Get ready for the deluge of Treasury bills, and the increase in short-term funding costs that's likely to accompany it.

Investors are bracing for an onslaught of T-bill supply following last week's U.S. debt ceiling suspension. That's already prompting them to demand higher rates from borrowers across money markets. And that's just a result of the government replenishing its cash hoard to normal levels.

The ballooning budget deficit means there's even more to come later, and that deluge of supply could further buoy funding costs down the line, making life more expensive both for the government and companies that borrow in the short-term market.

Recommended For You

Concerns about the U.S. borrowing cap had forced the Treasury to trim the total amount of bills it had outstanding, but that's no longer a problem, and the government is now busy ramping up issuance. Financing estimates from January show that the Treasury expects to issue $441 billion in net marketable debt in the current quarter, and the bulk of that is likely to be in the short-term market.

“Supply will come in waves, and we're in a very heavy wave right now,” said Mark Cabana, head of short-term interest rates strategy at Bank of America Corp. “If you take Treasury at their word, that they want to issue $300 billion in bills; that's a lot of net supply that needs to come to market.”

Next week's three- and six-month bill auctions will be the largest on record, at $51 billion and $45 billion respectively, Treasury said Thursday. The four-week auction will be boosted to $55 billion next week, having already been lifted to $50 billion for the Feb. 13 sale. Auction volume at the tenor had earlier been shrunk to just $15 billion.

The government's cash pile will, of course, receive a sugar hit when annual tax receipts start really flowing through to the coffers in April, and that may allow a temporary slowdown in issuance—and a reprieve in rates. But bill sale volumes are likely to surge again in the second half of 2018 as tax changes and increased government spending swell the fiscal deficit and the Fed continues shrinking its balance sheet.

The anticipated supply boost is already causing T-bill yields to rise relative to overnight index swaps as investors seek more compensation to hold the securities.

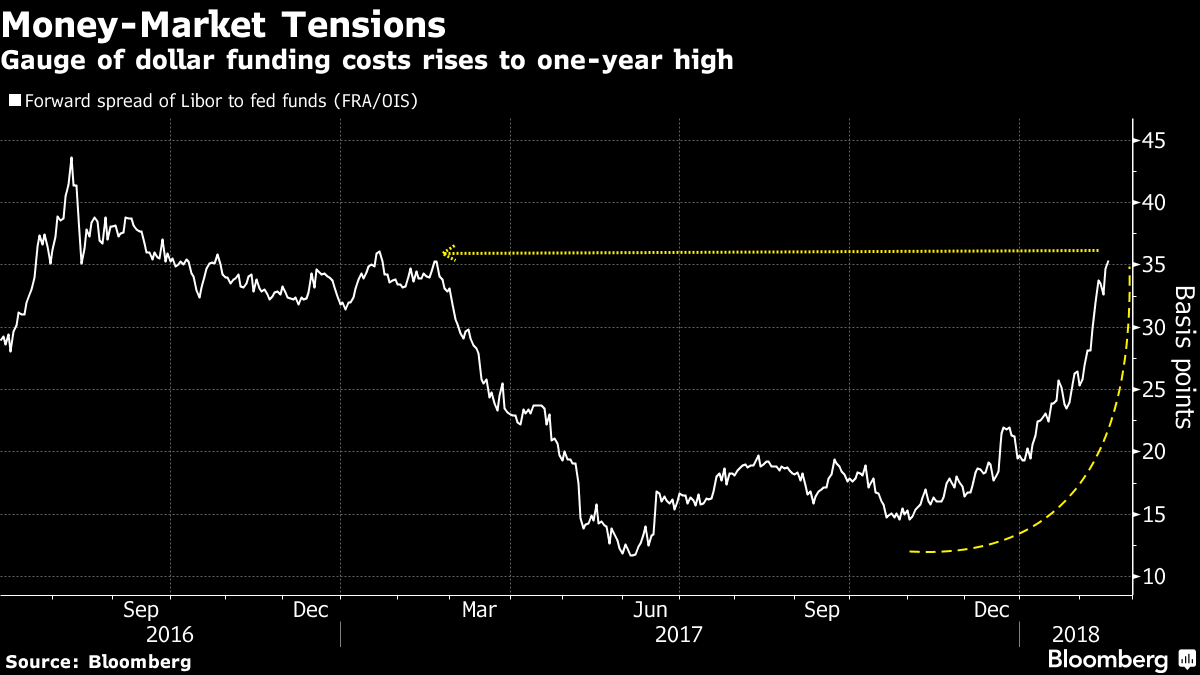

Rates on repurchase agreements and other short-end secured instruments should also start rising as more paper hits the market, and unsecured lending instruments such as commercial paper and certificates of deposit are likely to be affected too. The prospect of further increases in bill supply has started to drive up forward expectations for the London interbank offered rate (Libor), the benchmark underpinning these markets, relative to the U.S. central bank's target. The so-called FRA/OIS spread this week blew out to a level unseen in about 12 months.

Borrowers may try be trying to get ahead of the supply deluge, “believing things are going to move cheaper and if they act now they may need to do less when rates start to move higher,” Bank of America's Cabana said.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.