More than $1 trillion of outflows in 12 months would roil just about any segment of the global financial markets. For prime money market funds, a corner of the U.S. money market industry that had only $1.4 trillion of assets to begin with, it looked like a fatal blow.

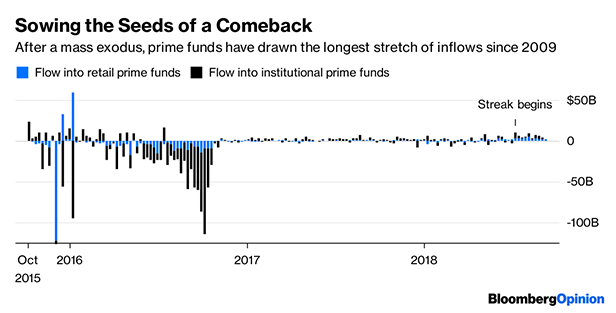

Yet almost two years after reaching their low point, prime funds, which buy certificates of deposit and company IOUs, are staging a surprising resurgence. They've attracted inflows for 10 consecutive weeks through Sept. 12, the longest stretch since early 2009, according to Investment Company Institute (ICI) data. At $534 billion, the industry remains a fraction of what it was before sweeping changes to U.S. money markets prompted a mass exodus starting in late 2015. Yet the steady stream of cash suggests a path forward.

Recommended For You

Those who follow short-term fixed-income markets aren't exactly sure what to make of this. Strategists at BMO Capital Markets said last month that they suspected prime funds would experience outflows from September through December. In their view, companies that repatriated overseas cash were largely responsible for inflows and would probably use the cash hoard to pay taxes.

It's true that institutional prime funds just had their smallest inflow in four weeks. But individual investors appear willing to pick up the slack. They have collectively added money for 16 consecutive weeks, now the longest stretch in ICI data going back to 2007, which more than makes up for the ebb and flow of corporate cash.

With mom-and-pop investors leading the way, the explanation for the resurgence in prime funds looks more like a simple dash for cash. As I wrote in June, people are flocking to money markets because they pay more than they have in years. Back then, the so-called real yield on two-year Treasuries (the return above inflation) was 0.72 percent. At the time, it was the highest level since 2009. It has since climbed above 1 percent.

A two-year Treasury yield isn't quite the same as the rate on a prime fund, but it's in the ballpark. The Vanguard Prime Money Market Fund, for instance, has a yield of about 2.1 percent. The dividend has grown a whopping 364 percent over the past three years and 91 percent in just the last 12 months.

Prime funds offer higher yields than those that strictly invest in T-bills and other short-term U.S. debt. Vanguard's Treasury Money Market Fund, for instance, yields 1.96 percent. Regulations steered cash toward those government-only portfolios in an effort to curb risk in an area of the market that's meant to be ultra-safe.

Prime funds used to have a dollar-a-share fixed price, which gave the impression that they were just as stable as bank accounts. Now, their value can float. Vanguard's, though, has yet to deviate from $1, according to data compiled by Bloomberg. The JPMorgan Prime Money Market Fund over the past year has traded in a range of $0.9999 to $1.0003. The Fidelity Prime Money Market Portfolio has traded from $1.0002 to $1.0004.

Basically, for all intents and purposes, the funds' share prices haven't budged. While not that surprising, it was still an uncertain outcome as the new rules took hold. With prime funds proving their safety and resilience even with variable net asset values, investors may be growing comfortable putting money back in again.

Whether prime funds ultimately return to their previous size is anyone's guess. It's been a slow process thus far just to stem the outflows and regain a solid foothold in the short-term fixed-income market.

Much will probably depend on how many more times the Federal Reserve raises interest rates and whether the U.S. economy can withstand that tightening. Higher short-term yields will naturally attract investors, but if there's a sense that corporate finances are deteriorating, it could lead to a renewed march toward government money-market funds.

For now, though, the economy is humming and traders are growing more confident that the Fed will raise rates twice more this year. That means there's little in the way of prime funds' unexpected comeback.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.