After a year of chest thumping, President Donald Trump has finally delivered the type of trade blow his political base has been craving.

Trump slapped tariffs on imported solar panels and washing machines on Monday in his first major move to level a global playing field he says is tilted against American companies. The decision came two days after the one-year anniversary of his inauguration as he prepares to travel to the World Economic Forum in Davos, Switzerland, where his “America First” stance is likely to be at odds with the global business and political elite.

The key now is whether the shift from protectionist rhetoric to hard action will disrupt the broadest global recovery since the world was pulling out of the financial crisis. The initial verdict from markets: probably not. Even those directly affected, such as LG Electronics, pared losses in Tuesday trading. JinkoSolar, China's biggest panel maker, said the outcome is “ better than expected.”

“The economic impact is not material,” Trinh Nguyen, a senior economist at Natixis SA in Hong Kong and former consultant to the World Bank, said Tuesday in a Bloomberg Television interview. “The concern really is whether or not this is a trend with more to come.”

Much will depend on how China responds. While officials in Beijing voiced displeasure Tuesday, saying the tariffs were a “misuse” of trade measures, their response was restrained, for now. But there's a list of things the world's second-largest economy can do if the U.S. ratchets up the pressure further.

China Has Targets Aplenty to Retaliate Against U.S. Trade Action

Eleven Pacific nations led by Japan agreed on the text of their own trade accord Monday and are aiming to sign the deal in March, Singapore's trade ministry said. The Trans-Pacific Partnership doesn't include China, however, and Trump pulled the U.S. out of the talks shortly after taking office last year.

There are also still several key files remaining on the president's desk that could lead to further tension between the world's two biggest economies. Trump has about three months to decide whether to impose tariffs on imported steel and aluminum, while his top trade official is probing China's intellectual-property practices.

U.S. negotiators are hunkered down in Montreal this week with their Canadian and Mexican counterparts, trying to fashion an update to the North American Free Trade Agreement (NAFTA). A tough line there could suggest Monday's actions are just the start.

In Europe, governments are following the Trump administration's moves closely. Germany, which has been the subject of Trump criticism for its trade surplus with the U.S., is seeking talks with the administration on the tariffs, said acting Finance Minister Peter Altmaier.

“Our position is that the fewer the tariffs, the less protectionism, the better it is for the people in our countries,” Altmaier told reporters in Brussels.

Portugal's Economy Minister Manuel Caldeira Cabral said in an interview in Davos that the European Union has a chance to step in and promote itself as defender of free trade. “By sending this message, the EU is going to differentiate itself from other regions in the world that are having doubts about gains from trade,” he said.

What Our Economists Say…

“Coming ahead of Trump's Davos trip, the solar and washing machine tariffs are striking but still fall into the narrow category,” said Tom Orlik, Bloomberg Economics chief Asia economist in Beijing. “The big question on U.S. tariffs heading into 2018 is if new measures will be narrow and bad news just for targeted sectors or broad and risk tipping over into a drag on overall growth.”

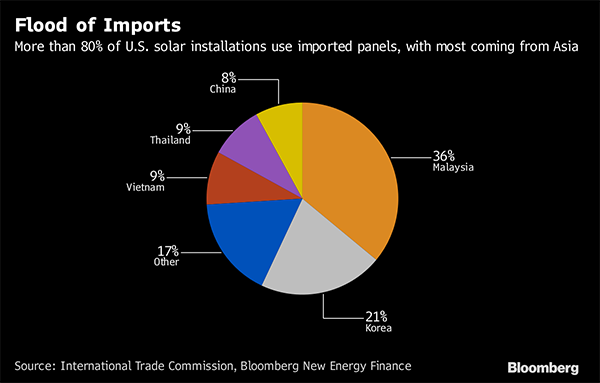

For now, the countries and companies on the receiving end of the Trump tariffs are not declaring crisis. Through its subsidiaries in neighboring Asian nations or directly, the biggest impact is potentially in China, the world's largest producer of solar panels.

The nation is also a major exporter of washing machines, selling 21 million units abroad worth just under 19 billion yuan ($2.9 billion) globally from January through November 2017, according to customs data.

Chinese solar manufacturers have been figuring out how to deal with the ups and downs of the trade outlook with the U.S. for years, and most recently since the U.S. International Trade Commission ruled that the influx of cheaper foreign panels was hurting domestic producers.

The president approved four years of tariffs that start at 30 percent in the first year and gradually drop to 15 percent. The first 2.5 gigawatts of imported solar cells will be exempt from the tariffs, USTR said in a statement Monday. The solar tariffs are lower than the 35 percent the ITC recommended in October. The body was responding to a complaint by Suniva Inc., a bankrupt U.S. panel maker that sought duties on solar cells and panels.

In the washing-machine case, Trump was responding to an ITC recommendation in November of tariffs following a complaint by Whirlpool Corp., which accused Samsung Electronics and LG Electronics Inc. of selling washing machines in the U.S. below fair-market value.

Trump opted for the most punitive recommendation by ITC judges for residential washers. He ordered a 20 percent tariff on imports under 1.2 million units, and 50 percent on all subsequent imports in the first year, with duties lowering in the next two years.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.