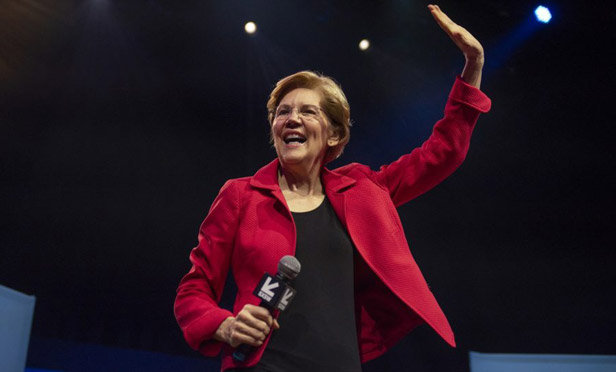

Sen. Elizabeth Warren, D-Mass., vows to restore the Labor Department's vacated fiduciary rule if she is elected president.

In a 14-page labor manifesto released Thursday, Warren states that as part of her plan to defend worker pensions and other retirement savings, she will restore the Labor Department's fiduciary rule that was vacated by the U.S. Court of Appeals for the 5th Circuit "that the Trump administration delayed and failed to defend in court, so that brokers can't cheat workers out of their retirement savings."

A coalition of industry groups fought the rule in court, arguing that the rule was inconsistent with existing laws; that Labor had overreached to regulate services and providers beyond its authority; that Labor was imposing legally unauthorized contract terms to enforce the new regulations and violating the First Amendment; and that the rule gave arbitrary and capricious treatment to variable and fixed indexed annuities. The 5th Circuit found merit in many of these arguments, and the Trump Labor Department did not appeal.

Warren says her administration will also "recognize the value of defined-benefit pensions, and on multiemployer pensions, I will push to pass the Butch-Lewis Act to create a loan program for the most financially distressed pension plans in the country."

She vows to "work with labor leaders, policy experts, fund counsel, actuaries, and benefits specialists to improve the pension system and to devise policy for financially challenged plans that are not in immediate distress."

As to workplace retirement plans, Warren pledged to examine reforms to laws like the Employee Retirement Income Security Act (ERISA) and the National Labor Relations Act so that "they do not preempt positive experimentation by states and municipalities around issues of economic security and worker benefits," Warren said. "Strategic revisions to these federal statutes could promote the ability of states and cities to improve conditions for workers without weakening substantive worker protections."

While the proposal does not specify which policy areas Warren is referring to, the American Retirement Association (ARA) states in a recent brief that "one likely area is the efforts by various states and cities (including New York City) to require private sector employers that do not offer retirement plan coverage to participate in a state- or city-run auto-IRA or similar program for their workers."

Said ARA: "While other candidates have put forward various labor-related proposals, Warren's appears to be the first among the leading Democratic presidential candidates to address ERISA preemption, and it adds a new salvo in the ongoing debate over whether such plans are preempted."

From: BenefitsPro

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.