Companies are borrowing $74 billion in the U.S. investment-grade bond market this week, the most for any comparable period since records began in 1972. Since Tuesday, corporations including Coca-Cola Co., Walt Disney Co., and Apple Inc. have sold notes as yields have dropped. And the frenzy isn't letting up.

At least another $50 billion is projected for the rest of the month, and the activity is spilling over to junk bonds and leveraged loans as well. With more than $16 trillion of bonds in Europe and Asia paying negative yields, investors worldwide are snatching up debt that offers relatively higher returns, keeping demand strong in the United States.

"This is a great time for companies to refinance," Christian Hoffmann, a portfolio manager at Thornburg Investment Management, said. "Financing costs are near all-time lows, so I would not be surprised to see better high-yield companies coming to market and treating debt capital markets like a cheap buffet."

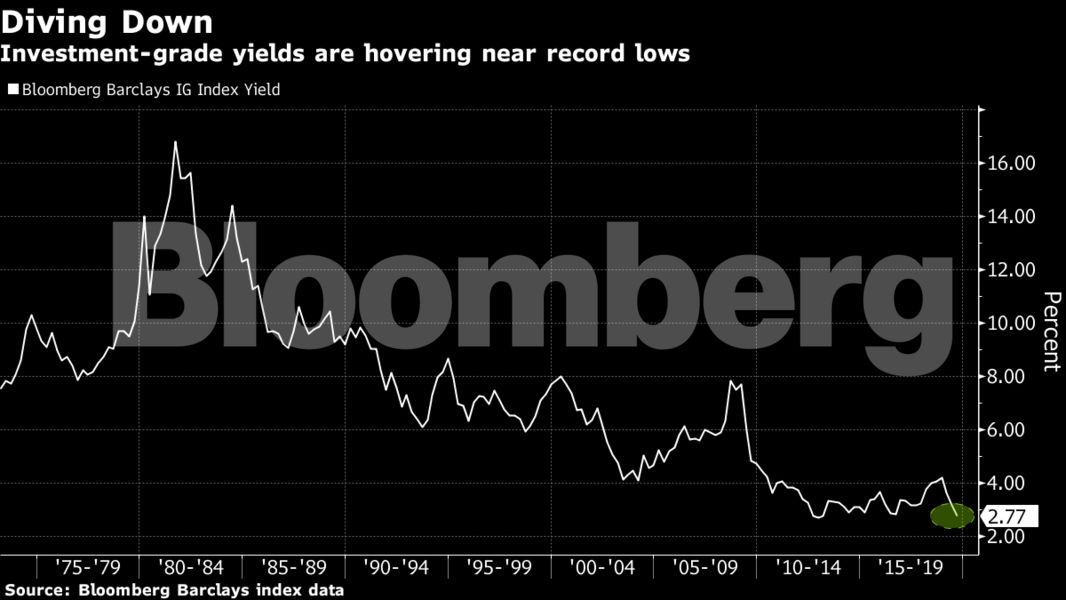

For investment-grade companies, the average yield on bonds was 2.77 percent as of Wednesday, according to Bloomberg Barclays index data. In late November, that figure was above 4.3 percent. For a company selling $1 billion of debt, that amounts to $15.3 million of annual interest savings, before taxes. Junk-bond yields have dropped too, with notes rated in the BB tier, the uppermost high-yield levels, paying a near-record-low 4.07 percent.

It's not clear how long that will last—on Thursday, U.S. Treasury yields surged, with the 10-year note jumping as much as 0.12 percentage point, to 1.59 percent. But for now the bond sales are intense enough to make up for a year that had previously been lackluster. Investment-grade issuance is now down just about 2 percent from the same point last year. In June, the gap was closer to 13 percent.

The recent spate of issuance is the latest surge in corporate debt sales, as companies have ramped up their borrowings to buy back shares and invest in new projects. Investment-grade debt outstanding totaled $5.8 trillion on Wednesday, more than double the level a decade ago.

The prior record for investment-grade bond issuance was $66 billion in the week of Sept. 9, 2013, when Verizon Communications Inc. sold $49 billion of bonds in eight parts, the biggest corporate debt offering ever. Companies now are by and large refinancing maturing debt, instead of funding big new capital projects.

The underwriting fees that the sales are generating are one of the few positives for bank profits that are expected to get hit by falling rates. The refinancing can also translate into greater trading revenues, said Bloomberg Intelligence analyst Arnold Kakuda.

It's a stunning turnaround from late last year, when Scott Minerd, Guggenheim Partners' global chief investment officer, said a selloff in General Electric Co. debt signaled that "the slide and collapse in investment grade credit has begun." While the investment-grade market last year generated losses of 2.5 percent, this year it's up 14.2 percent including both interest and price gains, making it one of the best-performing assets in fixed income.

In the leveraged-loan market, 17 deals totaling more than $16 billion have launched this week, making it the busiest week since October. Investment-grade and high-yield bankers are telling clients that the good times may not last.

"If someone has near-term financing needs, they should be looking to take advantage of this window," said Jenny Lee, co-head of leveraged loan and high-yield capital markets at JPMorgan Chase & Co. "Things potentially could shut down or get more difficult as we head toward the back half of this year."

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.