The amount of offshore cash U.S. corporations have returned home so far this year is just a fraction of what President Donald Trump had promised.

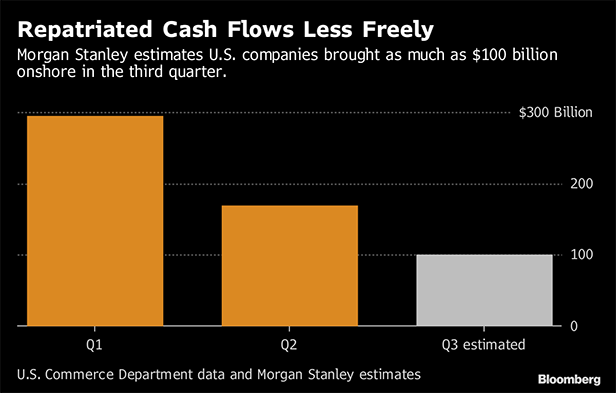

A Morgan Stanley report released Thursday estimates that companies brought back between $50 billion and $100 billion in the third quarter—which would place the total amount repatriated back to the U.S. at around $514 billion. Companies repatriated $294.9 billion in the first quarter and $169.5 billion in the second quarter, according to previously released Commerce Department data.

The tax overhaul signed into law by Trump in December gives companies incentives to bring money back to the U.S. by offering a low one-time tax on repatriated profits. Under the new law, companies pay a repatriation tax of 15.5 percent on cash and 8 percent on non-cash or illiquid assets, whether or not they're brought back onshore.

Trump has said, without specifying his source, that he expects more than $4 trillion to return to the U.S., which would help create jobs and increase investment.

However, even though companies are less restricted in moving their offshore profits under the U.S. tax overhaul, many are choosing to keep earnings in foreign subsidiaries, according to a team of Morgan Stanley analysts led by Todd Castagno.

“The sharp drop and trend trajectory [are] surprising—and may require analysts and investors to rethink their near-term capital deployment and return expectations,” the note said.

Johnson & Johnson, EBay Inc., and Cigna Corp. are among companies that have disclosed in regulatory filings that they plan to keep their foreign profits offshore. Onerous taxes imposed by foreign jurisdictions when the money leaves their borders create a disincentive for companies to move profits, according to the note.

Looking Ahead

The U.S. Commerce Department is scheduled to release the third quarter repatriation numbers on Dec. 19. Second-quarter figures could also be revised in that same release. The Internal Revenue Service is expected to issue final rules detailing when the repatriation tax applies and how to pay it.

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.