impact on their finance function, compared with 53 percent two years ago. Similarly, CFOs' growing digital literacy is helping them get a better handle on data, which continues to expand exponentially in volume, variety, and velocity. Even the perennial problem of attracting, retaining, and motivating the right kind of finance talent is a major issue for only 21 percent of respondents, versus 40 percent in 2011.

At the same time, four of the top five challenges survey respondents said they're facing today revolve around managing complexity: supporting increasingly complex legacy systems and environment (55 percent); managing the complex needs of all stakeholders (48 percent); managing new and complex business risks (46 percent); and supporting increasingly complex operating models (28 percent). Many CFOs would be quick to point out that these internal sources of complexity tend to be the natural by-products of growth and performance. Complexity is certainly a good problem to have, but it's a problem nonetheless—and one that CFOs will need to manage for the foreseeable future.

New Responsibilities on the CFO Agenda

The growing concerns around complexity underscore the fact that CFOs are no longer focusing solely on finance. Indeed, because they now occupy a pivotal position at the intersection of finance, technology, and strategy, CFOs are required to fulfill a much wider range of expectations for the organization. They are increasingly involved in strategic planning, business transformation, and evaluating and prioritizing prospective investments of corporate resources.

This means, of course, that CFOs need to think and act differently than they did in the past. Identifying, quantifying, and mitigating a raft of new and rapidly changing risks requires a holistic view across software systems. Even as companies embrace cloud, big data, analytics, and other transformational technologies, the CFO must make sure that these technologies are generating accurate and consistent information about corporate financials and performance to satisfy a multitude of stakeholders. This responsibility demands much closer collaboration between the CFO and other C-suite executives—not least of whom is the CIO, whose partnership is critical in order for CFOs to deliver the actionable insights that other business functions may need.

Many CFOs have risen to the challenge. The Accenture study shows that more than three-quarters (78 percent) of high-performing organizations—those that achieve above-average growth, profitability, longevity, and consistency of performance—have initiated, or completed, a rationalization of their operating model over the past two years. That's 11 percentage points higher than among companies not designated as high-performing.

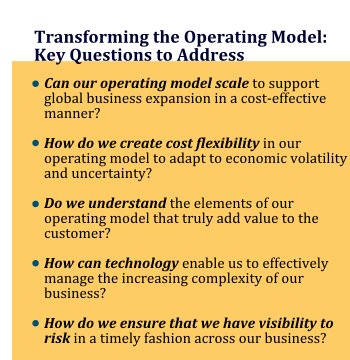

Businesses that undertake this type of project, ensuring that their operating model aligns with (and will keep pace with) broader organizational strategy and design, are taking a key first step toward transformational change. Usually the CFO is expected to take a leadership role in the initiative, which is a clear indication of the position's broadening influence. (See the sidebar Transforming the Operating Model: Key Questions to Address.)

As a CFO manages this project, he or she must also monitor and manage the complexity and risk involved in supporting multiple models. For example, as companies expand globally, they may have to support multiple different channel structures, regulatory requirements, and customer preferences in order to get their goods and services market. While such models may be essential, the consequences of maintaining them should be carefully considered, especially from a cost perspective. Naturally, CFOs are well-placed to lead in this area.

Successful Restructuring

Finance executives who see opportunities to improve efficiency across the company should start in their own backyard. When a CFO has successfully restructured the finance function, leveraging standardization and automation to increase agility and reduce costs, that project can pave the way for a larger-scale initiative that streamlines and simplifies the corporate structure.

CFOs are increasingly tackling complexity by leveraging either global business services models, which extend traditional shared services beyond basic administrative tasks into end-to-end processes, or integrated business services models, which join advanced services from beginning to end to enable overall strategy. Indeed, the Accenture study shows that the use of integrated services is set to increase five-fold over the next two years.

Intriguingly, more complex organizations—defined as those operating and selling in 50 countries or more, and having at least 50 legal entities—report higher levels of performance from the finance function. The study shows that these businesses are more satisfied with the performance of their finance team, they stress the need for flexibility within the function, and they place greater emphasis on finance driving enterprise-wide change. Furthermore, these companies' CFOs are more likely to partner with a wide range of other executives, to be involved in the design and implementation of major business transformations, and to have harnessed the power of technology to help manage complexity.

These businesses may have created their own complex business models, or complexity may have been thrust upon them by external forces beyond their control. Whatever the cause, they are plainly responding better than most. In fact, while most companies still struggle with key aspects of their business transformation initiatives, high-performance enterprises recognize complexity as an opportunity. Their CFOs are standardizing and optimizing processes to create an organization that is agile enough to seize those opportunities. Other executives who follow their example will find that they're able to deliver exceptional value to the business.

—————————————-

David Axson is managing director for CFO & Enterprise Value within Accenture Strategy. His role focuses on solving CFOs' most pressing challenges, helping them develop strategies to transform the finance function as well as positively influence their broader organizations.

David Axson is managing director for CFO & Enterprise Value within Accenture Strategy. His role focuses on solving CFOs' most pressing challenges, helping them develop strategies to transform the finance function as well as positively influence their broader organizations.

Complete your profile to continue reading and get FREE access to Treasury & Risk, part of your ALM digital membership.

Your access to unlimited Treasury & Risk content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Thought leadership on regulatory changes, economic trends, corporate success stories, and tactical solutions for treasurers, CFOs, risk managers, controllers, and other finance professionals

- Informative weekly newsletter featuring news, analysis, real-world case studies, and other critical content

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the employee benefits and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.