For all the flaws of the

tax reform that Congress passed back in December, there's one area where it appears to be working: Getting U.S. companies to bring back the enormous piles of money they have stashed abroad.Now the question is what they will do with it.Before 2018, the U.S. government taxed companies' foreign earnings in a highly unusual way. It applied the 35 percent U.S. corporate rate to their global income (minus foreign taxes paid), but collected the tax only when they brought the money home. So companies left it abroad, building a stockpile of as much as $3.1 trillion.The

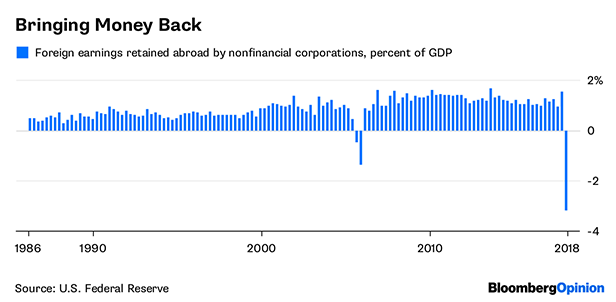

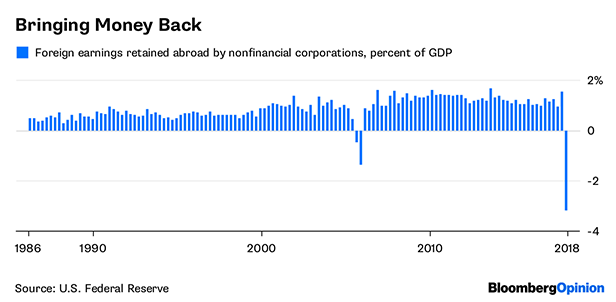

Tax Cuts and Jobs Act of 2017 changed all that, bringing the U.S. more in line with other countries. For one, it lowered the corporate tax rate to a more competitive 21 percent. It also largely eliminated taxation of foreign earnings and imposed a one-time tax—15.5 percent on cash, 8 percent on other assets—on what companies had already accumulated.The Trump administration predicted that the changes would trigger a flood of money back into the U.S., but many were skeptical. Companies already held so much cash domestically that they were giving it back to shareholders in the form of stock buybacks and dividends. Also, many other countries still had lower tax rates than the U.S., so why not deploy the money there?Well, an influx seems to be happening. Before 2018, U.S. non-financial corporations tended to add about $50 billion to earnings held abroad every three months. But in the first three months of 2018, that number turned to a negative $158 billion, according to the Federal Reserve. That's the biggest reversal on records going back to 1946, and much more than companies brought back in 2005, the last time the government tried something similar. Here it is as a percentage of gross domestic product:

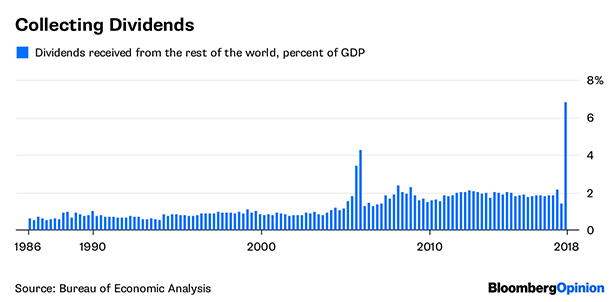

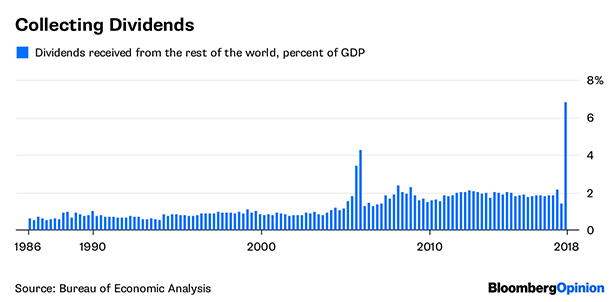

Interestingly, companies left extra money abroad—and received fewer dividends from their overseas investments—in the last three months of 2017. This might illustrate a perverse incentive that the tax changes created. As of Dec. 20, when Congress passed the reform, corporate executives knew they would be getting a big break on their foreign stash in 2018. So, it seems, they left more overseas in 2017 to take maximum advantage.In any case, money is coming back. But what are companies doing with it? The real test of the tax reform, after all, will be whether it prompts the kind of investment that boosts employment, growth, and productivity in the longer run. The Fed data offer some clues.In one positive sign, non-financial companies' capital expenditures increased by about $14 billion—or 3 percent—in the first quarter of 2018, compared with the previous quarter. They also gave more money back to shareholders: Stock buybacks were up by about $20 billion, but still well within the range seen in previous quarters. This is perhaps less encouraging—unless the shareholders find productive ways to invest the money elsewhere.It's still early days, and the true impact of the tax reform probably won't be known for years. But give credit where credit is due: In terms of bringing money back home, the new tax law is proving some of its critics wrong.

Copyright 2018 Bloomberg. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.