For years, corporate America has unsuccessfully lobbied regulators to crack down on an industry that's known for questioning companies' decisions to enrich top executives and pursue big merger and acquisition (M&A) deals.

Now, with Trump appointees leading the U.S. Securities and Exchange Commission (SEC), business groups are optimistic that they will win some restrictions on so-called proxy-advisory firms.

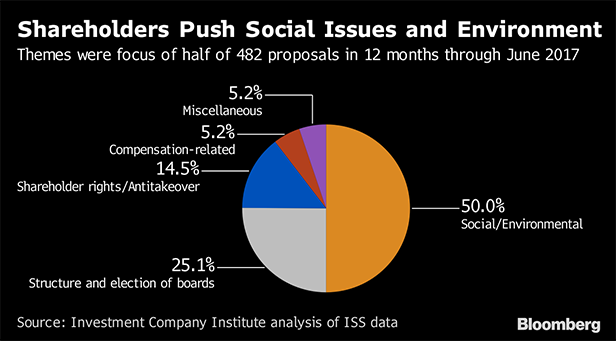

At issue are companies such as Institutional Shareholder Services (ISS) and Glass Lewis, which mutual funds and other shareholders pay for advice on how to vote in corporate elections. Such polls can decide who sits on boards, shifts in corporate strategy, and how much businesses should focus on social and environmental issues.

Recommended For You

The U.S. Chamber of Commerce has long argued that proxy-advisory firms have too much influence and are riddled with conflicts of interest, charges that ISS and Glass Lewis reject.

While the advisory firms frequently back management, they sometimes support shareholder proposals that corporate executives find threatening. An example came Wednesday when ISS urged Campbell Soup Co. shareholders to back a slate of five director candidates nominated by activist hedge fund manager Dan Loeb. Loeb's Third Point owns a 7 percent stake in Campbell and has demanded changes to improve the soup maker's lagging performance.

See also:

A common flashpoint between companies and advisory firms is executive compensation. In 2011, the SEC required all public companies to give their shareholders non-binding votes on whether they approve of top executives' pay. Though companies can ignore the results, they risk investor upheaval if they do. Business leaders feel they are more likely to face embarrassing votes if ISS and Glass Lewis advise investors to oppose pay packages.

The chamber, the nation's biggest business lobbying group, and the National Association of Manufacturers are seizing on a scheduled Thursday SEC meeting on corporate governance issues as a sign that the agency is poised to take action. Representatives from the chamber, ISS, and Glass Lewis are slated to appear.

The two groups took out a full-page newspaper advertisement this week claiming that advisory firms “pose a threat” to Americans' retirement accounts. “Proxy-advisory firms have advocated for politically motivated policies that actually reduce shareholder returns,” the ad said.

In response, Steven Friedman, ISS's general counsel, said in a statement that investors' “hard-earned money is being wasted on a Washington lobbying campaign and advertising to silence their voice on important voting matters.

“At the core of this effort, financed by some public corporations, is a desire to see no shareholder dissent on CEO pay and other governance matters,” he added.

The Council for Institutional Investors, whose members include large pension funds, has defended proxy-advisory firms as critical to good corporate governance. Last week, the group said it's “distressed” that the SEC might rein them in.

But, the chamber seems to be making some headway.

In September, the SEC withdrew a pair of staff letters that fund managers had partly relied on as legal backing for using proxy-advisory firms.

The SEC has said it will base future recommendations on what it learns from Thursday's event. Meanwhile, a bipartisan group of senators announced proposed legislation Wednesday that would put the proxy-advisory firms more directly under SEC oversight.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.