Despite the improving economy, companies have stubbornly withheld salary increases over the past few years, opting to fatten the bonus pool instead. Now, they're taking those bonuses away, according to a new survey.

Instead, employers are ever-so-slightly increasing salaries, but not enough to make up for the loss. Companies allocated 3.1 percent of their budgets to salary increases next year—a high since the recession. (This finding falls in line with another major survey by Willis Towers Watson from this year.)

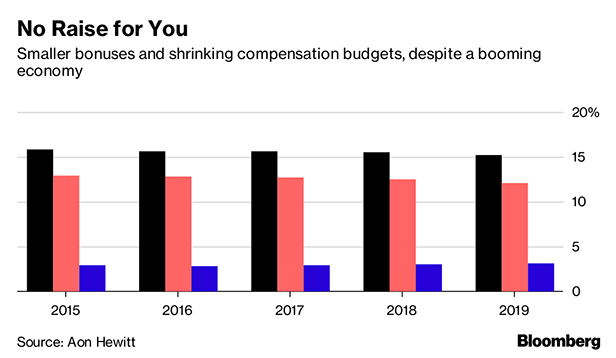

However, bonus pay decreased this year—and along with it, total spending on compensation. In 2017, companies allocated 15.7 percent of their total budgets to salary and bonuses. That number dropped to 15.5 percent this year, and employers are planning on budgeting just 15.2 percent on pay next year.

The survey, conducted by HR consulting firm Aon, questioned 1,026 employers in June and July of this year.

“From a total earning opportunity, people are less well-off than they were a year ago, two years ago, or three years ago,” said Ken Abosch a compensation researcher at Aon. The trend is “completely counterintuitive, particularly given the fact that company performance is very strong,” he added.

Traditionally, companies have doled out bonuses during boom times (such as the present) to share the wealth with their workers. Given the strong economy and recent tax windfall, now seems a strange time to pull back on these kinds of one-time cash rewards. In recent years, employers also increasingly opted for bonuses as a way to reward and motivate high-performing employees. “Results are very good for most organizations, so we would expect to see bonuses also very strong,” Abosch said.

Since the recession, companies have shied away from salary increases out of fear of another economic downturn. A pay increase is a fixed cost that is hard to take away in economic hard times, short of laying someone off. Instead of straining their budgets on pay, employers have turned to bonuses. Unlike a raise, bonus pay is flexible. Employees don't expect one every year, and don't necessarily notice if it disappears.

Employers are now taking advantage of that flexibility. A tight labor market has forced companies to increase base pay to attract and retain people. But instead of devoting more of their total budget to compensation, they're simply trimming money from the bonus pool and hoping employees don't notice.

“A lot of employees don't necessarily even understand the bonus arrangement,” said Abosch. “If they got a smaller bonus payout, I'm not sure they would know why that occurred.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.