Increasingly frequent and severe weather events are symptomatic of a wider shift in global weather patterns. The uncommonly destructive Atlantic hurricanes Harvey, Irma, and Maria are a few examples from the past year.

Increasingly frequent and severe weather events are symptomatic of a wider shift in global weather patterns. The uncommonly destructive Atlantic hurricanes Harvey, Irma, and Maria are a few examples from the past year.

As the damages resulting from global weather trends compound year by year, international credit markets have begun to take climate change more seriously. Environmental and climate (E&C) risks—as well as opportunities—may affect an entity's capacity and willingness to meet its financial commitments. Therefore, S&P Global Ratings incorporates these considerations into our ratings methodology and analytics. We factor projected short-, medium-, and long-term E&C impacts into various analytical inputs used in our credit analysis methodology. And where these factors have a material impact, they can result in a change to the rating.

Material Impact

Over the past two years, E&C factors have affected corporate credit ratings with a marked increase in frequency. At S&P Global Ratings, environmental and climate concerns were materially relevant in 717 cases from July 2015 to August 2017. These cases accounted for a little under 10 percent of the corporate ratings assessments we undertook in that time period; given the myriad risks that can impact credit quality, this is a significant proportion of assessments. It is especially noteworthy considering that in the prior two years—among ratings analyses we undertook between November 2013 and October 2015—E&C factors were relevant in only 299 cases.

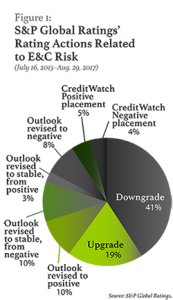

Moreover, among the 717 recent cases in which S&P Global Ratings found climate change to be materially relevant, an E&C factor was the key rationale for a rating change—such as an upgrade, downgrade, outlook revision, or CreditWatch placement—in 106 of them.

What does the increase in corporate credit ratings' references to E&C factors mean? It could indicate that environmental concerns are having an increasingly significant impact on credit quality. If so, this trend could result from changes in environmental policies, or from the heightened frequency of severe weather events as witnessed around the world in the past year—from wildfires in Portugal, Greenland, and California to the Atlantic's costliest hurricane season on record.

While some of S&P Global Ratings' 106 E&C-related rating actions from mid-2015 to mid-2017 were triggered by specific events, others were based on developments that we see as likely to occur over a longer time horizon. This reflects two considerations: first, that natural catastrophes such as droughts, floods, and storms are likely to occur more frequently as the planet warms; and second, that climate change is causing the earth to experience longer-term shifts in the variability of weather patterns. As global warming continues, we expect to see more instances in which an E&C risk factor proves material to credit quality.

It is worth noting that S&P Global Ratings' research indicates that the industries in which ratings are most likely to be affected by climate factors are oil refining and marketing, regulated utilities, and the unregulated power and gas subsectors. This may not be surprising, given these sectors' exposure to both environmental regulations and the physical effects of climate change. However, it's also worth noting that although policy and weather events tend to have a more direct impact on credit quality in some sectors than in others, E&C risks factor into our ratings criteria—to some degree—for most industries.

A Different Direction

Another trend that S&P has noted is growth in the number of E&C rating actions that are positive. Among research updates in the 2013–2015 review period that listed an E&C factor as a key driver of a rating change, 79 percent of those changes were negative. Only 21 percent of E&C-driven changes took a positive direction. In contrast, in the 2015–2017 period, 56 percent of E&C-driven rating changes were negative, while 44 percent were positive—a considerably more balanced outcome. (See Figure 1.)

This trend might reflect improvements in businesses' management of E&C risks in recent years. The Financial Stability Board's (FSB's) Task Force on Climate-related Financial Disclosures (TCFD) has identified “resource efficiency” as one of several definitive categories for climate-related risks and opportunities. Resource efficiency involves reducing operating costs by improving efficiency across production and distribution processes, buildings, machinery, and transportation use. Many of these changes relate to energy efficiency, but resource efficiency also includes policies around use of materials, water use, and waste management. Such initiatives, and the innovative technologies used in them, can result in direct cost savings for a company over the medium to long term, at the same time they contribute to global efforts to curb emissions. S&P Global Ratings believes resource efficiency and the TCFD's other categories help explain the diversity of risks and opportunities that can be captured under the broad umbrella of climate and environmental factors.

This trend might reflect improvements in businesses' management of E&C risks in recent years. The Financial Stability Board's (FSB's) Task Force on Climate-related Financial Disclosures (TCFD) has identified “resource efficiency” as one of several definitive categories for climate-related risks and opportunities. Resource efficiency involves reducing operating costs by improving efficiency across production and distribution processes, buildings, machinery, and transportation use. Many of these changes relate to energy efficiency, but resource efficiency also includes policies around use of materials, water use, and waste management. Such initiatives, and the innovative technologies used in them, can result in direct cost savings for a company over the medium to long term, at the same time they contribute to global efforts to curb emissions. S&P Global Ratings believes resource efficiency and the TCFD's other categories help explain the diversity of risks and opportunities that can be captured under the broad umbrella of climate and environmental factors.

For example, when West China Cement Ltd, a prominent cement manufacturer operating in Northwestern China, was upgraded to B+ in March 2017, the key rationale was improved liquidity and profitability. These improvements resulted, in part, from an efficiency initiative that aligned with the TCFD's concept of resource efficiency. West China Cement implemented strategic changes in the form of a waste-heat recycling system as a cost-reduction effort—which resulted in a 4.5 percent savings on electricity costs.

Meanwhile, in October 2016 in the United States, Darling Ingredients Inc.—a company focused on turning by-products from other businesses into sustainable ingredients for food and energy—had its ratings outlook revised from “negative” to “stable.” One of the key drivers of this revision was the U.S. expansion of lower-carbon fuel standards, which are beneficial to biofuel sales. As such, Darling Ingredients was expecting an increase in dividends from the company's joint venture in biofuel sales, Diamond Green Diesel. This contributed to an expected improvement in the company's EBITDA. It also fits into TCFD's definition of climate opportunities under “Products and Services,” a category that covers innovation and development of new low-emission products and services which may improve competitive position as a result of capitalizing on shifting consumer and producer preferences.

It is difficult to draw definitive conclusions about why the proportion of positive ratings actions has increased. However, in light of the Paris Climate Agreement's goal of keeping the increase in global temperatures this century below 2 degrees Celsius and continued decarbonization initiatives, the ratings trend could signal that corporates are increasingly benefiting from energy transition opportunities. It may also indicate that corporates are developing a more acute understanding of E&C risk and are therefore mitigating it more effectively than before. A final contributing factor may be that some corporates are benefiting from changes in environmental policy, such as low-carbon and energy efficiency standards.

Environment in Analysis

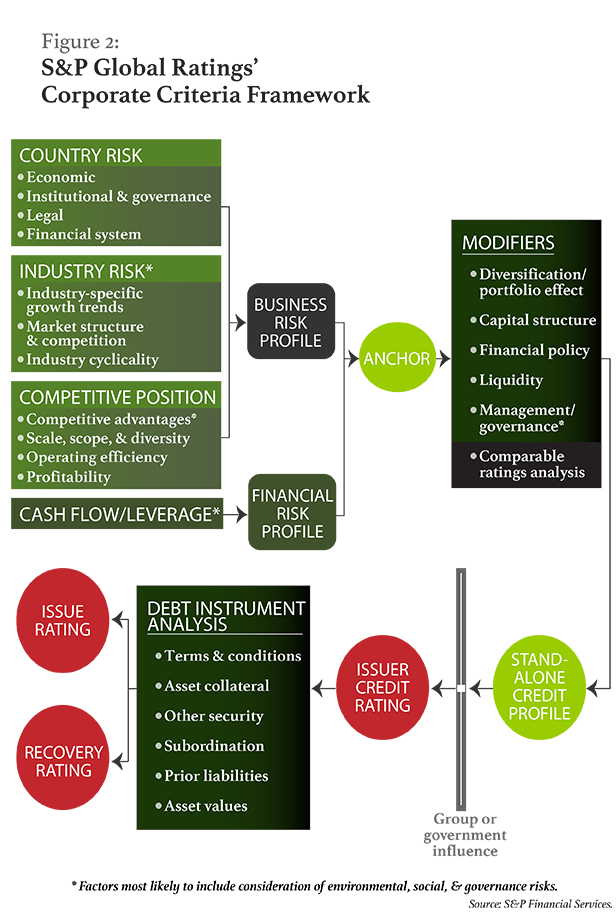

Measuring a business's resilience to E&C risks, as well as potential E&C opportunities, is part of S&P Global Ratings' analytical methodology. In our corporate ratings analysis, we evaluate the impact of material, known credit risks that could reduce the company's creditworthiness. These credit risks include environmental, social, and governance risks—collectively known as “ESG risks.” Within our corporate criteria framework, the areas most likely to reflect ESG risks are industry risk, competitive advantages, cash flow/leverage, and management/governance (see Figure 2).

In particular, management and governance is a category of analysis whose guiding framework explicitly references environmental and social risk. The section regarding comprehensiveness of risk management standards and tolerances states: “Corporate enterprises with a deliberate, consistent, articulated, resourced, and integrated approach that effectively identifies, selects, and prudently mitigates risks are more likely to build long-term credit strength as compared to enterprises with a casual, opportunistic, or reactive approach. Business managers demonstrate proficiency by institutionalizing comprehensive policies that recognize the complex interdependencies of the risks their businesses face, the trade-off between risk and reward, and the interplay between business and financial risk. The management of environmental and social risk is included under this subfactor.”

S&P Global Ratings' assessment of management and governance acts as a modifier in our corporate criteria framework and can, therefore, influence an issuer's credit rating. This is because we believe that material management, environmental, social, and governance risks can harm a company's creditworthiness if they are not managed properly.

Another category in which ESG risk factors could affect S&P Global Ratings' view of the creditworthiness of corporate entities is industry risk. For example, if we consider that emerging or increasing environmental or social risks are likely to cause industry-specific growth trends to deteriorate, or the level and trend of industry profit margins to weaken, we may review our assessment of industry risk for that market sector. This, in turn, could weigh on the business risk profiles of rated corporates in that industry.

Complex Climate

Although our ratings comprehensively incorporate E&C risks as part of ESG factors, analyzing climate change risk is a still-developing science. Climate change is a global reality that affects the magnitude and frequency of extreme weather events, both chronic and acute. Nevertheless, there is no broad, systematic agreement about the precise quantitative impact. It's also extremely difficult to know whether climate change actually caused any specific weather event.

Take Hurricane Harvey as an example. The first major hurricane to move from the sea and strike the U.S. in 12 years, Harvey caused nearly US$200 billion worth of damage, earning it the title of most damaging tropical cyclone ever. Harvey might have happened even without climate change, but it is possible that climate change is increasing the likelihood of events of this magnitude occurring.

So, while climate change might make events like Hurricane Harvey more likely, these disasters would not be impossible without it. If climate change continues to expand, it could potentially generate more E&C risks pertinent to our analyses, which S&P Global Ratings would then factor into our corporate credit ratings.

Ultimately, we will continue to monitor the impact of climate and environmental factors on companies' credit risk profiles, as we consider all relevant factors. And our view can be expected to evolve as new information, including that related to climate change and environmental science, becomes available.

Michael Wilkins is the head of sustainable finance within S&P Global Ratings' infrastructure practice, based in London, where he has global responsibility for environmental finance research and the Green Evaluation. Previously, as head of infrastructure finance ratings, he covered utilities, project finance, PPPs, and transportation in EMEA. Wilkins is a frequent guest lecturer at the London Business School, Cambridge and Oxford Universities, and UCL and King's College London. He is also a member of the FSB's TCFD, the G-20 Green Finance Study Group (GFSG), the advisory council of the Smith School Sustainable Finance Programme, and the Climate Bonds Initiative.

Michael Wilkins is the head of sustainable finance within S&P Global Ratings' infrastructure practice, based in London, where he has global responsibility for environmental finance research and the Green Evaluation. Previously, as head of infrastructure finance ratings, he covered utilities, project finance, PPPs, and transportation in EMEA. Wilkins is a frequent guest lecturer at the London Business School, Cambridge and Oxford Universities, and UCL and King's College London. He is also a member of the FSB's TCFD, the G-20 Green Finance Study Group (GFSG), the advisory council of the Smith School Sustainable Finance Programme, and the Climate Bonds Initiative.

Peter Kernan is a managing director and the global criteria officer for corporate and infrastructure ratings at S&P Global Ratings, where he oversees the development of all corporate and infrastructure criteria globally. He was previously the head of S&P Global Ratings' EMEA utilities team and the chairman of S&P Global Ratings' global government related entity focus team. Kernan has also held roles as the head of S&P Global Ratings' EMEA telecommunications team and EMEA diversified industries team, which provided ratings and analytics for the investment holding company, forest products, business services, paper and packaging, transportation, and building materials sectors.

Peter Kernan is a managing director and the global criteria officer for corporate and infrastructure ratings at S&P Global Ratings, where he oversees the development of all corporate and infrastructure criteria globally. He was previously the head of S&P Global Ratings' EMEA utilities team and the chairman of S&P Global Ratings' global government related entity focus team. Kernan has also held roles as the head of S&P Global Ratings' EMEA telecommunications team and EMEA diversified industries team, which provided ratings and analytics for the investment holding company, forest products, business services, paper and packaging, transportation, and building materials sectors.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.