Travel company TUI AG warned of grounded vacation flights, Cambridge University said its supply of fee-paying continental European students could run dry. Corporate borrowers are stepping up efforts to avoid being caught off guard when Britain leaves the European Union (EU) next year.

Warnings about how Brexit might stop bond investors getting their money back are becoming lengthier, while clauses allowing issuers to switch governing jurisdiction away from English law are appearing in documentation. New courts to settle cross-border disputes are also opening in European capitals, a further sign of the looming threat to London's status as a financial hub.

British and EU negotiators are moving closer to a divorce deal. But there's still a risk that the financial institutions concentrated in London may find themselves isolated from their clients across a hastily constructed border. To head off the unthinkable, scores of lawyers, lobbyists, and bankers have been rewriting the debt-market rule books.

Recommended For You

“A messy Brexit is not just a tail risk, it's a bigger probability event and it needs more air time in documents,” said Geraud Charpin, a portfolio manager in London at BlueBay Asset Management, which oversees more than $60 billion.

Buyer Beware

The 'risks' sections included in all bond prospectuses have become longer to incorporate “more fulsome” attention to the potential mishaps triggered by Brexit, according to Cenzi Gargaro, a partner at White & Case in Paris.

“When the referendum happened, borrowers weren't sure what to write, and risks started with a couple of general lines,” he said. “They've developed over time.”

“When the referendum happened, borrowers weren't sure what to write, and risks started with a couple of general lines,” he said. “They've developed over time.”

Tour operator TUI, which postponed a sale of notes earlier this year, said in its prospectus that its U.K.-based airlines may lose access to EU airspace after the split. Connect Plus, operator of the M25 motorway that circles London, warned ahead of a bond sale in July of potentially having to repay borrowings to the European Investment Bank after Brexit, which could impact its ability to service other debt.

When Cambridge University sold debt in June, it said it could lose access to EU research budgets while the supply of EU students applying to take degrees could also dwindle. In all, the institution's list of Brexit-related pitfalls ran to two pages.

As well as warning investors of what might lurk over the horizon, debt issuers are also shoring up their legal protections against being stuck in regulatory limbo when Brexit takes effect.

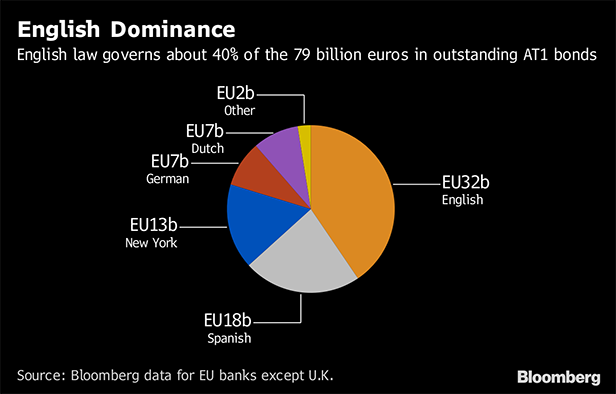

One risk facing banks is how regulators treat so-called bail-in bonds, which put creditors on the hook for losses, if they are governed by English law. The risk is that they may not count under EU rules after Brexit.

EU banks have used English law for about 40 percent of the most junior class of these notes, known as Additional Tier 1 bonds, Bloomberg data show.

In April Elke Koenig, head of the euro area's bank-failure agency, warned that bonds issued by Eurozone lenders under English law will become “third-country issues.” About 100 billion euros ($116 billion) of securities could lose their loss-absorbing status, the Single Resolution Board said at the time.

Many banks have been rewriting the small print for new subordinated bonds to include clauses that give them an option to change the governing law in certain circumstances, according to Richard Levy, a capital markets partner at Linklaters in London.

Deals such as Belgian lender Belfius Bank SA's 500 million euro sale of Additional Tier 1 bonds in January and Societe Generale SA's $1.25 billion bond in April incorporated this type of clause into their documentation. Portuguese lender Novo Banco SA went a step further in June when it issued 400 million euros of Tier 2 bonds, specifying Brexit as the potential trigger for a change in the governing law.

That may not be popular with investors, even if it gives some peace of mind to issuers and their legal advisers.

“English law bonds are considered to be superior from a litigation perspective because of the objectivity of the system,” said Sebastiano Pirro, a portfolio manager at London-based asset manager Algebris Investments, which oversees about $10 billion in bond investments. “Novo Banco probably ended up paying a higher price for that clause.”

English OTC Derivatives

It isn't just bonds that face uncertainty because they have English law baked into their structure.

Brexit also risks disrupting the $532 trillion market for over-the-counter derivatives if it eliminates automatic recognition of English court judgments across the EU.

In July, the International Swaps & Derivatives Association (ISDA) published new master agreements that govern the swaps under Irish and French law, aiming to make it easier to settle contractual disputes after the split.

Steps are also being taken in Paris to establish a new court to make English law judgments on commercial swap contracts, and similar initiatives are underway in Dublin, Amsterdam, Brussels, and Frankfurt, according to law firm Haynes and Boone.

Crossing Borders

As well as legal complications from a disorderly Brexit, banks are also at risk of abruptly losing the right to lend across borders in the EU and are considering whether they can acquire licenses to ensure access. Because much of the bloc's banking is concentrated in London, European companies could find themselves isolated from their main capital market.

The International Capital Market Association, a lobby group, warned in June of such “cliff-edge risks,” where markets are disrupted as soon as Brexit takes effect. The Loan Market Association has set up a working group to look at potential disruption to the loan market.

“The Brexit discussions have larger ramifications for credit markets than people realize,” said Jeroen van den Broek, ING Groep NV's head of debt strategy and research. “People are preparing, but there is also very little realism in terms of what will actually happen if and when there is a no-deal Brexit.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.