Sen. Bernie Sanders, I-Vermont, is a big proponent of a Medicare-for-All healthcare system.

Sen. Bernie Sanders, I-Vermont, is a big proponent of a Medicare-for-All healthcare system.

Government-controlled healthcare has been on the minds of leaders in the benefits industry for years now—looming as a distant threat but often pushed aside for more pressing concerns. During the opening keynote of the NextGen Growth & Leadership Summit in Nashville earlier this month, Nelson Griswold, president of the Workplace Benefits Association, warned that his industry underestimates the threat of single-payer healthcare at its own peril.

Citing a progression from Hillary Clinton to Bernie Sanders, and a lack of clarity from President Trump, Griswold discussed the growing momentum around the idea of Medicare for All, adding that although government-controlled healthcare doesn't generally poll well, everything changes when you ask Americans if they're interested in “Medicare for All.” For example, recent surveys have found that 70 percent of Americans are open to adopting Medicare for All. Even 52 percent of Republicans support the idea.

Griswold noted that former Aetna CEO Mark Bertolini also weighed in recently, saying, “As a nation, I think we should have a debate about single-payer.”

“As I was growing up,” Griswold said, “the bulwark against the idea of socialized medicine was always the doctors. So most concerning of all to me is the fact that 56 percent of doctors now either strongly support or somewhat support single-payer healthcare. … Once a country has moved to government-controlled healthcare, it has never gone back. My prediction is that we'll have single-payer in five years.”

As attendees let those words sink in, Griswold examined the factors contributing to this potential sea change. “What's driving people's frustration and willingness to embrace a new system?” he asked. “The numbers, of course.”

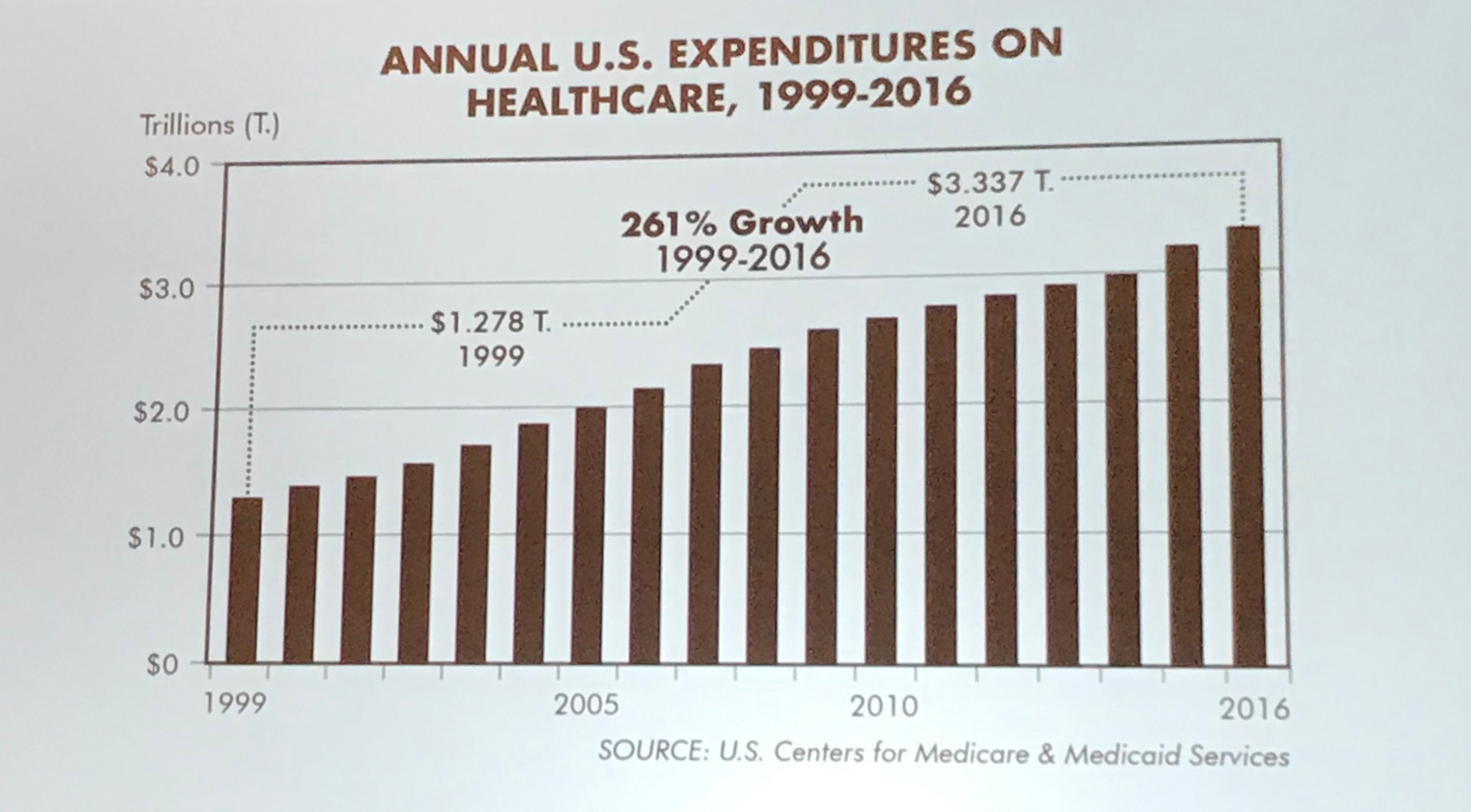

American healthcare has increased in cost every year since 1960, Griswold said. “In the last 17 years alone, we've seen 261 percent growth in the cost of healthcare. Why does it go up every year? We're in a period of almost no inflation elsewhere, and yet we've had massive inflation in healthcare year over year.”

Griswold pointed to the root cause of the problems with American healthcare identified by John Torinus in his book The Company That Solved Health Care: “CEOs should be embarrassed at how they have allowed health costs to run wild. They would not allow that to happen in any other part of their businesses.”

Companies manage and negotiate other aspects of their business down to the penny or even a tenth of a penny, Griswold said. “Why wouldn't they do the same with the cost of a heart transplant?”

Some executives are starting to get it, but it's been a very slow awakening. “Why is the C-suite ignoring their second- or third-largest cost set?” he asked. “Why do these otherwise brilliant and business-savvy people refuse to look at healthcare?

“I believe it's due to something I call 'healthcare's big lie.' This lie has been told over and over to CEOs and CFOs until they believe it.”

What's the big lie? “Mr. and Mrs. CEO/CFO, you have no control over the cost of your healthcare. There's nothing you can do to influence it, and it will increase every year. So will your healthcare premiums. You must learn to live with it. We'll do our best to manage it, but there's nothing we can really do either.”

Griswold said this idea creates a wall that separates two groups which should be talking: the payers (employers or individual patients who are paying) and the providers (doctors, hospitals and drug companies). The wall means there's no communication, other than providers throwing claims statements over the wall and payers throwing cash back the other way, Griswold said.

The buyers aren't watching the sellers, and no one is managing healthcare as a purchase. Hospitals manage their supply very closely, but their customers—the employers—don't. And neither do the employees, Griswold said.

What is the wall? According to Griswold, it's “carriers and status quo brokers” who maintain the lie that nothing can be done.

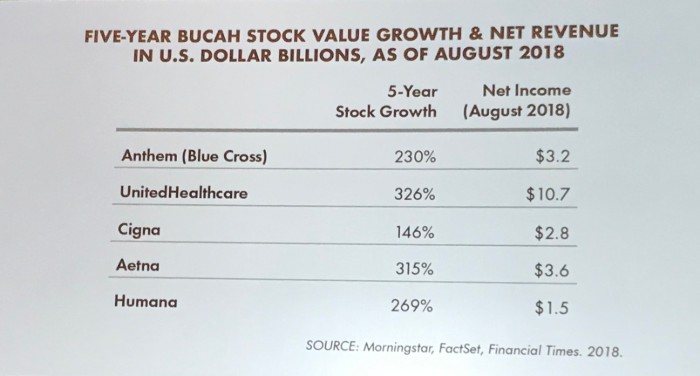

Despite the upheaval in healthcare since passage of the Affordable Care Act, insurance companies continue to do very well, as evidenced by their revenue numbers, he said.

“When an insurance company's revenue goes up, what drives their revenue?” Griswold asked. “Premium. When healthcare drives up the cost of premium, revenue goes up for insurance companies. They have no incentive to lower the cost of healthcare and every incentive to prevent employers from doing so.”

Griswold added that their partners in crime, often unaware of their role, are status quo brokers. If a client's premium goes up, they get a raise.

The current cycle of massive increases every year is unsustainable, he said. “The system will collapse. Single-payer is looming, and companies and their employees are paying more and more all the time.”

The only hope, according to Griswold, is a “benefits revolution” that is already under way. It is gaining momentum due to the frustration that's spreading throughout the healthcare and employee benefits worlds. The goal of the revolution is to address the misaligned incentives that exist in the current system. So, what's the strategy? “To reinvent U.S. healthcare from the inside out in order to lower and control the cost of healthcare and make single-payer healthcare unnecessary.”

To be successful going forward, he said, benefits advisors need to change what they sell, who they sell it to, and how they sell it.

Instead of selling insurance, they need to sell strategy, solutions, results, and the supply chain management of healthcare. In other words, controlling and managing the quality and cost of the healthcare employees purchase under their employer-sponsored healthcare.

Strategies, tactics, and solutions providers that are already out there can help drive down costs of prescription drugs, outpatient surgery, and hospital and physician visits, Griswold noted. They include medical management, reference-based pricing, direct primary care, and direct contracting, among others.

Although brokers used to sell to HR because they manage benefits, they now need to work directly with the C-suite. Why? “Because they own the profit-and-loss statement and give a damn whether costs are cut. That's not in HR's job description.”

Members of the C-suite are the ones who are willing to make big changes because they care about big results and how it could impact the bottom line, Griswold said.

“Single-payer and Medicare for All aren't going away,” he concluded. “The idea has been chipping away at the body politic for decades. We have an opportunity to stop single-payer in its tracks with strategies that do to healthcare costs what government control presumes to do.”

Adapted from: BenefitsPro

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.