Fed Tightening

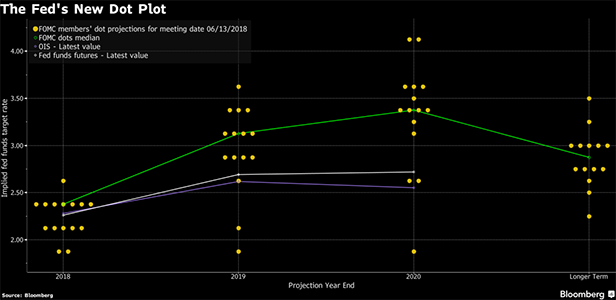

In June, officials signaled they thought monetary policy would need to become restrictive by the end of next year. They penciled in rates of 3.1 percent by end-2019, versus their 2.9 percent median estimate of the neutral rate which neither supports nor slows the economy. Rates were seen at 3.4 percent by the end of 2020. Powell's “for now” reference “speaks to the idea that if the data starts to deteriorate, say because of trade tensions, they'll slow down,” said Joseph Song, senior U.S. economist at Bank of America Corp in New York. “But it works the other way. The tax cuts potentially could be more stimulative and could lead to a faster pace of tightening.”Several regional Fed presidents, including Neel Kashkari of Minneapolis and Raphael Bostic of Atlanta, have already warned about the Fed's need to avoid inverting the yield curve by hiking rates so that short-term borrowing costs rise above longer-term bond yields.Powell, who will appear before the House Financial Services committee at 10 a.m. on Wednesday, said his interpretation of the narrowing spread between short- and longer-term rates is that it might be saying something about how close the Fed is to the neutral rate.That judgment is a hard one to make in real time, and estimates of the neutral rate vary quite widely.The Fed's July Monetary Policy Report, which it prepares as part of the chairman's semi-annual appearance before Congress, included a section on various policy models that produced estimates of neutral ranging from 0.1 percent to 1.8 percent in real terms. Adjusting for the Fed's 2 percent inflation target would put that range for neutral rates between 2.1 percent to 3.8 percent in nominal terms.Officials often don't know until it's too late whether monetary policy is too tight or too loose—that is, when the economy's momentum starts to slow with rising unemployment, or when financial bubbles emerge.With a couple of quarter-point hikes to go before the Fed enters the bottom of policymakers' own range of estimates for the neutral rate, which in June was 2.3 percent to 3.5 percent, Powell used his testimony on Tuesday to underscore that policy isn't on a preset path.“'For now,' suggests that the recent Fed policy of raising rates a quarter point every quarter or so is not set in stone,” Roberto Perli, a partner at Cornerstone Macro LLC and a former Fed staff economist, said in a note to clients. “One good reason for the Fed to slow down or even take a break is that the funds rate is approaching its present neutral level.”

Powell's “for now” reference “speaks to the idea that if the data starts to deteriorate, say because of trade tensions, they'll slow down,” said Joseph Song, senior U.S. economist at Bank of America Corp in New York. “But it works the other way. The tax cuts potentially could be more stimulative and could lead to a faster pace of tightening.”Several regional Fed presidents, including Neel Kashkari of Minneapolis and Raphael Bostic of Atlanta, have already warned about the Fed's need to avoid inverting the yield curve by hiking rates so that short-term borrowing costs rise above longer-term bond yields.Powell, who will appear before the House Financial Services committee at 10 a.m. on Wednesday, said his interpretation of the narrowing spread between short- and longer-term rates is that it might be saying something about how close the Fed is to the neutral rate.That judgment is a hard one to make in real time, and estimates of the neutral rate vary quite widely.The Fed's July Monetary Policy Report, which it prepares as part of the chairman's semi-annual appearance before Congress, included a section on various policy models that produced estimates of neutral ranging from 0.1 percent to 1.8 percent in real terms. Adjusting for the Fed's 2 percent inflation target would put that range for neutral rates between 2.1 percent to 3.8 percent in nominal terms.Officials often don't know until it's too late whether monetary policy is too tight or too loose—that is, when the economy's momentum starts to slow with rising unemployment, or when financial bubbles emerge.With a couple of quarter-point hikes to go before the Fed enters the bottom of policymakers' own range of estimates for the neutral rate, which in June was 2.3 percent to 3.5 percent, Powell used his testimony on Tuesday to underscore that policy isn't on a preset path.“'For now,' suggests that the recent Fed policy of raising rates a quarter point every quarter or so is not set in stone,” Roberto Perli, a partner at Cornerstone Macro LLC and a former Fed staff economist, said in a note to clients. “One good reason for the Fed to slow down or even take a break is that the funds rate is approaching its present neutral level.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.