Every year, the U.S. Securities and Exchange Commission (SEC) settles disputes between companies and shareholders as to whether an investor proposal really belongs on the corporate ballot. But after the lengthy government shutdown, companies—and shareholders—are wondering if they will get responses in time for annual meetings.

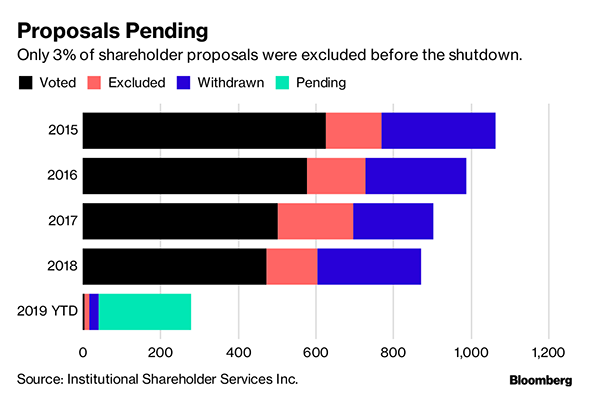

Companies that want to exclude a shareholder proposal usually have to seek approval from the SEC each December and January. In a typical year, the process keeps 15 to 20 percent of proposals from a shareholder vote.

The SEC, though, hasn't posted any responses to the requests since Dec. 19. There were at least 42 requests pending at that time, and there's no way to know how many have been submitted since. Now companies are running out of time: It usually takes at least a month to resolve a contested proposal, then another 40 to 60 days to get proxy ballots printed and sent to investors.

Recommended For You

On Friday, U.S. President Donald Trump announced a deal to reopen the government for three weeks. Whether lawmakers can come to an agreement about border spending in time to avoid another shutdown is anyone's guess.

“We're definitely in uncharted territory,” said David Lynn, the former chief counsel at the SEC's Division of Corporation Finance and now a partner at law firm Morrison Foerster in Washington, D.C. “Even when the government opens on Monday, they're going to have to play catchup before company mailing deadlines.”

Green Century Capital Management, a Boston-based investment firm, was hoping to make progress on a proposal asking Domino's Pizza Inc. to stop using beef and pork treated with antibiotics. Domino's asked for SEC approval to reject it, saying the proposal was micromanaging their business.

Green Century is working on a rebuttal letter to ask the SEC to let the proposal go forward, arguing that other companies like McDonald's, Starbucks Corp., and Panera Bread Co. have adopted similar policies amid fears of antibiotic resistance. “It seems unlikely for us to have time to respond and for the SEC to make a decision on it,” a firm spokesman said. “They'd have to move very quickly, and we don't know what's going to happen in three weeks if the government shuts down again.”

Domino's didn't respond to requests for comment.

Most companies haven't said what they'll do if they don't hear back from the SEC about the shareholder proposals they're trying to reject. Companies could opt to settle with shareholders to keep a proposal off the ballot, but “the path of least resistance is just to include the proposal,” Lynn said.

Verizon Communications Inc. has five such requests pending, according to letters posted to the commission's website. “We will continue to monitor the government shutdown and will assess the most appropriate action to take when we are closer to our proxy filing deadline,” a Verizon spokesman said. Coca-Cola Co. is likewise evaluating its options, a company spokesman said. PACCAR and Citigroup Inc. are among a handful of companies that have reached agreements with investors to withdraw their proposals since submitting their request.

It's a mixed result for shareholders. More proposals may make it to the ballot, but they also may get fewer votes because the shutdown has interfered with shareholder efforts to publicize battles and gather support from other investors, Green Century said.

Companies don't need to seek the SEC staff's input to decide whether to include or exclude a shareholder proposal, an agency spokesperson said, noting companies could go to court for a definite ruling. Lawyers say that's expensive, considering the average shareholder proposal gets less than 30 percent support.

The SEC didn't say how it plans to tackle these requests once the government reopens. The Division of Corporation Finance will have its hands full—it will also have to address the backlog in the IPO market.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.