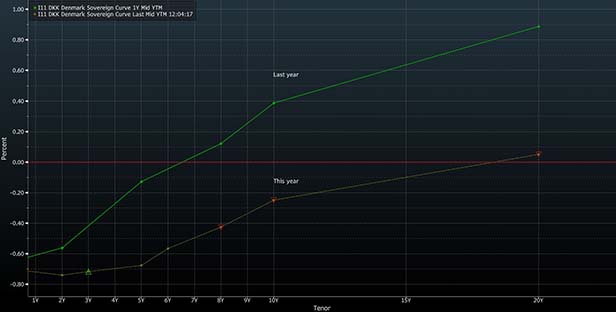

The entire government yield curve in Denmark is a hair's breadth away from turning negative, setting a milestone in the history of interest rates as investors wager on more monetary stimulus in Europe.

The benchmark yield on Denmark's debt due 2039, the longest maturity for government securities, dropped to a record low of 0.028 percent on Tuesday after dovish comments by European Central Bank (ECB) President Mario Draghi. Denmark pegs its krone to the euro, forcing the central bank in Copenhagen to closely track the ECB's every step.

The amount of bonds globally with negative yields surged to a record $12.5 trillion this week. Danish two-, five- and ten-year securities are already trading with below-zero yields, while 30-year Swiss obligations fell into negative territory Tuesday.

Drivers for the global fixed-income rally include trade tensions, tumbling inflation expectations, and anxiety over economic growth, prompting central banks to talk up the prospect of looser policy—juicing bonds anew.

While the Federal Reserve is expected to keep its interest rate unchanged on Wednesday, the market has already priced in more than one rate cut for this year.

Danish government debt is the top performer among top-rated European bonds so far in 2019. The 5.7 percent return beats Germany, the Netherlands, Norway, Sweden, and Switzerland. The country's monetary authority cut rates below zero back in 2012.

— With assistance from Frances Schwartzkopff.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.