Verizon Communications Inc.'s billion-dollar entrance into the green-bond market this week is fueling optimism that more U.S. corporations will begin tapping into the growing pot of money seeking to invest in sustainable projects.

The telecommunications giant on Tuesday issued $1 billion of 10-year green bonds in a deal that drew orders for eight times the amount offered, a person with knowledge of the matter said. The sale was one of the most oversubscribed corporate-bond offerings this year, and it allowed Verizon to lower its borrowing cost as investors jockeyed for a piece of the debt. Bank of America Corp. and Goldman Sachs Group Inc. managed the sale.

“This really opened up a whole new investor base and funding source for us,” says Jim Gowen, chief sustainability officer at Verizon.

Recommended For You

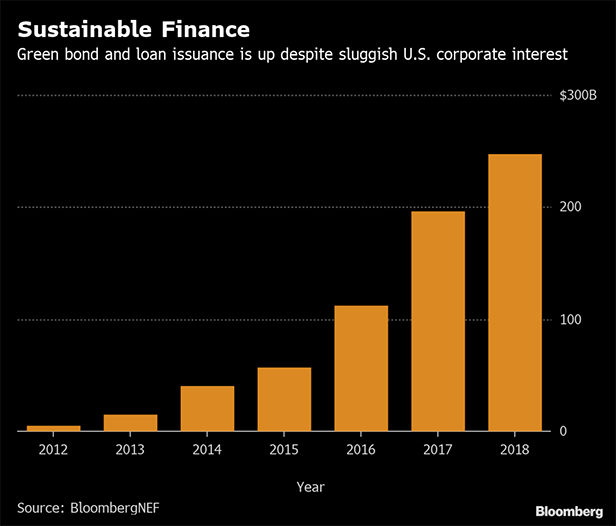

U.S. companies have been among the most sluggish participants in the almost $600 billion green-bond market. Verizon's sale is igniting hope that it will pave the way for more to tap into it.

“Corporates in the U.S. have been AWOL,” says Sean Kidney, chief executive of the nonprofit Climate Bonds Initiative in London.

That's left a gaping hole for investors looking to build out a diverse portfolio of sustainable investments. APG Groep NV, the Dutch pension manager that oversees about $540 billion in assets, issued a public appeal last month for U.S. corporations to issue more green debt.

“Investor demand for corporate green bonds continues to be high, but the U.S. market remains constrained by limited supply,” the firm lamented.

While U.S. financial services firms, utilities, and energy companies have joined their worldwide rivals in becoming regular issuers of green bonds, corporate stalwarts have largely sat out. Of the $592 billion of green bonds ever issued to finance sustainability projects, less than $7 billion has come from U.S. companies outside the financial services, utilities, and energy sectors, according to Bloomberg NEF.

That compares with roughly $16 billion in Europe, where industrial players are more apt to tap the market. Apple Inc. has been the biggest non-financial U.S. issuer of green bonds, raising $2.5 billion in two deals since 2016.

Verizon plans to use the money raised from the green bond to support investments in renewable energy and energy efficiency projects, such as its plan to source half of its annual electricity usage from renewables by 2025. The company's campus in New Jersey already gets between 30 percent and 60 percent of its energy from renewable investments, depending on the season, Gowen says. It could also use the funding for developing its new 5G network in a climate-sensitive way, he says.

From: Bloomberg

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.