Federal Reserve Chairman Jerome Powell has some further explaining to do after the central bank's monetary messages whipsawed financial markets over the last month.

Powell holds a press conference at 2:30 p.m. on Wednesday in Washington following a two-day meeting of the Federal Open Market Committee (FOMC). Investors expect the FOMC to keep interest rates on hold. Its policy statement will be scrutinized for hints that officials still expect to raise rates twice this year, as they forecast in December.

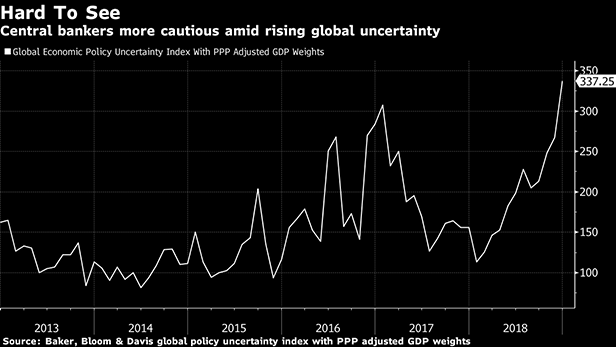

But the message may be more nuanced, and Powell's delivery more scrutinized, because the outlook has been clouded by cooler global growth and the impact of the U.S. government shutdown. The risk of misinterpretation could be high.

“The Fed does have to balance these expectations, sounding appropriately responsive to any softness that may appear in the economy or markets but at the same time articulating its view that it expects the underlying economy is relatively sound'' with some further hiking likely, says Nathan Sheets, chief economist for PGIM Fixed Income and a former head of the Fed's Division of International Affairs. “That's a very difficult balance to make.”

Powell must avoid the communication pitfalls of last month. U.S. stocks slumped following the December FOMC meeting, as investors interpreted the Fed's stance as determined to tighten into rising economic risks. Powell's efforts in the press conference to soften that tone didn't calm investors, though he did a more comprehensive job of emphasizing policy patience in remarks two weeks later.

Meanwhile, the global outlook has dimmed. Though the labor market still looks strong, the 35-day shutdown has caused economists to cut estimates for first-quarter U.S. growth. And while the Fed doesn't release updated forecasts at this meeting, other officials have reinforced Powell's remarks on patience, pointing to rates being on hold for months.

Communication Challenges

That's all a tough message to fit in a statement whose core message runs about 300 words, and each change could lead to new misunderstandings. Here is how they might address these communication challenges:

The first paragraph updates economic conditions. The FOMC in December said “economic activity has been rising at a strong rate.'' Officials may now have less conviction on that assessment. Consumer sentiment has dipped, as have regional Fed manufacturing surveys. On the other hand, unemployment is still at the lowest level in years.

There is also less clarity. While President Donald Trump agreed on Friday to reopen the federal government for about three weeks, the shutdown has already hampered statistical agencies and the Fed hasn't seen data on a range of important economic indicators.

“How can you say anything definitive when you don't have the data?” says Laura Rosner, senior economist at Macropolicy Perspectives LLC.

In the second paragraph, the message of “some further gradual increases'' in the December statement was perceived by investors to have more rate-hiking urgency than the committee intended, minutes released three weeks later revealed. The minutes said “the committee could afford to be patient about further policy firming.”

Using some variation of the word “patience” in the statement has risks. Interest-rate futures prices show no rate hike this year. Those expectations could be hardened because “patient'' conveys no sense of time, risking more volatility if the FOMC still intends to hike.

Seth Carpenter, the chief U.S. economist at UBS Securities and a former senior Fed official, said the statement could phrased this way to keep options open: “The committee judges it can be patient in making any further increase in the target range.”

“It opens up the possibility that there could be anywhere from zero to the two rate hikes'' they saw in December, he says. “Nothing is predetermined.”

The committee may also tweak their characterization of the risks as “roughly balanced.'' The minutes showed officials listed at least five downside risks and three upside risks in their December meeting. If anything, downside risks have grown.

“The Fed should acknowledge that the global economy has decelerated and that it's not clear how that might affect the U.S. economy,” says Andrew Levin, an economist at Dartmouth College and former senior Fed adviser. “Upside scenarios are still plausible but not nearly as probable or consequential as the downside scenarios.”

Levin suggested that the “roughly balanced” characterization could be changed to “some downside risks.”

Given the constraints of the statement, Powell must use the press conference to hammer his message home. He can explain how patience fits into their policy tilt toward higher rates and how they aren't bound by that tilt if the economy sickens.

Quantitative Tightening

Then there's the balance sheet.

For months, the Fed tried to keep the runoff in the background, dismissing claims it was contributing to market volatility. But they were losing ground to a competing story from external critics who called the runoff quantitative tightening.

Powell has since expressed flexibility on the balance-sheet unwind if necessary and is likely to be pressed for more details.

“Being Fed chair is a tough job. Sometimes it's kind of tough and other times it's really, really tough,'' Sheets says. “This is one of those times when it's really, really tough. Chairman Powell has got to nail this communication.”

From: Bloomberg

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.