Since President Donald Trump signed an executive order last year seeking ways to ease banking rules prompted by the global financial crisis, much has happened—but not much has been completed.

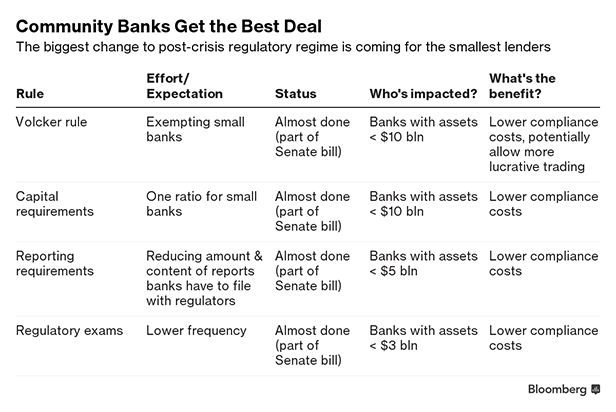

On Wednesday, the U.S. Senate took the most concrete step so far, passing a bill that provides considerable regulatory relief to smaller lenders such as regional and community banks. Yet it's probably the least worrisome for defenders of the 2010 Dodd-Frank Act, the bedrock law enacted to prevent a future financial meltdown.

Recommended For You

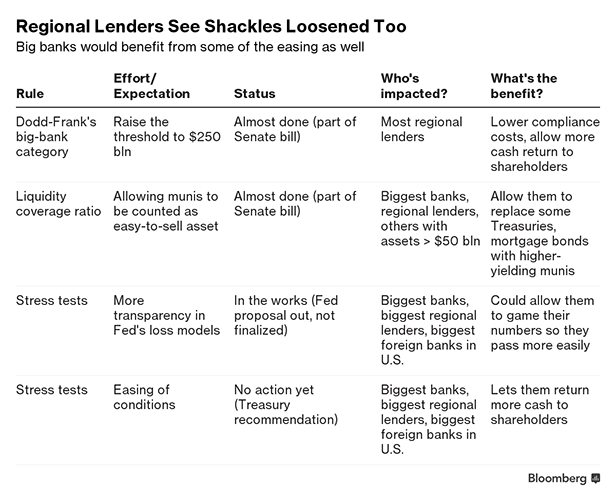

The House would have to approve a bill akin to the Senate's for it to become law. A core element of the Senate legislation raises the threshold established in Dodd-Frank for being considered a systemically important bank—a label that imposes annual stress testing and other requirements on firms.

Lifting the threshold to $250 billion from $50 billion would also likely benefit midsize regional banks, which would face fewer restrictions and lower compliance costs. There are a few elements of the Senate bill that even help the largest banks, though most of their attempts to get further concessions from legislators failed.

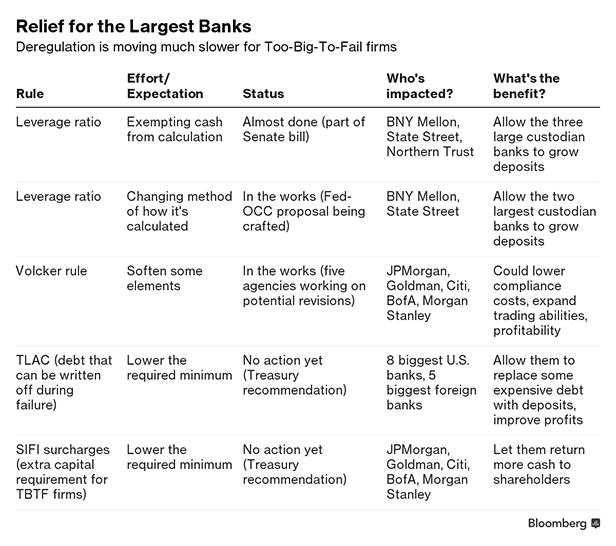

Among the top goals of Dodd-Frank was ending bailouts of “too-big-to-fail” firms whose collapse would risk bringing down the rest of the financial system. In addition to Dodd-Frank, global regulators revised the international capital regime known as Basel and introduced liquidity rules for all of the largest banks worldwide to follow.

U.S. regulators went further in implementing those global standards, gold-plating some of the elements such as the minimum level of debt that can be written off to help re-capitalize a failing bank. The Treasury has recommended dialing back some of those rules, though progress has been slow.

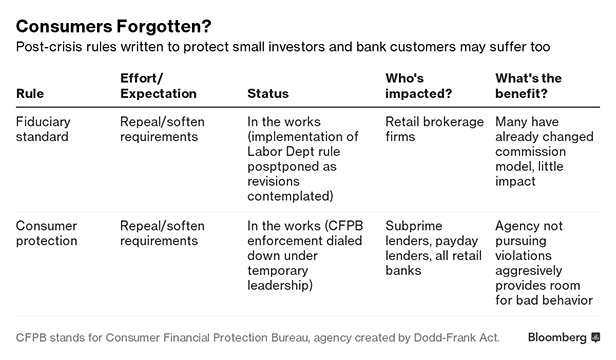

Another element of post-crisis reforms was to protect consumers and small investors from abuse after predatory lending contributed to the housing bubble and its collapse. While some of the enforcement has been curtailed, rule changes haven't come forth so far.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.