Wall Street is moving closer to modernizing the clubby $2 trillion market for new corporate bond issues while seeking to retain control of a lucrative business that's being eyed by the tech sector.

A group of banks led by Bank of America Corp., Citigroup Inc., and JPMorgan Chase & Co., has set up a company and appointed a CEO to develop an electronic system for investors to request allocations of new debt, according to people familiar with the matter.

Other banking heavyweights including Barclays Plc, BNP Paribas SA, Deutsche Bank AG, Goldman Sachs Group Inc., and Wells Fargo & Co. have also joined the founders in backing the platform that was originally conceived more than a year ago, the people said, asking not to be identified because it isn't public.

Recommended For You

Bloomberg talked to 10 people familiar with the initiative. While many of its details are yet to be finalized, Bloomberg reported a year ago that the banks plan to focus initially on U.S. investment-grade bonds.

The new system, dubbed Project Mars, aims to modernize the process of buying new corporate bonds, streamlining communication in a market that still relies on phone calls, instant messaging, and emails to handle billions of dollars in orders from investors.

The Project Mars group has invited some of the world's biggest money managers—including AllianceBernstein Holding LP, BlackRock Inc., and Invesco Ltd.—to test its platform, though the investors have not yet seen the platform, according to other people familiar with the matter.

“I think everyone involved—from underwriters to issuers to investors—will all benefit from making this process more efficient, and technology can do a lot to achieve that,” said John Sheehan, a San Francisco-based portfolio manager at Osterweis Capital Management, which oversees $6.7 billion in assets. “I've been in this business for 25 years, and the new-issue process hasn't evolved much.”

A spokeswoman at JPMorgan declined to comment on behalf of all the banks in the consortium. Officials at BlackRock, Invesco, and AllianceBernstein declined to comment.

Investors have pushed banks for years to streamline the market and make it more transparent amid mounting frustration at current practice where they often over-order to secure a quota of bonds that's close to what they want. Bond allocation has become a high-stakes game, as demonstrated by Saudi Aramco's recent $12 billion deal, which saw investors place orders for more than $100 billion.

“I have to fight for my clients, and I want to get as many bonds as I can,” said Jim Barnes, director of fixed income at Bryn Mawr Trust, which has $13.4 billion in assets under management.

Rival System

A rival platform from tech firm Ipreo already allows investors in Europe and Asia to receive market updates and place orders for bonds. But it has struggled to get off the ground in the U.S., partly because the banks that dominate the new issuance bond market are backing Project Mars.

“There is a different dynamic here,” said Herb Werth, New York-based managing director at Ipreo's owner IHS Markit Ltd. “Figuring out how either two platforms can coexist or inter-operate is something that hasn't been worked out yet, and that is really the key.”

Even co-existing with Ipreo may not appeal to Project Mars' backers in the banking industry if it means ceding some of Wall Street's control over one of the most profitable areas of finance for banks. Their grip has already been loosened in the arena of bond trading.

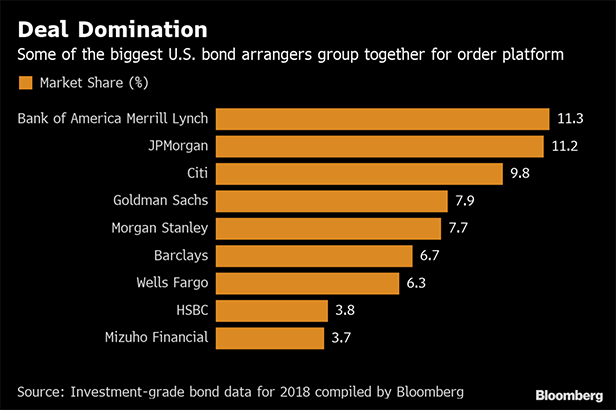

The U.S. market for new-issue bonds has traditionally been dominated by a handful of banks, unlike the European market, where a larger number of dealers compete for clients along linguistic and cultural lines. The top five underwriters in the U.S. investment-grade market arranged around 48 percent of deals last year, while banks with the same rankings in Europe managed 27 percent, according to data compiled by Bloomberg.

“Dominant incumbents in any market have a difficult time rationalizing innovation,” said Chris White, Goldman alum and founder of market structure advisory firm ViableMkts LLC in New York. “Why would they change a system that they don't see as broken?”

A light-touch approach to primary markets from U.S. regulators may also have contributed to slower adoption of new technology, according to Kevin McPartland, head of research for market structure and technology at Greenwich Associates.

But the launch of a company to steer Wall Street's adoption of new technology to streamline the market suggests investor concerns have had an impact, even if none have yet seen the new system.

“The movement is toward automation, and that's not stoppable in the long term,” said George Bollenbacher, head of fixed income research at Tabb Group.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.