Amid the fallout of the General Electric Co. (GE) debacle, a delicate but crucial social contract between shareholders, bondholders, and corporate America is being quietly redrawn.

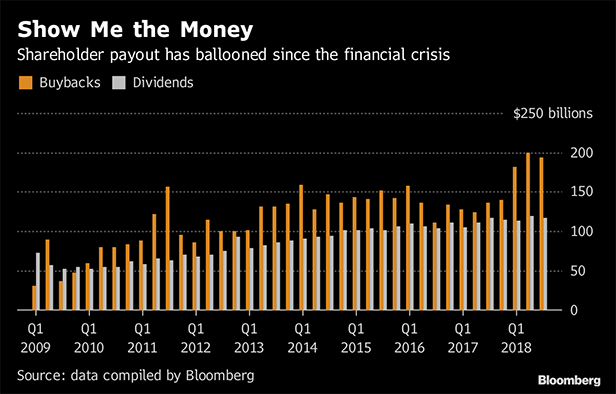

For a decade since the financial crisis, U.S. companies have piled up debt to fund generous equity buybacks, helping supercharge a fourfold jump in the S&P 500 Index. But as scrutiny on companies' financial health mounts, creditors are seeking to wrestle back control and curb these balance-sheet-be-damned maneuvers.

Already, U.S. companies are curtailing the volume of bonds sold to buy back their own stock—reducing that amount by a third in 2018, based on a Bloomberg data search of transactions detailing use of proceeds. In Europe, where it's more unusual for companies to borrow to redeem stock and profitability has recovered more slowly, issuance is running at an eight-year low.

Recommended For You

This all points to a reversal of the type of shareholder-friendly activity that propelled the S&P 500 to dizzying peaks this year. Companies need to shore up their leverage before an economic downturn hits, and they need to court lenders they may need down the road. As interest rates grind even higher, treasurers are likely to think even harder about borrowing to enrich shareholders.

“It's a different calculus in this environment,” says Joseph Elegante, a money manager at UBS Asset Management. “We're going to see a lot more discipline. We've absolutely seen share prices react to higher levels of leverage.”

“It's a different calculus in this environment,” says Joseph Elegante, a money manager at UBS Asset Management. “We're going to see a lot more discipline. We've absolutely seen share prices react to higher levels of leverage.”

Yields on U.S. investment-grade corporate bonds trade at 4.35 percent, their highest level in more than eight years, according to Bloomberg Barclays indexes. This level is also higher than the benchmark's average coupon, which means that new corporate bonds will be more expensive than existing debt.

For Fidelity International fund manager Bill McQuaker, GE was the watershed moment.

The blue-chip had AAA ratings on par with the U.S. Treasury from Moody's Investors Service in 2009. Now, it's been forced into fire sales to shore up its rating as yields shot up to near junk levels.

“If the credit markets are now a bit more nervous about that run of events, if their willingness to fund companies' appetite for credit isn't as great as it was, we need to worry about that,” McQuaker said at a Nov. 27 briefing in London. “One of the biggest positives for the U.S. market ever since 2009 has been companies that have been happy to use cash to buy back equities.”

Since the S&P 500 bottomed out in 2009, its constituents have splashed $4.7 trillion on buying back shares and $3.4 trillion on dividends, data compiled by Bloomberg show.

The leverage binge that helped fuel such activities pushed about half of outstanding investment-grade bonds into BBB ratings ranks—setting them up as candidates to become fallen angels in the next downturn. For high-grade companies in 2017, debt outstanding relative to an earnings measure was at its highest level since at least 2010, according to Morgan Stanley.

Of course, low borrowing costs aren't the only reason behind the buyback boom. Companies building up cash piles from growing profits may still prefer repurchasing shares to investing in the business. Even as rates rose, the second quarter of 2018 marked a record for buybacks on the S&P 500 in the post-crisis period, and the amount dipped only slightly in the following three months.

And while higher premiums may prove a barrier to some, others remain eager to window-dress their share prices, and they won't mind taking out debt to do it, according to Brian Reynolds, an analyst Canaccord Genuity LLC.

Home Depot Inc. said its $3.5 billion sale of bonds on Nov. 27 will partly fund stock repurchases.

Still, the drop in issuance volumes is illustrative of a growing trend: Corporate America is facing a wake-up call as once-acquiescent bondholders balk at funding rewards to equity owners.

After CVS Health Corp. closed a $70 billion deal to buy health insurer Aetna Inc. on Nov. 28, Moody's Investors Service downgraded its credit rating and laid out its prescriptions for balance-sheet repair: “We expect the company to cut all share repurchases and use free cash flow to reduce debt.”

That followed Comcast Corp.'s chief executive saying his company's “plate is full” on Nov. 6 following the acquisition of Sky Plc, and that his company will be “pausing the share buyback and focusing on the balance sheet.”

It's good news for bondholders who've been on the losing side of shareholder-friendly actions.

“Many companies are rated BBB because they've been shareholder-friendly, so they can defend their rating by chopping dividends or share buybacks,” says Fraser Lundie, co-head of credit at Hermes Investment Management.

History is on his side, at least. Previous cycles show that companies cozy up to creditors when they need them most. The 2008–2009 period coincided with dividend cuts and halts to share buyback, according to Matthias Schell, credit analyst at Landesbank Baden-Wuerttemberg.

“We're paying a great deal of attention to the balance sheet of companies that we're following, making sure we're not making mistakes that were made in prior financial crises,” says Elegante at UBS Asset.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.