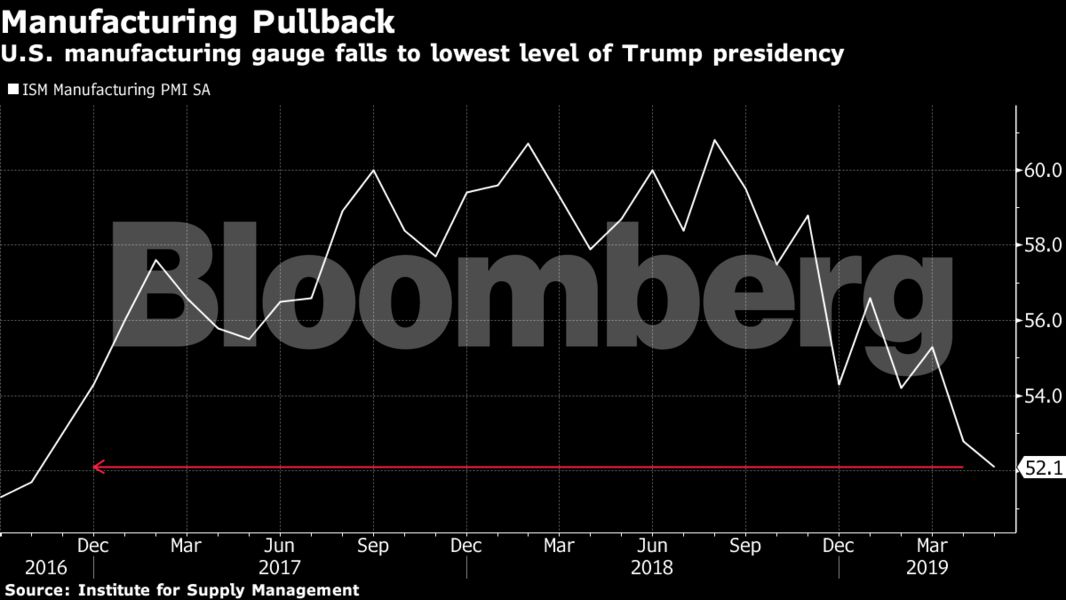

A measure of U.S. manufacturing activity unexpectedly fell in May to the lowest level since October 2016, in a sign that President Donald Trump's trade war with China is weighing on the economy as he considers further tariffs.

The Institute for Supply Management's (ISM's) purchasing managers index declined to 52.1 from 52.8, missing the median forecast of 53 in Bloomberg's survey but holding above the 50 mark that indicates expansion. Three of five components declined, including production, inventories, and supplier deliveries, according to a report Monday.

Key Insights

- The ISM index's lowest reading of Trump's presidency—down from a 14-year high in August —follows a slew of other economic data that suggest the sector was on shakier ground even before the latest escalation of tariffs between the U.S. and China began to pinch margins. A separate factory PMI released Monday by IHS Markit also fell, dropping to the weakest level since 2009.

- Producers, who already faced headwinds from slowing global growth and inflated inventories, may face additional fallout after Trump's threat last week to impose tariffs on all imports from Mexico. Sustained weakness would dent economic growth and could be a factor that prompts the Federal Reserve to cut interest rates, as investors and some economists expect.

- ISM's production gauge dropped to 51.3 in May, the lowest level since August 2016, even as the gauge of backlogs declined to a two-year low. At the same time, the measure for new orders increased, as did the employment gauge, a sign of possible stronger hiring in manufacturing ahead of the May employment report.

- The measure of exports increased, rising back above 50, while the imports gauge decreased for a third month to a two-year low of 49.4.

—With assistance from Chris Middleton.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.