Bristol-Myers Squibb Co. is taking out a $33.5 billion loan to help finance its purchase of Celgene Corp. in the largest ever pharmaceutical-company acquisition.

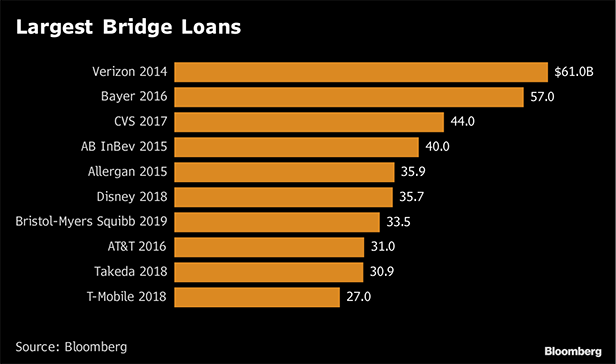

The loan will contribute to the $74 billion cash-and-stock deal and be refinanced with $32 billion of new debt, according to filings on Thursday. It will rank as the seventh-largest bridge facility on record, according to data compiled by Bloomberg. Morgan Stanley and MUFG Bank Ltd. are underwriting the financing.

Recommended For You

The deal may give a boost to what's expected to be a weak year for investment-grade debt issuance following the worst for the U.S. market in a decade. While strategists at Wells Fargo & Co. expect strong merger and acquisition (M&A) activity within pharmaceuticals, they're calling for total supply across the sector to fall, according to a Dec. 6 report. They cited Amgen Inc., Biogen Inc., Merck & Co Inc., Gilead Sciences Inc., and Bristol-Myers as potential candidates.

“You can look around and see other companies that have drugs coming off patent in the next couple years that are significant,” says Bloomberg intelligence analyst Mike Holland. “Consensus doesn't seem to be expecting another $50 billion to $100 billion deal, but if it's structured like this with equity and debt, and leverage is under three times, it can most likely get done.”

Net leverage after the deal will be 2.8 times debt to a measure of earnings, Holland said. The combined company will generate $17 billion of adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), compared with $48 billion of net debt, according to Holland and company statements.

Bristol-Myers CFO Charles Bancroft said on a conference call the company will “still have a very strong balance sheet” and should be able to de-leverage “pretty quickly.”

The New York-based company said it's committed to maintaining strong investment-grade credit ratings and expects the combined company to generate more than $45 billion of free cash flow over the first three full years after the deal closes, according to a statement on Thursday. It's also planning to maintain its dividend policy and buy back $5 billion of shares upon the close of the transaction. That may not be enough to appease credit raters.

“A downgrade could be prompted by large debt-funded acquisitions,” Michael Levesque, an analyst at Moody's Investors Service, said in a February report. Moody's rates Bristol-Myers A2, the sixth-highest investment-grade ranking, while S&P Global Ratings puts it one step higher at A+ and expressed similar concerns in a March report. Both give stable outlooks.

Investors bought Celgene's bonds on the news, sending the 4.55 percent notes due in 2048 up more than 5 cents on the dollar to 92.154 cents, according to Trace bond price data. The spread —the extra yield investors demand to hold the debt over Treasuries—tightened about 40 basis points, or 0.4 percentage point, across Celgene's maturities.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.