More than 70 percent of today's retirees say they have "no idea what they would do" without Social Security, but younger working generations fear the program won't be available when they retire, according to Wells Fargo's 10th annual retirement study.

That's one of the key findings of the study, which examines attitudes and savings of working adults and retirees based on an online survey of 2,708 workers (ages 18 to 75) and 1,004 retirees.

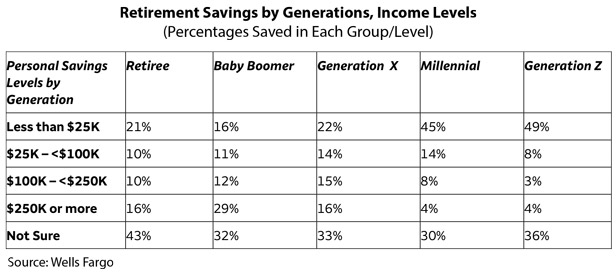

The survey found that more than 8 in 10 retirees fund their retirement primarily with Social Security or a pension, while far fewer millennials (25 percent) and Generation Xers (37 percent) expect to do the same when they retire. Both younger generations, along with even-younger Generation Z, anticipate that 401(k) or IRA assets will be their primary funding source in retirement, contributing around 40 percent or 45 percent.

The ability of workers in any of these groups to save for retirement will be hampered by the amount of debt they hold, according to the survey. Sixty-seven percent of workers paying student loans say that burden is an obstacle to saving for retirement, and 31 percent of millennials—along with about 25 percent of workers in Gen X or Gen Z—say they have an "unmanageable amount of debt."

What these and all other workers need to do to save enough for retirement is to adopt a "planning mind-set," Wells Fargo says. It involves setting long-term financial goals and working diligently to achieve them, starting to save for retirement early, and developing a financial plan.

Only 35 percent of workers surveyed have adopted a planning mind-set, but those who have are nearly twice as confident that they will ultimately save enough for retirement, two and a half times more likely to have a strong sense of control over their debt situation, and five times more likely to have a plan for handling the unexpected.

There are emotional benefits to that way of thinking. People who have adopted a planning mind-set are happier than those who have not, more comfortable talking with a spouse about financial matters, and far less likely to be divorced, according to Fredrik Axsater, head of strategic business segments at Wells Fargo Asset Management, at a media luncheon to discuss the study's findings.

"When people have a planning mind-set, extraordinary things happen," said Axsater.

Despite these findings, more workers today than in years past are confident that they will have enough money saved for retirement—67 percent, which is the highest level since 2004, according to Lori Lucas, president and CEO of the Employee Benefit Research Institute. About 45 percent are confident about Medicare and Social Security, a level not seen in more than 25 years.

On the negative side, many workers expect to remain in debt throughout their lives: 52 percent of millennials, 43 percent of Gen Xers, and 34 percent of boomers, said Lucas.

"Debt a is a problem across all generations and a tough challenge," said Zar Toolan, head of advice and research at Wells Fargo Advisors. Many people are struggling with choosing between investing money and paying down debt, but "it's never too early to start saving for retirement," said Toolan.

It's a crucial issue for all generations, and 8 out of 10 workers believe retirement policy should be a top priority for all presidential candidates, Axsater said.

From: ThinkAdvisor

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.