Just how much of this Trump tax cut will really trickle down?

Since Republican leaders pushed through their once-in-a-generation tax overhaul, more than 70 major U.S. companies—including Wal-Mart Stores Inc., Apple Inc., and JPMorgan Chase & Co.—have announced either pay raises or bonuses for rank-and-file employees or more hiring and investment.

That's not all that many; there are over 3,500 publicly traded corporations in the U.S., after all. And to some, they amount to little more than well-timed PR stunts designed to curry favor with the public and the president. But they've been enough to get some analysts rethinking just how much the $1.5 trillion package of cuts might benefit ordinary Americans and the broader economy.

Recommended For You

One thing's pretty certain: This is a good moment for workers. A tight labor market has pushed unemployment to historic lows, and many economists see wage gains just around the corner. On top of that comes the big tax cut, which may encourage more companies to pass some of the savings on to employees, instead of simply rewarding shareholders.

“If the unemployment rate were 8 or 10 percent, you wouldn't be seeing a lot of these announcements,” said Stephen Stanley, chief economist at Amherst Pierpont Securities. Companies would still be investing in their businesses, but the “wage piece of it is probably driven primarily by the labor market.”

Of course, the benefits aren't exactly raining down, and most say it's too early to tell if any of this will give a meaningful boost to growth. But for some, the trickle from the top—a classic supply-side approach championed by Republicans—has been a little bigger than initially expected.

With corporate profits as a share of GDP close to the highest levels in 70 years and labor's share near an all-time low, some say something had to give.

Now, after the tax rewrite pushed the corporate rate down from 35 percent to 21 percent, executives may feel more compelled to share the savings, according to Goldman Sachs Group Inc. Even before the tax cut, a number of businesses like Wal-Mart were struggling to retain good help as an upswing in the economy pushed the jobless rate down to 4.1 percent.

“Competition for customers and employees may claim part of the potential tax benefit,” David Kostin, a strategist at Goldman Sachs, wrote this month.

With their slew of splashy announcements, there's no question companies are trying hard to counter the perception they're only interested in rewarding shareholders and offshoring American jobs to maximize profits.

Tweeter In Chief

It doesn't mean companies can't quietly do buybacks later, but it's likely a number of them were already thinking about pay raises and hiring. Putting them front and center gives corporations the chance to deliver a high-profile thank-you to the Trump administration for the tax windfall. (Not to mention an opportunity to get a personal shout-out from the tweeter in chief, who will give his State of the Union address today.)

Amherst Pierpont's Stanley says it ultimately doesn't matter why companies are investing more in their workers and businesses. The bottom line is that they're doing it, and he says that will help economic growth top 3 percent this year—more bullish than any of the 83 economists surveyed by Bloomberg.

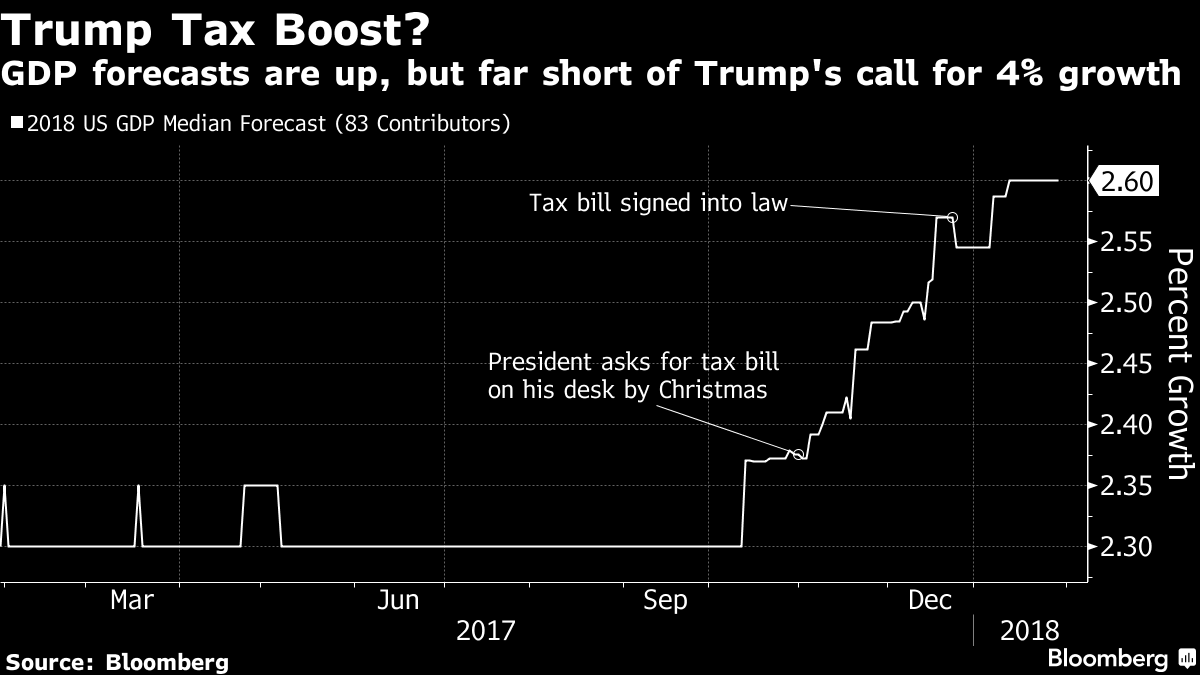

Most agree the tax overhaul will be a plus, at least in the short term. But just how much it ultimately moves the needle is up for debate. Since November, economists have started to slowly inch up their projections. They currently expect the economy to expand 2.6 percent this year and spending on plants and equipment to rise 6 percent. It would be a welcome lift after both growth and capex languished in recent years.

Nevertheless, the projections are well short of the “ 4, 5, even 6 percent” economic growth President Donald Trump has repeatedly promised to deliver.

PR Panacea

“Overall, it's a net positive,” said Savita Subramanian, the head of U.S. equities and quantitative strategy at Bank of America Corp. “Whether it's a panacea, I don't know. It's not like tax reform really drove a reason for companies to spend. The tax reform happened when the economy was also improving. It's hard to say how much the improvement in the economy is tax-related versus the normal pickup in economic activity.”

One reason for the uncertainty is that while companies have been long on hoopla, they've been short on meaningful context or comparisons.

For example, it's hard to know whether Apple's five-year, $30 billion U.S. spending pledge is a significant increase. In the prior five years, Apple's capex totaled $55 billion worldwide. (It doesn't break out spending regionally.) Same goes for its hiring plan. Twenty thousand new jobs sounds like a lot, but Apple's global workforce has grown over twice as much since 2012. Spokesman Josh Rosenstock didn't immediately respond to requests for comment.

“We haven't heard a lot of specific steps,” said Matt Maley, a strategist at Miller Tabak & Co. Some of what we have heard, like the one-time bonuses, are “more PR than the real thing.”

Much was made of Wal-Mart's wage bump and its $1,000 bonus because of how many low-income Americans it employs, but spokesman Kory Lundberg said at the time that a “sizable group” of its 4,700 U.S. stores already pay $11 an hour due to state minimum-wage laws. In fact, the $1 wage hike was the retailer's third in as many years and “part of a longer-term trend” in the industry, says David Schick, director of research for Consumer Edge Research. Wal-Mart spokesman Blake Jackson declined to comment.

To be fair, there's little doubt businesses really do prefer a staunchly pro-business administration intent on slashing taxes and rolling back regulations. After years of uncertainty, the rewrite not only gives companies a big windfall, but it also provides a permanent, low-cost way for them to repatriate trillions of dollars in untaxed overseas profits. Business confidence, which stagnated during the Obama years, is now sky-high.

Confidence Game

“It's a confidence thing,” said Bank of America's Subramanian. “If they were holding back on spending because they didn't know what the tax law is going to look like, now they have it all clear.”

Regardless of how it plays out, the booming stock market itself may lead CEOs to favor investment and labor over buybacks and dividends. That, and the fact the tax cut is coming at a time when the economy is humming along.

“Don't expect companies to redeploy as much capital” to shareholders, Subramanian said. “For the first time I can think of, we are having this massive stimulus occur within an improving, and already reasonably healthy, economic backdrop. That's what might be a bigger driver of capital expenditures or spending on growth.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.