Big U.S. companies are paying higher risk premiums when they borrow and finding less demand for their bonds, a sign that investors are worried about rising wages and slowing economic growth hitting corporate profit growth.

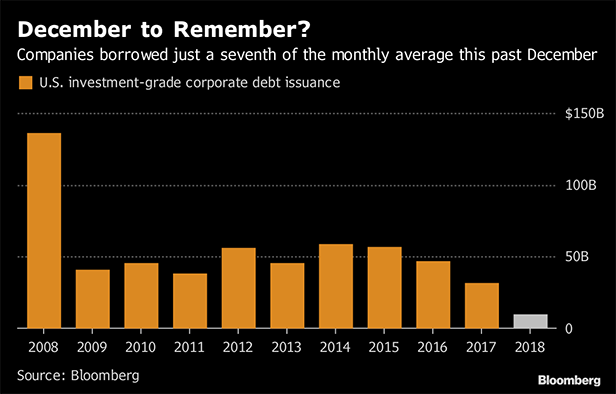

Companies are responding by borrowing less: They sold around $8 billion of U.S. investment-grade debt last month, about a seventh of the average for December over the last decade. The low levels of high-grade company borrowing reflect how even if U.S. workers are doing relatively well—a report on Friday said average hourly earnings in December jumped—those wage gains are pressuring companies' bottom lines.

Recommended For You

Until Thursday, there had been no corporate bond sales for three weeks. When units of companies like Ford Motor Co. and Duke Energy Corp. broke the drought this week, they received orders equal to about two times the amount of bonds they were selling, far below the average of around three times for corporate debt last year, according to Bloomberg data. The results made some money managers wonder how long the tepid demand would last.

“One thing that could be worrisome is if corporate debt markets continue to be choppy—if borrowing costs more, you might be less willing to fund a new project,” says Zachary Chavis, portfolio manager at Sage Advisory Services. “That could feed into the economy over the next 12 to 18 months.”

Other companies are lining up to sell notes—a unit of farm machinery maker Deere & Co. plans to offer debt, for example. But Bank of America Corp. strategists forecast just $100 billion to $120 billion of debt sales for this month, which according to Bloomberg data would be around 10 to 25 percent less than the average of the last five years.

Overall demand for corporate debt has waned as trade wars have continued. Those skirmishes are already showing signs of weighing on corporate results. Late Tuesday, Apple Inc. cut its revenue forecast for the latest quarter for the first time in almost two decades.

Falling oil prices have also cut into investor demand for energy bonds, which account for around 6 percent of the investment-grade market and more than 20 percent of high-yield, according to Bloomberg data. Crude oil futures have fallen more than 35 percent since October.

With weaker demand, investment-grade companies have had to pay more interest relative to Treasuries to convince investors to buy their bonds. The extra interest, or spread, that borrowers pay has jumped to 1.57 percentage points, the highest level since June 2016. Overall yields for the bonds have drifted lower as Treasury yields have dropped in recent weeks, but companies could be paying even less to borrow if spreads hadn't also widened.

Companies usually have to pay higher yields on their new debt relative to their old debt to induce investors to buy new securities, but the size of that extra yield has jumped to around 0.25 percentage point on Thursday from an average of 0.051 percentage point in 2018.

Retail investors have been worried, too. They've pulled $4.5 billion from U.S. investment-grade bond funds in the week ended Jan. 2, the sixth straight period of outflows and largest in three years, according to Lipper.

“Some issuers are still wondering when is the best time to come back to the market,” says Dorian Garay, a money manager in New York at NN Investment Partners. “There hasn't been a rush at this point.”

The last big offering in the U.S. investment-grade bond market was from UnitedHealth Group Inc., which sold $3 billion of notes on Dec. 13. The year is still just a few days old, and demand may increase in the coming weeks and months. The Ford notes that sold on Thursday were among the most actively traded on Friday, and risk premiums on the securities narrowed a bit.

More bond deals are coming in January, so it makes sense to wait to see how cheaply other offerings are priced, says Matt Brill, head of U.S. investment-grade credit at Invesco Ltd. One factor to look out for is how much debt banks decide to sell this month, he says.

The biggest U.S. financial companies start reporting earnings in the middle of January and usually sell bonds soon thereafter. But this is not a great time to sell debt, so if banks choose to do so anyway, it could be a sign that they don't think the market will get better for them later this year, Brill says.

“We need to see the repeat issuers like the banks make the decision that they don't want to issue at these spread levels, to be more disciplined if they can wait another quarter or six months,” Brill says. “That'd be a very good sign for the market.”

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.