Allianz Global Investors, AXA Investment Managers, and Janus Henderson Investors are among asset managers forming a group to push for better terms in a faltering European leveraged-finance market.

At least 10 money managers are setting up the European Leveraged Finance Alliance (ELFA) Investor Group to represent them in discussions with high-yield bond and leveraged-loan borrowers, according to its newly appointed spokeswoman Sabrina Fox. ELFA will also act as a public lobbying group and aims to expand to about 20 members in the next year, Fox says.

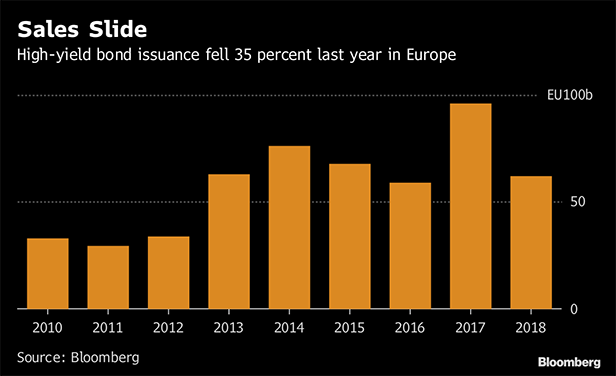

Investors are getting more assertive in the junk-debt market after they suffered the worst losses in a decade during 2018. At least 18 corporate borrowers pulled out of sales of new securities last year amid tougher bargaining from asset managers. In December, the new issuance market closed completely on both sides of the Atlantic for the first time in years.

Recommended For You

“The focus on investor protections is far greater than in recent years because it has to be,” says Mark Wade, head of industrials and utilities research at Allianz GI. “Borrowers have been stripping them away with little awareness for what happens when the market falls away. We're now at that point.”

“The focus on investor protections is far greater than in recent years because it has to be,” says Mark Wade, head of industrials and utilities research at Allianz GI. “Borrowers have been stripping them away with little awareness for what happens when the market falls away. We're now at that point.”

Risky companies took on unprecedented piles of debt during a credit market boom, fueled by central banks' cheap money policies after the global financial crisis. Investors, meanwhile, had to swallow evaporating yields and a gradual stripping away of the covenants from bond documents that prevented borrowers taking on more risk.

Last year about 50 investors quit the Association for Financial Markets in Europe (AFME) after the body, which also counts the banks and law firms working for borrowers among its members, introduced a 7,500 pound (US$9,560) fee.

The new investor group will comprise AFME members, but under certain circumstances may take independent positions from AFME, according to Gary Simmons, managing director of AFME's high-yield division. This will give asset managers some level of autonomy, he says.

“We value the relationship we have with investors and we see this as a positive step,” Simmons says.

Members of the new group will still pay 7,500 pounds, with most of the fee going to ELFA, according to Fox. ELFA also has the freedom to publish statements without AFME's endorsement, provided it consults on the material first and makes its independence explicit, she says.

Better Disclosure

Fox was previously head of European high-yield research at credit research firm Covenant Review and left last month, she says. Paul Clews, a partner at lawyers White & Case in London will be advising the group.

Among their concerns, investors want clearer disclosure of covenants that are often buried within hundreds of pages of sales literature. They also want better public disclosure of company results, which are frequently difficult to obtain, hidden on password-protected websites, according to Clark Nicholls, a senior portfolio manager at AXA Investment Managers, one of ELFA's founding members.

A spokeswoman at Janus Henderson confirmed that the firm is a founding member of ELFA.

“We want to create a healthier leveraged-finance market that will be able to withstand the volatility that 2019 may bring,” says Fox. “We want the market to remain open and financing to be available to companies.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.