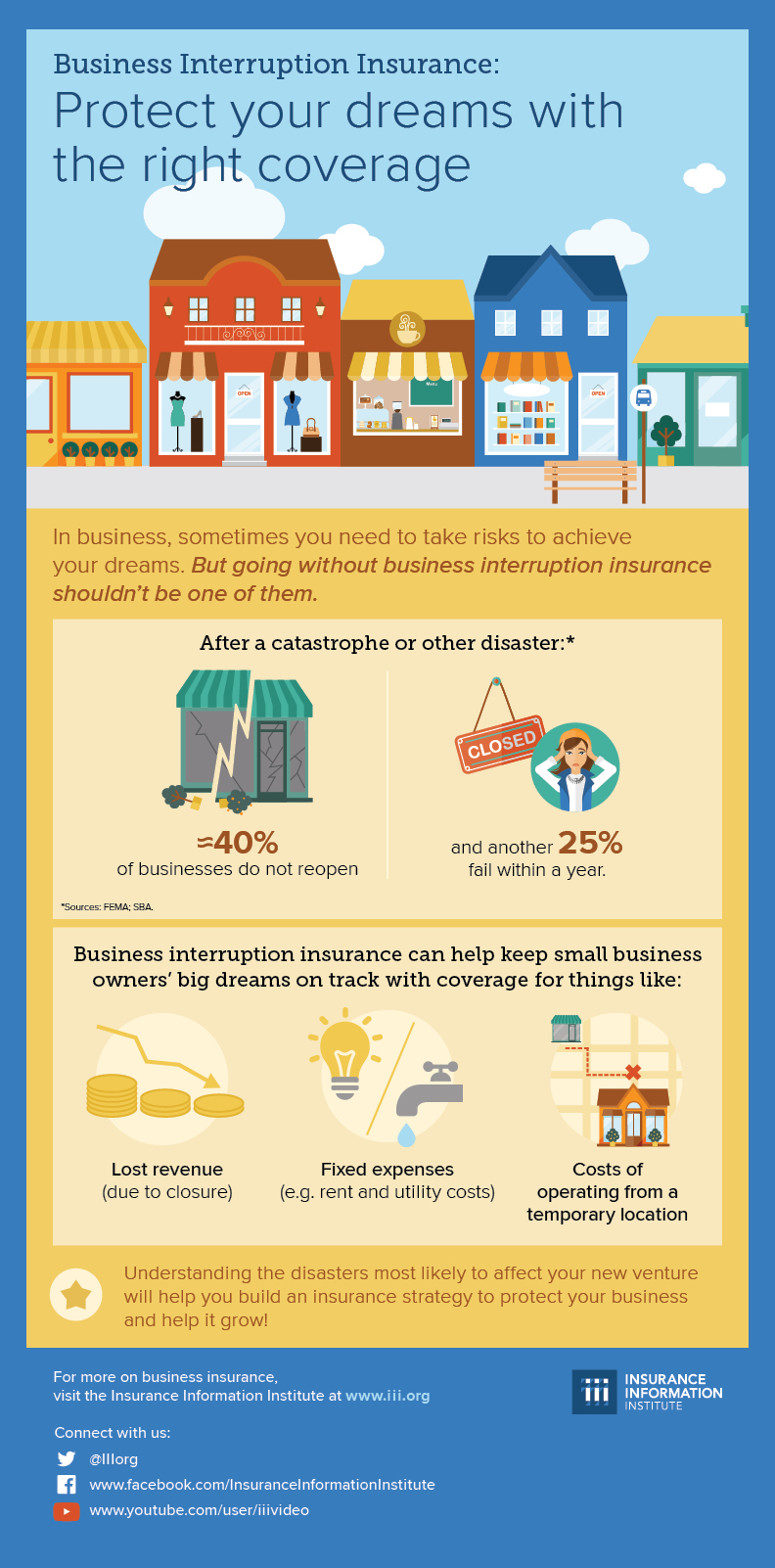

According to FEMA and the Small Business Administration, 40% of businesses do not reopen after a catastrophe or other disaster, and another 25% fail within a year.

What can businsses do to help their chances of surviving an incident?

The answer is business interruption coverage. Also known as business income insurance, business interruption insurance compensates policyholders for lost income if their company has to vacate its premises due to disaster-related damage that is covered under a property insurance policy, such as natural catastrophes, supply chain disruptions or cyber risks.

Two in five businesses have suffered a business interruption loss in the last five years, according to the 2017 RIMS Business Interruption Survey. Additionally, a 2015 Nationwide survey found that 66% of small businesses, generally identified as those with 50 or fewer employees, lack business interruption coverage.

“Many businesses are often unaware of the true costs and impact a business interruption can have on their operations without the proper coverage,” said Loretta Worters, a vice president of the Insurance Information Institute (I.I.I.). “Many businesses do not survive because they either lack coverage or have inadequate limits for that coverage.”

See the infographic below from I.I.I. for more stats about business interruption insurance.

From: PropertyCasualty360

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.