General Electric Co. (GE) shares sank after two analysts sounded more alarm bells around the company's liquidity and a report said former GE employees were being questioned by federal investigators about its troubled insurance business.

Once among the most respected American businesses, GE can now barely go a full week without a negative headline. In just the past month, news about an expanded probe of the company's accounting, credit rating downgrades, potential tax problems, and escalating liquidity concerns have led to a 27 percent erosion in the stock price, overshadowing more positive announcements from GE, including its accelerated exit from Baker Hughes and the restructuring of the struggling power business.

GE's finance arm, especially, has garnered a lot of attention. The insurance business came under the spotlight earlier this year when GE said it would take a $6.2 billion charge related to an old portfolio of long-term care insurance, and has since then thrown up many more red flags. J.P. Morgan analyst Stephen Tusa warned earlier this year that the finance unit, GE Capital, may still have underappreciated risk.

Recommended For You

On Friday, Deutsche Bank analyst Nicole DeBlase slashed her price target on the stock by more than a third amid continuing questions about the beleaguered multinational's liquidity outlook. J.P. Morgan's Tusa, a long-time bear on the company, said commentary from GE's partner Safran SA supported his view that profit and cash flow growth at the aviation segment would be below consensus expectations.

The other blow came as the Wall Street Journal reported that several former GE employees have said the company's insurance business failed to internally acknowledge worsening results over the years. The employees also said that they were interviewed by government lawyers.

GE spokeswoman Jennifer Erickson declined to comment on the specifics of the insurance business investigation, saying in an emailed statement that the company is “exploring every option to manage and mitigate risk” from its legacy insurance liabilities.

Shares were down 5.2 percent at 12 p.m. in New York, after dropping as much as 6.4 percent earlier in the session. The stock has remained below $8 over the past two weeks, a level last seen in March 2009 at the financial crisis market bottom.

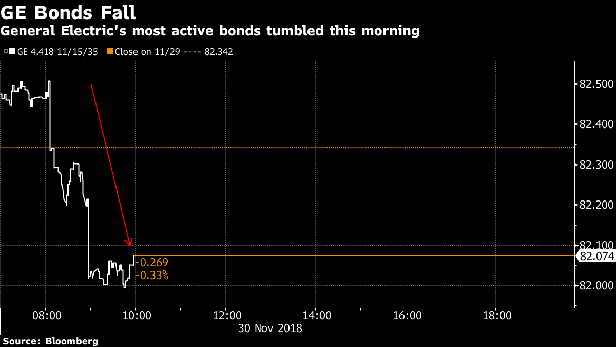

General Electric's 4.418% notes due in 2035, issued out of the GE Capital entity, also fell this morning and now trade at a spread of about 286 basis points above Treasuries, 12 basis points wider than where the bonds closed yesterday. The notes are the most active in the investment-grade bond market today.

In analyst DeBlase's base case model, GE will likely be able to build up its balance sheet next year with cash flow from its industrial units to around 34 cents a share, assuming economic headwinds don't worsen in the next three years and debt comes down. Still, the scenario supports a lower price target on the stock, prompting a cut to $7.00, from $11.00, compared with the average of $11.38 according to data compiled by Bloomberg. She rates the stock a hold.

A more bearish case assumes earnings at the power unit continue to decline and GE's other business units are hit by a modest downturn. DeBlase sees the industrial units facing a cash burn of about 21 cents per share next year. Yet she doesn't see the company facing a liquidity crisis, “even in this drastic scenario.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.