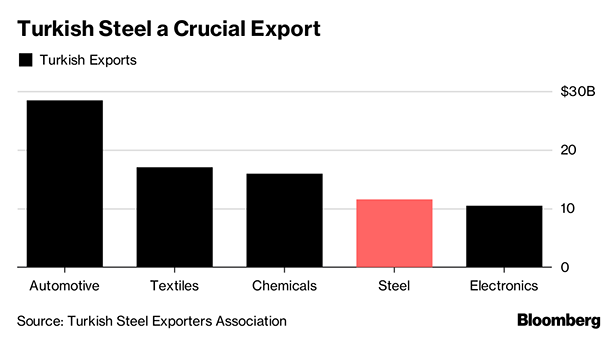

President Donald Trump's latest broadside against Turkish steel is a fresh blow to one of the country's most important industries and will reshape global trade flows.

Under a higher level of tariffs, Turkey will continue to lose American customers, once the country's top buyers of steel. The new tariffs won't put Turkish steelmakers out of business but will force them to find new markets, likely across North Africa or the Middle East, or displace other imports to Europe.

Steel, in its more basic form of slabs, sheet, or reinforcing bar, is a highly liquid market, and it's usually easy for a company to find new buyers. Attacking imports has become a favorite tool of politicians from Europe to the U.S., causing flows to be rerouted. The global industry has been described as a game of whack-a-mole. If exports are blocked in one market, the action shifts elsewhere.

Recommended For You

The U.S. plans to double tariffs on Turkish steel to 50 percent and raise the rate on aluminum to 20 percent, Trump said on Twitter today.

In aluminum, Turkey is a tiny player. The U.S. imported about 4,500 tons of aluminum bars, rods, and profiles from the country in 2017, according to World Bank statistics. However, Turkey ranks as the world's sixth-biggest steel producer. Turkey exported about 500,000 tons to the U.S. in the five months to May, compared with more than a million tons in the same period last year, according to data from the U.S. Census bureau. The U.S. has fallen from Turkey's main steel buyer to number three.

The new U.S. tariffs are designed to add pressure on Turkey to release an American pastor and will further squeeze an economy that's being engulfed by a financial crisis and plunging currency. An index of Turkish steel stocks plunged almost 10 percent after the announcement, before recovering some of those losses.

In response to U.S. tariffs earlier this year, Turkey turned its exports toward European countries, such as Italy and Spain. The new U.S. tariffs will heighten fears that even more steel will head to the region, pressuring European producers. Regulators have introduced so-called safeguard measures, which slap tariffs on steel if imports exceed historical averages.

“The tariffs on Turkey itself won't form a big threat,” to Europe, Philip Ngotho, an analyst at ABN Amro Bank NV, said by email. “Europe has measures in place to limit imports of steel into Europe, so that will continue to offer some protection from potentially cheaper and more steel from Turkey.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.