Most U.S. workers who have health plans through their employers must cover at least some expenses before their insurance kicks in, and those out-of-pocket costs have risen eight times as fast as wages, a closely watched study found.

American employers are the largest source of health coverage in the country, insuring about 152 million people. Over the past decade, they've asked workers to shoulder a greater and greater share of medical costs, in a system-wide redistribution of risk that shows no signs of abating.

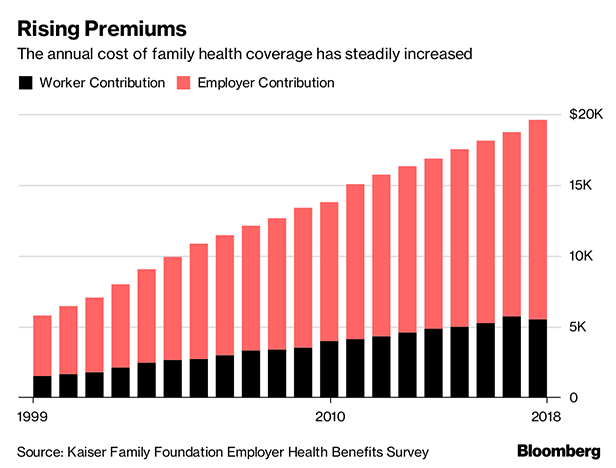

New data from an annual survey by the Kaiser Family Foundation, a health-policy research group, shows health benefits are steadily becoming more expensive for both workers and employers. As total costs increase, higher deductibles expose workers to increased financial risk when they fall ill.

Recommended For You

“They see the higher deductibles and they perceive them as larger dollar amounts, and they know their wages aren't going up that fast,” said Gary Claxton, a vice president at the Kaiser Family Foundation.

Premiums have also increased more quickly than earnings and inflation.

In 1999, the average total premium for a family health-insurance policy—taking into account what workers and their employers paid—was about 14 percent of median household income. By last year, that was up to 31 percent. Workers' contributions on average reached about 9 percent of household income.

Recent years have seen slower annual increases in total healthcare costs than other periods such as the early 2000s, when double-digit growth was the norm. That's good news for both companies and workers. As a share of total compensation, employer health costs have stabilized in recent years.

Claxton says the one-year increase in premiums is roughly in line with wages and inflation. Employers may be reluctant to make big changes in their health benefits in a tight labor market, he said. The unemployment rate, at 3.9 percent, is near a 20-year low.

“When you're at full employment and you're not really being stressed, that's not the decision you want to make,” he said. “You're still out there fighting for workers.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.