A new Financial Accounting Standards Board (FASB) standard, ASU 2017-12, was released in August 2017. The goal was to simplify hedge accounting rules and reporting.

A new Financial Accounting Standards Board (FASB) standard, ASU 2017-12, was released in August 2017. The goal was to simplify hedge accounting rules and reporting.

The standard takes effect for public companies for fiscal years starting after December 15, 2018, and for private companies beginning after December 15, 2019. However, the standard permits early adoption, spawning an interesting question: Is there a benefit to adopting prior to the beginning of 2018?

The answer depends on whether the company has recorded losses or gains, or neither, from ineffectiveness in cash-flow hedging relationships.

Many organizations are choosing to wait until 2018 to adopt ASU 2017-12, but even a one-day difference in adoption—January 1, 2018, vs. December 31, 2017—could result in a very different outcome on a company's financial statements. Finding the right answer for your business will require you to perform a quick analysis. For simplicity in presenting the approach, we will assume that the end of your current fiscal year is December 31, 2017, and that your new fiscal year begins January 1, 2018.

To perform the analysis for your company, you will need to identify all derivatives that are open and designated in a cash-flow hedging relationship at year-end. For these derivatives—and only these derivatives—quantify the cumulative balances of the derivatives' gains or losses at the end of FY2017 that are due to the hedges' ineffectiveness. Next, bifurcate the cumulative gains/losses associated with these derivatives into amounts recognized during FY2017 and those recognized in prior years.

Company Z: An Example

To understand how these numbers are used, consider the example of Company Z, which has two open derivatives at year-end. The first derivative, which we'll call “2016 Hedge,” was designated in 2016. The second, which we'll call “2017 Hedge,” was designated in 2017. Both remain designated in cash-flow hedge accounting relationships beyond the end of 2017.

Suppose that at the end of FY2017, Company Z has recorded a cumulative $234,000 loss for the 2016 Hedge and a cumulative $20,000 loss for the 2017 Hedge. The loss associated with the 2016 Hedge needs to be further divided into the losses recognized in FY2017 (say, a $111,000 loss) and FY2016 or all prior periods (a $123,000 loss).

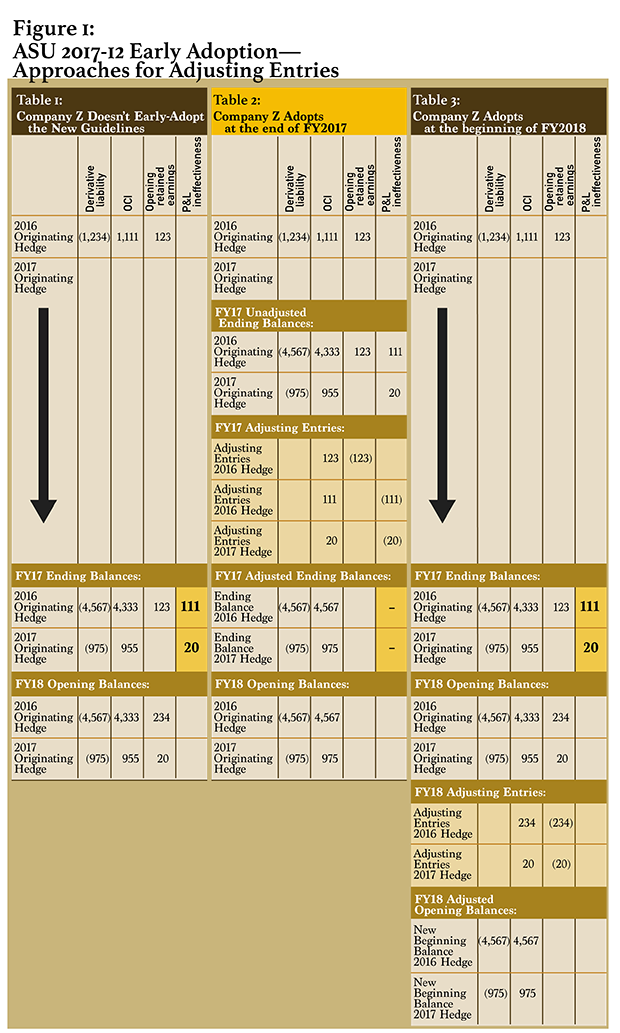

Table 1 on Figure 1, below, shows the FY2017 opening and closing trial balances and the FY2018 opening trial balance for Company Z if it decides not to adopt the new guidance at all.

Early adoption. If, instead, Company Z chooses to adopt ASU 2017-12 at the end of 2017, the company will adjust FY2017's beginning (January 1, 2017) opening retained earnings with a credit equal to $123,000 and a debit to Other Comprehensive Income (OCI).

Next, the current year-to-date ineffectiveness will be reversed by crediting earnings of $111,000 for the 2016 Hedge and crediting an additional $20,000 to earnings for the 2017 Hedge, then offsetting those changes with a $131,000 debit to OCI.

After these entries, OCI will equal the fair value of the two derivatives at year-end (assuming time value is not excluded from the hedging relationship) and at the start of the new fiscal year. Table 2 in Exhibit 1 shows the FY2017 opening and closing balances and the FY2018 opening balance for Company Z if it adopts the new FASB guidance on the last day of FY2017.

Adoption at beginning of 2018. If the same company were to wait until the start of 2018 to adopt the new guidance, it would adjust its opening retained earnings for 2018 with a credit of $234,000 for the 2016 Hedge plus $20,000 for the 2017 Hedge, then offset those changes with a $254,000 debit to OCI.

After this adjustment, OCI would equal the fair value of the derivative at the beginning of the new year—again, assuming that time value is not excluded from the hedging relationship. Table 3 on Exhibit 1 shows the FY2017 opening and closing balances and the FY2018 opening balance for Company Z, if it adopts the new guidance on the first day of FY2018.

Conclusions

A company should review the amounts and direction of cumulative ineffectiveness to determine whether adopting the new FASB guidance prior to fiscal year-end is in its best interests, or whether it will be better off waiting until the start of the new fiscal year to adopt.

If your company has registered ineffective losses, it should be motivated to adopt the standard at the end of the year. Otherwise, it will end up running those ineffective losses through its financial statements twice: Once during FY2017, as the already-recorded ineffectiveness, and again in FY2018, as an effective component—being made whole through an adjustment to the FY2018 opening retained earnings, which will likely be invisible to stakeholders. Please note: Should a company choose to adopt the FASB guidance in the current year, it will likely need to evaluate the materiality of reversing ineffectiveness in previous quarters of the current year.

Conversely, if your company has earned gains from ineffectiveness due to your existing hedge portfolio, you have the opportunity to keep the gains from ineffectiveness in the current year and re-record those gains in 2018 by waiting to adopt the standard at the start of the year—again, the gain being reversed is likely to remain an unnoticed adjustment to the next year's beginning retained earnings.

As this example demonstrates, there is an opportunity for some companies to unwind losses from ineffectiveness by adopting ASU 2017-12 prior to year-end, and there is an opportunity for companies that have gains from ineffectiveness to re-book those gains again the following year by waiting to adopt after year-end. There aren't any timing benefits for those entities fortunate enough to not have to record ineffectiveness in their cash-flow hedging relationships.

——————————–

Helen Kane is a recognized leader in the application of ASC 815 (formerly FAS 133, “Accounting for Derivative Instruments and Hedging Activities”) within corporate environments. She founded Hedge Trackers in 2000 as a FAS 133 consulting and outsourcing firm providing deeply technical yet practical solutions to Fortune 1000 companies.

Helen Kane is a recognized leader in the application of ASC 815 (formerly FAS 133, “Accounting for Derivative Instruments and Hedging Activities”) within corporate environments. She founded Hedge Trackers in 2000 as a FAS 133 consulting and outsourcing firm providing deeply technical yet practical solutions to Fortune 1000 companies.

If your organization is still unsure about how the new rules would affect your financial outcomes, the Hedge Trackers team would be happy to help with modeling the impact and recommending an implementation plan to maximize the advantages.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.