Comcast Corp. sold bonds to finance its $39 billion acquisition of Sky Plc in one of the biggest corporate debt sales ever in the United States.

The Philadelphia-based cable giant sold $27 billion of unsecured bonds in 12 parts. The longest portion of the offering, a 40-year security, yields 1.75 percentage points above Treasuries, less than an initially discussed range of between 1.95 percentage points and 2 percentage points, according to a person with knowledge of the matter, who asked not to be identified as the details are private.

Comcast was able to cut the cost on its sale as investors put in orders for about $88 billion of the debt. A deal of that size was likely to draw strong demand, said David Knutson, head of credit research for the Americas at Schroder Investment Management.

Recommended For You

“There are a lot of buyers out there today asking the question of what percentage of the index this will be, versus what will the leverage on this be,” he said before the deal was finalized. “It's a good issuer, well-regarded and well-rated.”

Big Deal

At $27 billion, Comcast's offering is the second-largest deal of the year behind CVS Health Corp.'s $40 billion issuance in March. It's the fourth-largest debt sale on record in the U.S. after Verizon Communications Inc., Anheuser-Busch InBev NV, and CVS.

Comcast came away with a winning bid of $39 billion for Sky following a months-long bidding war against 21st Century Fox Inc., which culminated in an auction in London last month. Fox, which is in the process of selling itself to Walt Disney Co., relinquished its 39 percent stake in Sky to Comcast shortly after the auction, giving Comcast full control of Europe's largest satellite broadcaster.

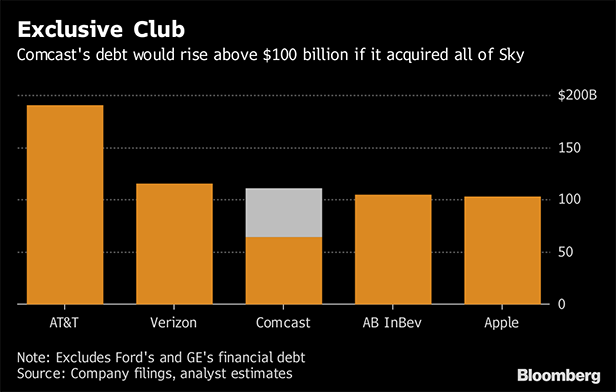

By owning all of Sky, Comcast's debt could nearly double, to $114 billion, according to S&P Global Ratings. Only telecom providers AT&T Inc. and Verizon have debt loads higher than that, while AB InBev and Apple Inc. have also crossed into 12-figure territory. This would push Comcast's debt to 3.6 times earnings before interest, tax, depreciation, and amortization (EBITDA), according to S&P.

Comcast is committed to maintaining its current rating and paying down debt to return to current leverage levels of around 2.2 times a measure of earnings. That may a tough feat to achieve, S&P said. It rates Comcast A- with a negative outlook, while Moody's has given the company an equivalent A3 with a stable outlook. The firms affirmed their ratings last month after the Sky auction.

To prioritize debt reduction, Comcast said Monday it would pause its stock repurchase program next year. It still expects to buy back US$5 billion of shares this year. That announcement, along with “strong language” from management, likely helped convince credit raters to affirm Comcast's ratings, CreditSights analysts Lindsay P. Gibbons and Jay Mayers said in a report Tuesday.

“When Brian Roberts speaks, everybody listens, and he sent a clear message yesterday,” the analysts said of Comcast's CEO, who was speaking on a call to fixed income investors. “The company is committed to ratings and will get back to low 2x leverage in 18 to 24 months.”

Bank of America Corp. and Wells Fargo & Co. were lead managers on the bond sale, according to a filing.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.