Investor expectations are building that the Swiss National Bank (SNB) will take its key interest rate even further below zero as it faces a renewed franc appreciation.

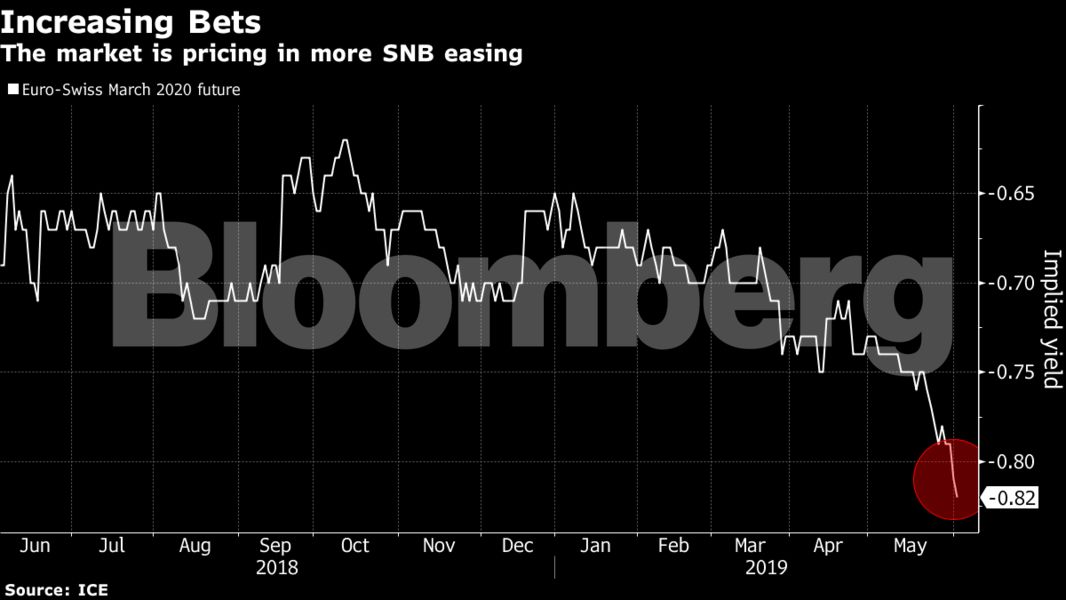

Amid escalating trade tensions and market jitters, the Swiss currency has gained about 2 percent against the euro in the past month. Futures for March 2020 are now putting an almost 50 percent probability of a 25 basis-point-cut in the SNB's deposit rate. It's currently at minus 0.75 percent, the lowest rate among the world's major nations.

The franc's gain buttresses the case of SNB President Thomas Jordan and fellow officials, who declined to move off their ultra-low rates last year, even as the currency weakened and the economy expanded at a strong pace. They stressed that markets were still fragile, and Jordan has repeatedly said the current policy remains necessary. He's also said that rates can go lower still if needed.

The franc is moving along with other haven assets, which have rallied amid a decline in stocks on concern about the outlook for global growth. The German 10-year bond yield fell to a record low on Monday.

Futures also show investors betting on rate cuts by U.S. Federal Reserve and the European Central Bank (ECB), where a gauge of inflation expectations has plummeted.

ECB policymakers meet this week and are likely to reiterate their promise that Eurozone interest rates will remain at record lows until the end of the year.

The SNB, whose deposit rate has been unchanged since 2015, holds its policy meeting a week later. It considers the franc highly valued, and will probably reiterate that stance on June 13.

— With assistance from Richard Jones.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.