A tussle is emerging between underwriters over who controls the levers of a $2.3 trillion market for new company bonds, with the U.S. as the chosen battleground.

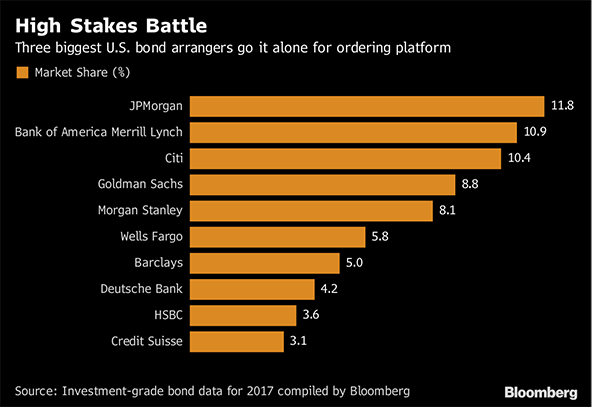

Tech firm Ipreo, jointly owned by a unit of Goldman Sachs Group Inc. and Blackstone Group LP., is taking a system for ordering bonds to Wall Street this year. That puts it in competition with the three U.S. banks that sold the most bonds in 2017—Bank of America Corp., Citigroup Inc., and JPMorgan Chase & Co.—which are setting up a rival platform.

“The U.S. banks have a privileged position in the dollar market, and it's probably one they like to defend,” says Armin Peter, London-based global head of debt syndicate at UBS Group AG, which is using Ipreo's platform.

Recommended For You

Regulators and investors are pushing for primary markets to increase transparency and streamline a process traditionally reliant on phone calls, instant messaging, and emails. That's triggered a race to develop Wall Street's go-to platform, which will be decided on who gets the backing of investors and other large bond arrangers.

Barclays Plc, Deutsche Bank AG, and Morgan Stanley—accounting for about 17 percent of the U.S. market between them—are among banks still mulling whether to adopt Ipreo's system, according to people familiar with the matter who asked not to be identified because they aren't authorized to speak publicly. That makes the banks key targets for both sides.

Buyers' Choice

But the outcome of the competition also depends on the choice of investors buying new bonds.

“We are big proponents of the market becoming electronic, given that the process of placing orders is currently in the dark ages,” says Sharon Ruffles, head of fixed income dealing at State Street Global Advisors, which oversees about $2.8 trillion in assets and uses Ipreo. “How that happens will depend on the creation of the best system out there.”

Ipreo said last week it has secured the backing of more than 160 investors, while 33 banks are signed up to share deal terms on its system. The platform, used by banks raising debt for corporate clients to communicate deal terms and take orders from creditors, has already rolled out in Europe and Asia. The company is also planning to expand into equities and municipal bonds in the U.S., according to Bill Sherman, executive vice president at Ipreo in New York.

BofAML, Citi, and JPMorgan have approached other underwriters to join their platform, according to other people familiar with the matter. They plan to initially focus on U.S. investment-grade bonds, the people said, asking to remain anonymous because the information is private. The product will later be expanded globally, one of them said. Spokesmen for the three banks declined to comment.

Uphill Struggle

Any product that competes with the three banks that together arranged a third of last year's U.S. bond sales may struggle, says Chris Perryman, senior vice president of fixed-income trading at PineBridge Investments which oversees about $85 billion.

“These banks bring a lot of deals, so it's a tough battle for the platform that doesn't have them signed up,” he says. Perryman says he's waiting until there's consensus among bond arrangers before deciding which product to adopt.

Spain's Banco Bilbao Vizcaya Argentaria SA is one of the banks signed up with Ipreo. Its head of bond syndicate, Pablo Vazquez, said the market will benefit from new technology that improves access.

“It makes sense to keep an eye on developing technology that diminishes dependence on an external provider,” he says.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.