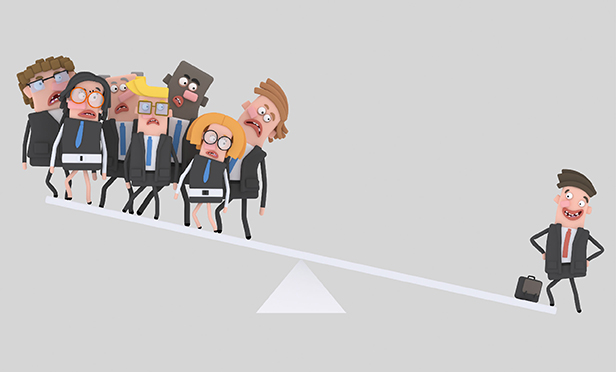

Early next spring, publicly traded U.S. corporations have to start reporting the ratio of their chief executive officer's compensation to the median pay received by their employees. Companies worry that the disclosure, mandated by the Securities and Exchange Commission, could elicit negative reactions from employees or investors.

Early next spring, publicly traded U.S. corporations have to start reporting the ratio of their chief executive officer's compensation to the median pay received by their employees. Companies worry that the disclosure, mandated by the Securities and Exchange Commission, could elicit negative reactions from employees or investors.

A recent survey suggests many are lagging in their preparations to begin disclosing the CEO pay ratio. Just 56% of companies have even calculated their CEO pay ratio, according to a survey of 276 executives conducted by Pearl Meyer, an executive compensation consulting company.

"People are still in the weeds on the data," said Sharon Podstupka, a principal at Pearl Meyer.

Recommended For You

Of course, until recently companies had hopes that either the Trump administration or Congress would step in to delay or eliminate the requirement to report the CEO pay ratio. In March, interim SEC chairman Michael Piwowar said the agency would review the rule and reopen comment, citing companies' complaints about difficulties complying. But Podstupka noted that in September, the head of the SEC's Division of Corporation Finance, Bill Hinman, said the agency didn't have plans to delay the rule.

There have also been various measures introduced in Congress that would reverse the requirement, but given Congress's current focus on tax reform, no help is likely from that quarter.

"The only thing that would delay the rule at this point is congressional action, and our expectation is that Congress has enough on its plate at this point that it won't," said Tom Langle, a principal specializing in executive rewards at consulting company Mercer.

That means companies with fiscal years ending Dec. 31 will have to report the CEO pay ratio in the 2018 proxy statements they file in early spring.

Langle said he thought that by this point companies "have a good handle on technical aspects" of calculating the CEO pay ratio, adding that recent guidance from the SEC has been helpful.

"The big unknown, and what many companies may not be prepared for, is the communication implications," he said, and noted that companies will be dealing with a number of different audiences on this issue, including their employees, investors, and the media.

In the Pearl Meyer survey, just 13% of company directors said the board has discussed disclosing the ratio in the company's proxy statement, and just 11% of companies have talked about communicating the CEO pay ratio both internally and externally.

How High

Earlier this year, the AFL-CIO reported that it had calculated the CEO pay ratio at S&P 500 companies at 347-to-1. The Pearl Meyer survey suggests that figure is overblown. Forty-two percent of the public companies it surveyed expect their CEO pay ratio to come in between 101-to-1 and 250-to-1. Just 18% expect a ratio that's higher than 250-to-1.

Podstupka. pictured at left, said revenue size is likely to play a role in companies' ratios, with more than half (62%) of companies Pearl Meyer surveyed that had revenue of less than $300 million expecting their ratio to come in at 50-to-1 or lower, while companies with more than $3 billion in revenue expect their ratios to be much higher.

Podstupka. pictured at left, said revenue size is likely to play a role in companies' ratios, with more than half (62%) of companies Pearl Meyer surveyed that had revenue of less than $300 million expecting their ratio to come in at 50-to-1 or lower, while companies with more than $3 billion in revenue expect their ratios to be much higher.

There are also likely to be similarities among companies in various industries. Langle said that according to a survey Mercer conducted in August, retailers were showing some of the highest CEO pay ratios because they tend to have a lot of part-time and hourly workers. On the other hand, the many highly paid employees at financial firms and banks should hold down the ratios in that industry, he said.

Companies' workforce models are another key factor. "Companies largely, or entirely, based in the U.S. are likely to have a lower ratio just because compensation for workers in the U.S. is high relative to global norms," Langle said. On the other hand, companies with a lot of employees in low-wage countries are likely to have a higher CEO pay ratio, even if they pay competitive wages in the low-wage countries, he said.

The Investor Angle

CEO pay ratios seem like information that would interest institutional investors, especially those that focus on executive compensation.

But Podstupka doesn't see the ratios as a big factor this year. "While investors will look at the data, I don't think we're necessarily hearing that they'll use it to influence say-on-pay votes," she said. "In years to come, if this continues to roll out and we see troubling trends, then maybe."

ISS, the most prominent of the proxy advisory firms, has said it won't factor the CEO pay ratios into its voting recommendations this year, Langle noted. On the other hand, an annual survey conducted by ISS showed most institutional investors are paying attention, with only 16% saying that they didn't plan to watch CEO pay ratios.

"It is something that we expect to capture the attention of the investor community and media, but no one is eager to start drawing conclusions as to whether it says anything about the company's compensation practices," he said, arguing that the ratios have "more to do with [a company's] industry or decisions they made about their workforce model."

The Employee Angle

While public companies have been reporting their chief executive officers' pay in their annual proxies for a while, there's a sense that employees weren't paying much attention. That could change when the CEO pay ratios roll out next year.

Langle pointed out that while companies have been disclosing the CEO's compensation, this will be the first time they report their median pay for all employees, which will allow employees to compare that number with their own earnings.

"Employees who are learning for the first time that they're below the median may be surprised to learn that, or they may compare their company's median pay to what a competitor pays," he said.

Pay inequality is a hot topic these days, Podstupka said, and "proxy statements are going to have a different level of visibility than they've ever had before. I don't think we can underestimate the public's curiosity.

"I think that the workforce reaction is probably the most worrisome and the one that I think companies should at the very least be prepared to react to," she added.

Preparations

A company's plans for communicating its CEO pay ratio should take into account what that ratio is, Langle said.

A company with a relatively low ratio may have an easier job ahead, he said, "whereas companies that are expected to disclose a very high or above-normal pay ratio may need to think about communication, assuming there is some negative reaction they will want to get in front of or have talking points or explanations available."

The big question mark will be how the media reports on the pay ratio disclosures, Langle said. He noted that U.S. companies that have a lot of workers outside the country have come under criticism. If such companies end up reporting a high CEO pay ratio as a result, that could catch the media's attention, he said.

Companies that are worried about their employees' reactions should ensure the human resources department is prepared, Podstupka said.

"That may mean training people to have discussions" on the topic of pay, she said. "HR and managers are absolutely going to have to be comfortable with talking with people about all kinds of compensation issues."

Companies are also "going to need to be prepared to answer anticipated questions from the media, investors, potentially proxy advisory firms, and even potentially unions, depending on what their workforce looks like," she said.

Podstupka said that while companies generally have "rigorous processes in place to ensure compensation is set in a fair way," they often haven't done a good job of explaining that.

"This is an opportunity for companies to reinforce what their compensation governance practices are and to remind people there are things companies do to ensure pay is set fairly and people have opportunities to grow in their careers," she said.

See also:

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.