Ten years after the credit crisis, and with the Federal Reserve raising rates eight times since 2015, the end game is fast approaching. As the U.S. economy has strengthened, the effect of rate increases on the yield curve has been uneven, resulting in speculation about prospects for a yield-curve inversion. Macroeconomic factors like trade policy, emerging-markets volatility, and quantitative easing in Europe further complicate the landscape.

Everyone seems to have a view about the future, although which view is prevailing changes regularly. One thing is clear, however: Further rate increases are very likely. We don't know how many, for how long, or what their effect on the yield curve may be. However, corporate treasury and finance professionals can use scenario analysis and simulations to assess the impact of the Fed's interest rate end game.

End of the “New Normal”

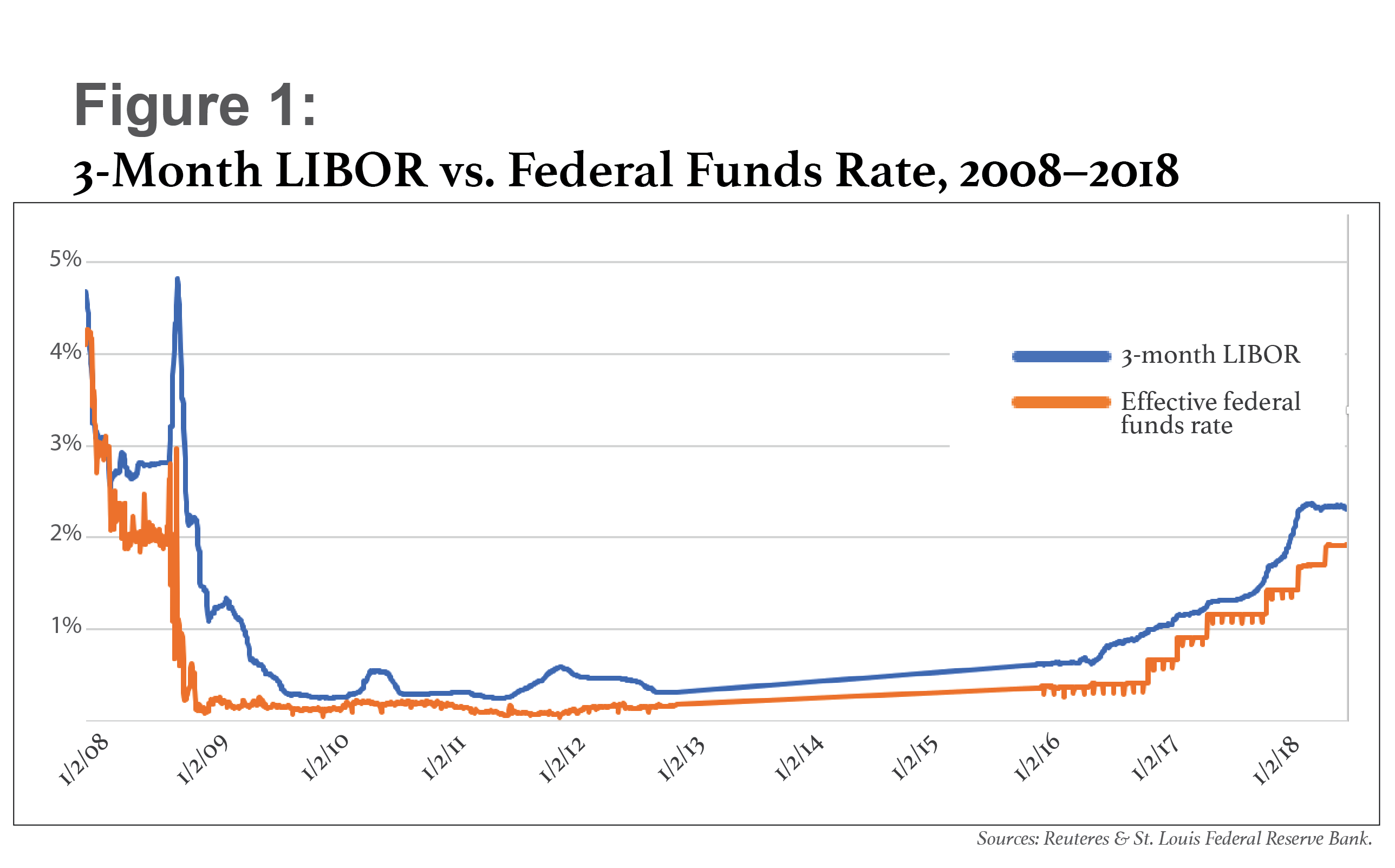

Figure 1 compares historical three-month LIBOR (London Inter-bank Offered Rate) levels with the effective federal funds rate. It shows that—historically and, especially, more recently—LIBOR rates track with movements in the federal funds rate. Therefore, Federal Reserve policy and future fed funds rates are useful guides to future LIBOR rates.

Consider the case of a typical U.S. corporate that entered into a revolving floating-rate line of credit (three-month LIBOR, plus 150 basis point credit spread) a few years ago and is due to renew the credit line in a year.

Assuming the line was mostly drawn and prudently hedged at inception, how should the treasury team go about assessing the impact of interest rate movement on their future funding costs if they expect the credit line to roll at maturity on similar terms? They should take a systematic approach that combines scenario and simulation analysis.

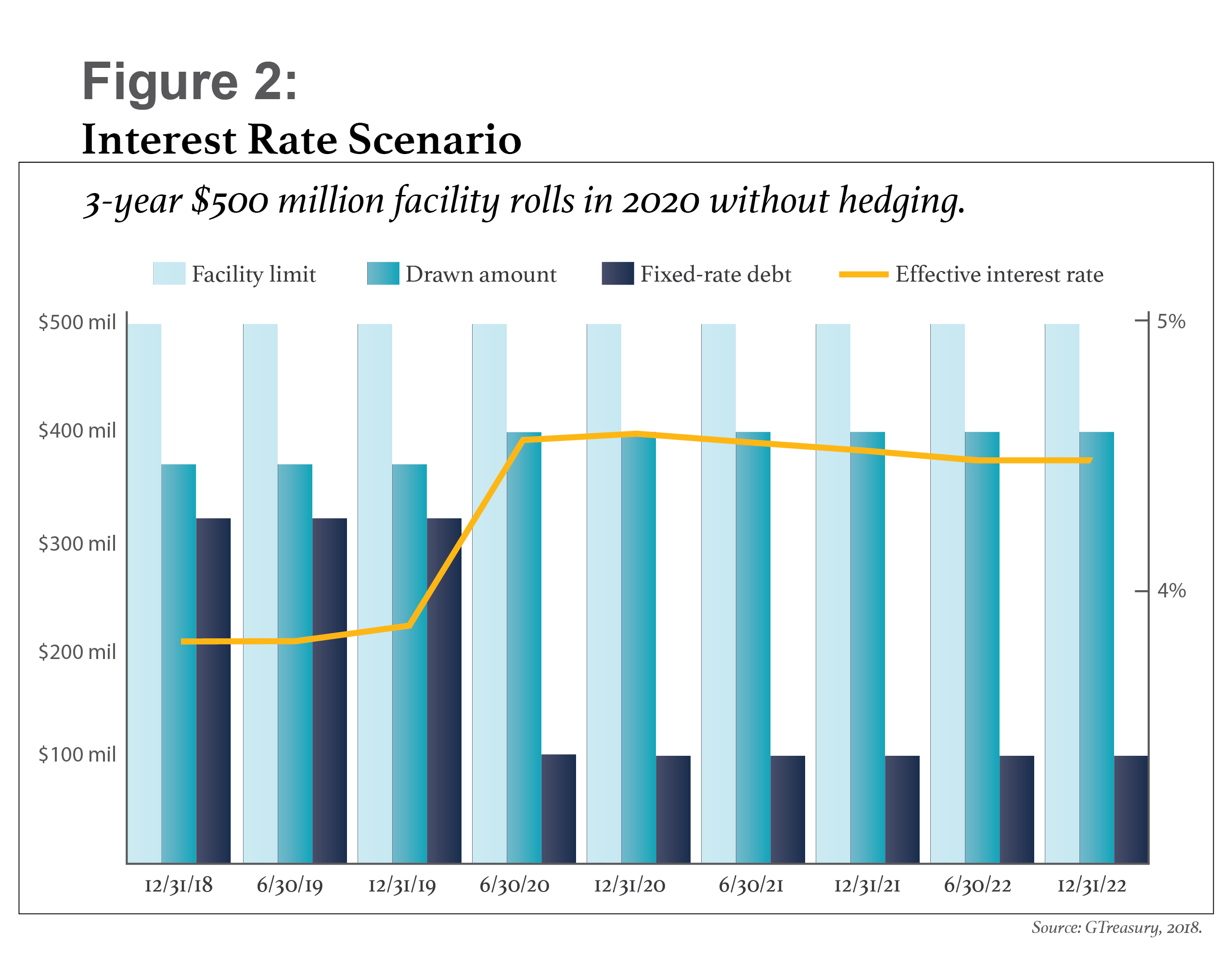

Figure 2, below, illustrates a simple use case, representing a three-year $500 million floating-rate facility that was established in 2017 and that matures at the end of 2019. The light-blue bars indicate the total credit line available, while the medium-blue bars show that the facility is almost 75 percent utilized—with $370 million drawn—through maturity. At the facility's inception, the company hedged $220 million with a receive-floating-pay-fixed interest rate swap and had $100 million in fixed-rate loans, as indicated by the dark-blue bars.

In December 2019, the credit facility will mature, and the treasury team assumes it will roll over on similar terms, to another three-year floating-rate term. The company plans to draw down another $30 million at that time, so it will be utilizing 80 percent of the facility. It will also roll the $100 million of fixed-rate loans.

Through December 2019, the end of the $220 million hedge, the effective interest rate on the credit facility—as indicated by the yellow line—hovers between 3.8 percent and 3.9 percent. But because most of the facility is no longer hedged after December 2019, the effective rate jumps up in 2020 to 4.6 percent and remains near that level through the full term of the new credit facility.

Confronted with this situation, the company's treasury team needs to assess what the effective interest rates on the new facility might be if the market moves in the next 18 months. Analyzing the impact of possible scenarios may shed light on this. Some observations:

- Effective rates are stable until maturity of the facility at the end of 2019. This is due to the hedge the company has put in place.

- The market has moved significantly since the initial hedge was put in place in 2017. Thus, a significant increase in effective rates will occur in 2020, regardless of the size of hedge the company adopts—i.e., jumping from 3.9 percent to 4.6 percent. This is inescapable.

- Further increases in effective rates will occur if the LIBOR rates increase more in the next 18 months, which will happen if the Fed continues to raise federal funds rates.

Calculating the Impact of Different Possible Interest Rate Outcomes

A market scenario planning exercise should consider the effect of a number of likely future states for interest rates. Four possible scenarios to consider for the three-month LIBOR are:

- Market. Current rates continue (benchmark).

- Market + 1%. Rates increase by 100 basis points (bps) evenly across the curve.

- Yield curve inversion. Rates increase more at the short end (around 100 bps), such that the curve begins to slope downward, for an inverted yield curve.

- Credit crisis. Rates rise to extremely high levels, very quickly—the worst-case scenario.

In a recent webinar poll, 29 percent of respondents expected credit-crisis rates to return, and more than 55 percent expected a rate increase of 50 bps to 100 bps.

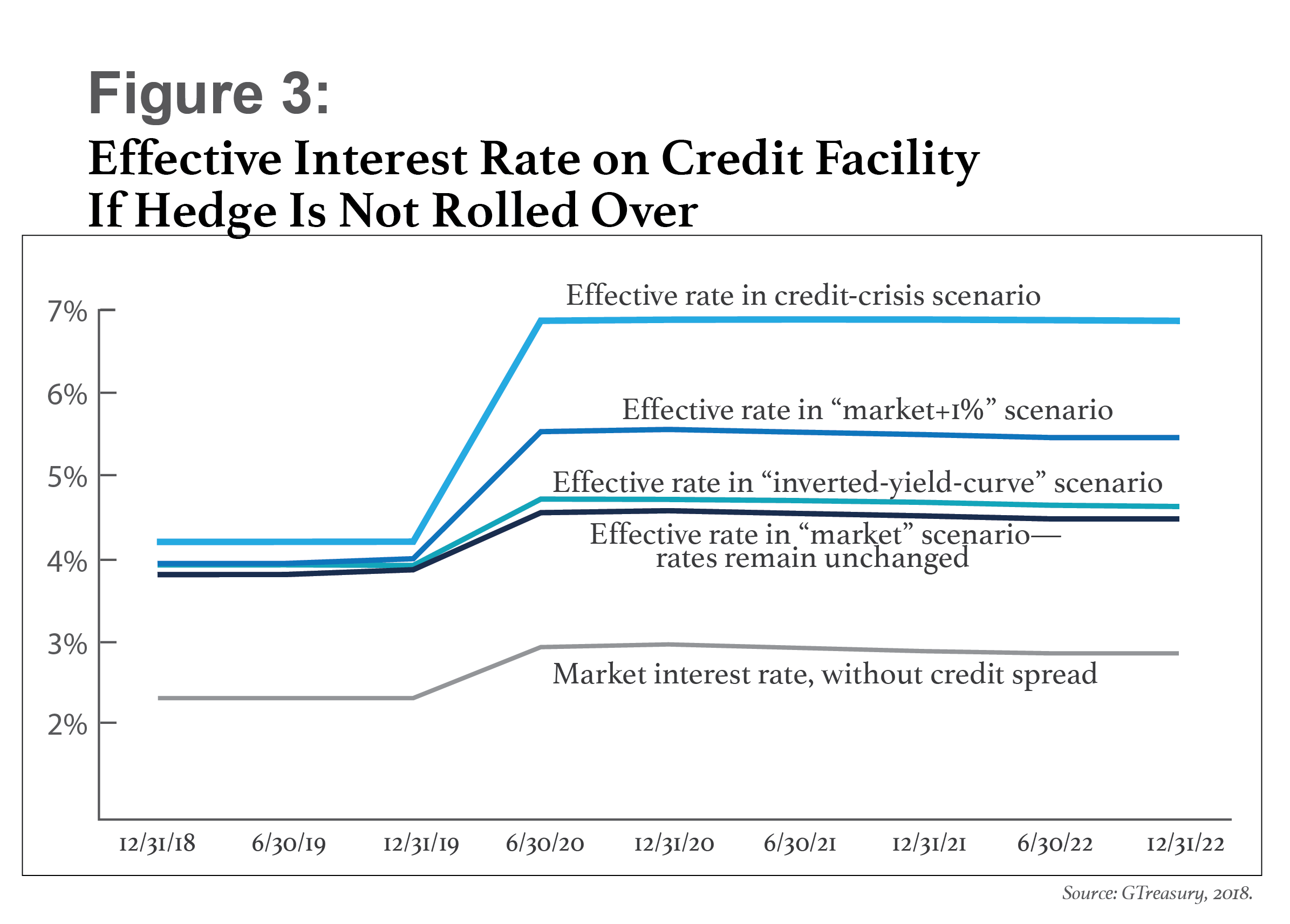

Figure 3 shows how the credit facility in our example would respond to each of the four scenarios described above. Every scenario results in a higher effective interest rate once the facility rolls over. This is unavoidable. However, if the facility is left unhedged, the actual interest rate paid (the effective rate) will vary widely, depending on the Fed's action. The blue lines on Figure 3 represent the effective rate—including the 150 bps credit spread—that the company would pay for the unhedged credit facility under each scenario. For reference, the gray line shows the effective rate under current market conditions excluding the credit spread.

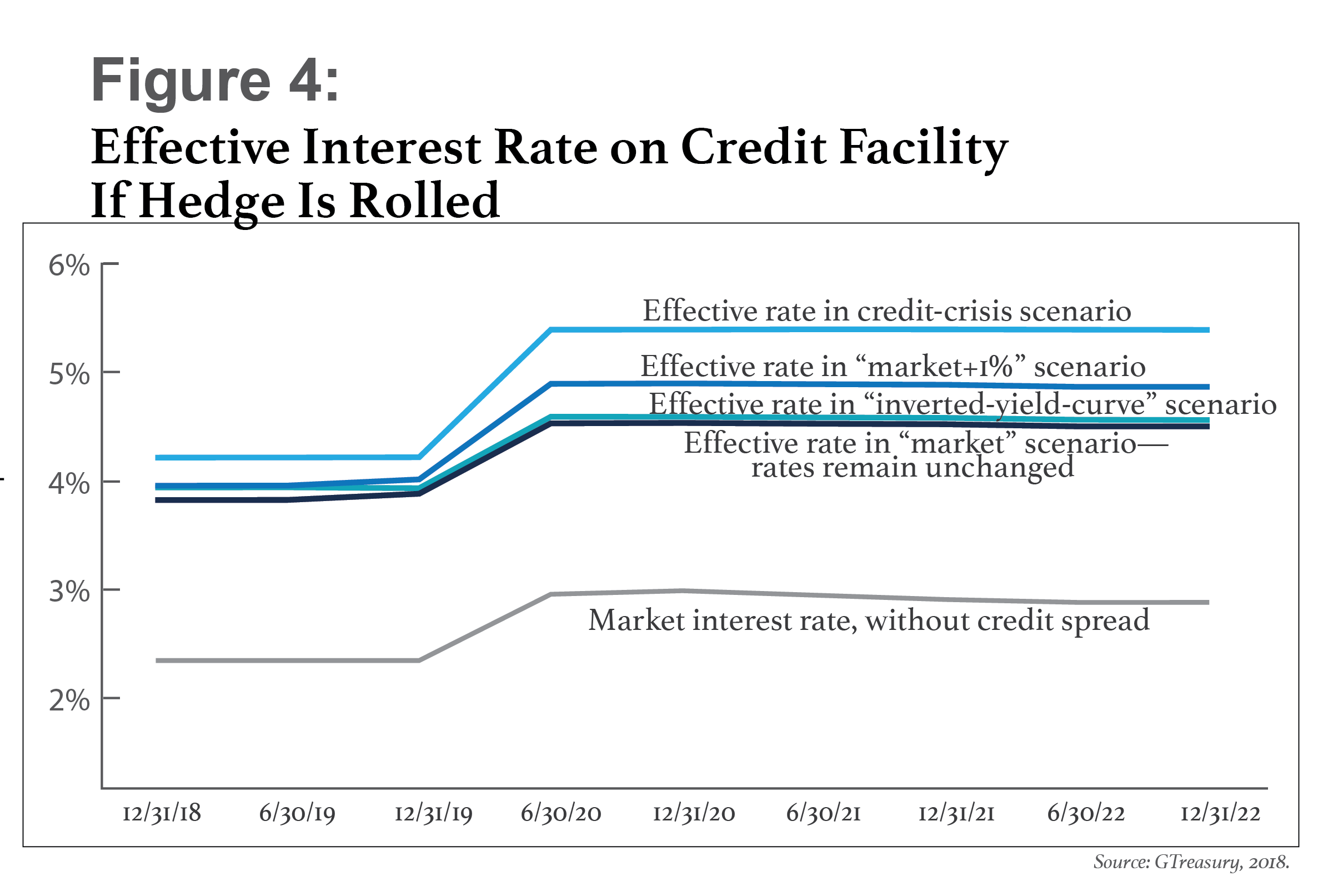

After evaluating likely effective interest rates in an unhedged scenario, the treasury team should look at the effective interest rates they would pay if they hedged the facility. This information can come from the company's banks, or treasury can use Bloomberg or Reuters to get published forward-starting swap rates. In our example, the company is considering entering into a forward-starting hedge for the term of the rolled facility. This would be a continuation of the original swap—a three-year receive-floating-pay-fixed interest rate swap, for the same notional value ($220 million) as the original swap. Figure 4 shows the effective rate in each of our four scenarios.

Hedging provides the most benefit if rates follow either the “market+1%” or credit-crisis path. In the “market+1%” scenario, the rate on the credit facility in April 2020 and beyond is 5.5 percent without a hedge (Figure 3) but 4.8 percent with a hedge (Figure 4). And in the credit-crisis scenario, an unhedged facility would carry an effective rate of 6.9 percent, whereas the effective rate with a hedge is 5.4 percent. In these scenarios, hedging a $500 million credit facility provides an annual savings on interest costs of $3.5 million to $7.5 million.

Hedging under the inverted-yield-curve scenario provides less benefit, as the impact is on the near end of the curve and the existing swap provides cover to the end of 2019. Without the hedge, the facility's effective interest rate ranges from 4.72 percent in June 2020 to 4.63 percent in December 2022, whereas with the hedge the rate stays between 4.55 percent and 4.58 percent throughout the facility's term. If yield curve inversion were associated with higher longer-term rates, then the benefit will be greater. Thus, hedging would result in a cost savings in the inverted-yield-curve scenario in Figures 3 and 4, but on a much smaller scale than in the “market+1%” or credit-crisis scenarios.

If the current rates don't change at all—our “market” scenario—the effective interest rate is 4.5 percent, whether or not the company hedges. Thus, entering into a three-year forward-starting fixed-for-floating interest swap would have no impact on the company's effective rates; the hedge would simply convert current market floating rates into their fixed equivalent.

Once the treasury team has assessed the impact of each scenario, they can make judgments about the likelihood that each scenario will come to pass. They can also run calculations on variations around each scenario—for example, determining the impact if market rates were to increase by 0.75 percent, rather than 1 percent.

Assessing Reasonableness

The next step is to assess how the scenarios fit into the range of all possible outcomes drawn from a simulation approach. Even though we can apply subjective probabilities to possible outcomes, our subjectivity may be biased when compared with the range of simulated outcomes based on historical volatilities and random simulations. In other words, our beliefs about the likelihood of each scenario may not be accurate. Recent press speculation about yield curve inversion and a “Powell put” that would result in fewer interest rate increases in 2019 shows how quickly prevailing views can change.

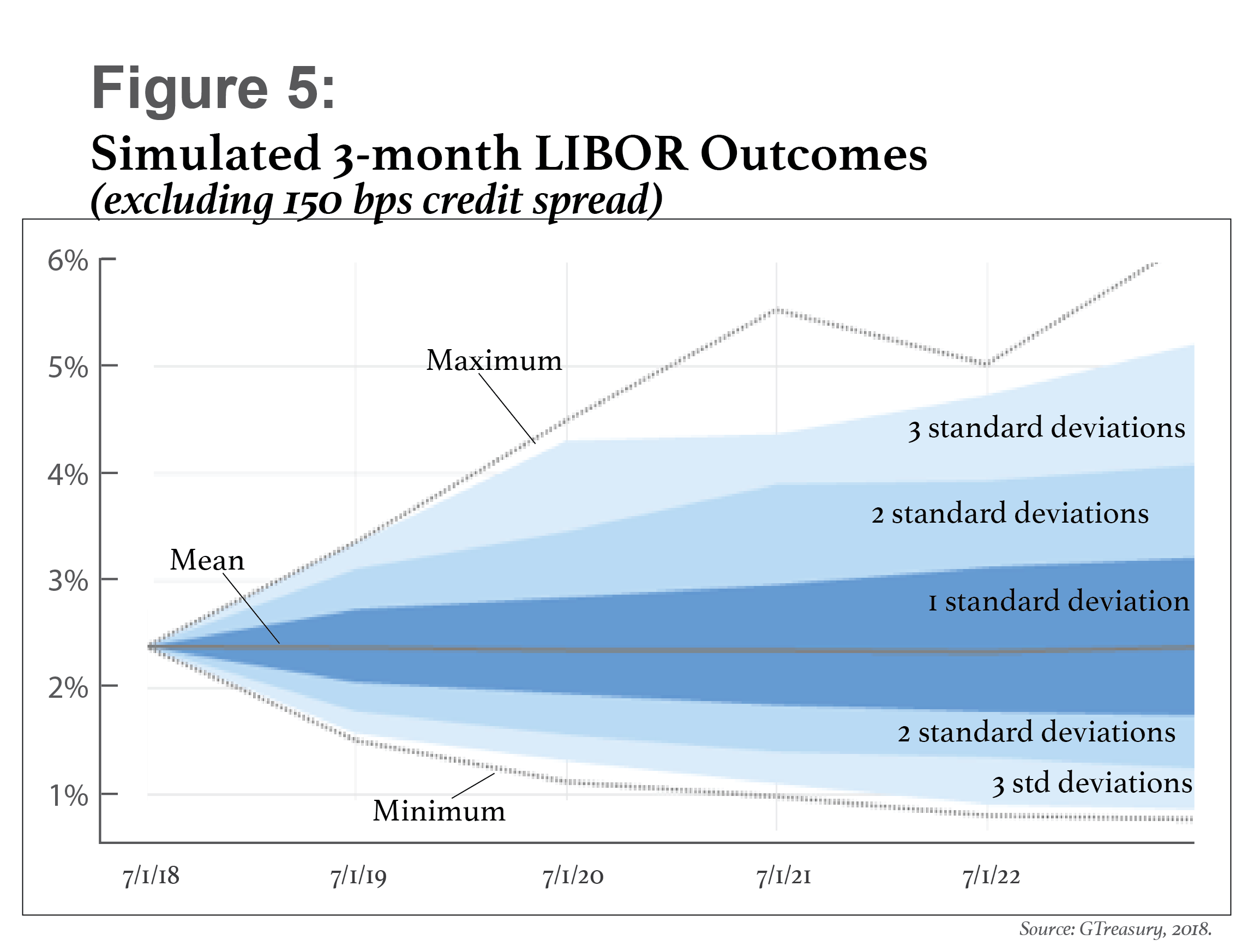

A statistical simulation of future three-month LIBOR rate paths enables the treasury team to assess the likelihood of different outcomes and then compare against their own subjective estimates of likelihood. In Figure 5, we've started with the July 2018 three-month LIBOR of 2.34 percent, then run simulations from that rate. The dark, medium, and light blue shaded values correspond to 1, 2, and 3 standard deviations. Note that this analysis does not include the 150 bps credit spread because it is a constant. However, the credit spread will need to be added back for purposes of comparing the scenario outcomes to the simulation.

A treasury team that runs a statistical simulation like that in Figure 5 can then compare the outcome against their subjective assessment of the likelihood of different interest rate scenarios. For example, the interest rate under the 2 standard deviation (medium blue) calculation is about 4 percent in December 2022, which corresponds closely with the “market+1%” scenario: In Figure 3, the effective rate without a hedge is 5.46 percent in December 2022, which equals a 4 percent three-month LIBOR plus the 1.5 percent credit spread. This corresponds to the two-sided 5 percent confidence interval. The credit-crisis scenario—which would involve a three-month LIBOR (effective interest rate without hedge, minus credit spread) of 5.3 percent by December 2022—is even less likely.

Figure 5 shows that the most likely outcome is a rate increase of between 0 and 1 percent.

Be Prepared

As the Federal Reserve continues to raise interest rates, the time has come for treasury teams throughout corporate America to start assessing and planning for hedging as they consider the future of credit facilities due to roll over in the next couple of years. There will be an inescapable increase in effective interest costs when facilities roll, regardless of a company's hedging strategy. And that cost will increase if LIBOR continues to rise.

This doesn't mean, however, that there's nothing treasury can do to mitigate the impact of rising rates. Treasury professionals can quantify the increased interest cost within a variety of different scenarios, both with and without hedging. They can then assess each scenario for “reasonableness” against a set of randomly simulated scenarios. Such an analysis provides a sound basis for assessing and acting.

In September, the Fed appeared to be planning on three rate increases in 2019. More recently, some have predicted that the increases will come more slowly, due to slowing economic growth around the world and volatility in the financial markets. Regardless, most Fed watchers expect rates to continue to rise in the short term. That means the time to prepare is now—not when facilities mature.

Peter Seward is the vice president of market development and risk for GTreasury. He is responsible for helping prospective corporate treasury clients understand how to apply technology to better manage risk and its impact on cash. An early pioneer of software-as-a-service (SaaS) treasury technologies, Seward regularly shares his expertise as an author and speaker.

Peter Seward is the vice president of market development and risk for GTreasury. He is responsible for helping prospective corporate treasury clients understand how to apply technology to better manage risk and its impact on cash. An early pioneer of software-as-a-service (SaaS) treasury technologies, Seward regularly shares his expertise as an author and speaker.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.