Boeing Co. has received orders of about $14 billion from around 20 banks for a loan that will give the planemaker more financial flexibility to manage the fallout from its grounded 737 Max jetliners, according to people familiar with the matter.

On an earnings call this morning, Boeing said it had received enough commitments to enter into a $12 billion term-loan facility. "Based on the strong demand, the size of facility could exceed this amount when the transaction closes in February," said CFO Greg Smith.

The loan deal is expected to close on February 6, the people said. It was initially marketed at a size of $10 billion with potential to grow.

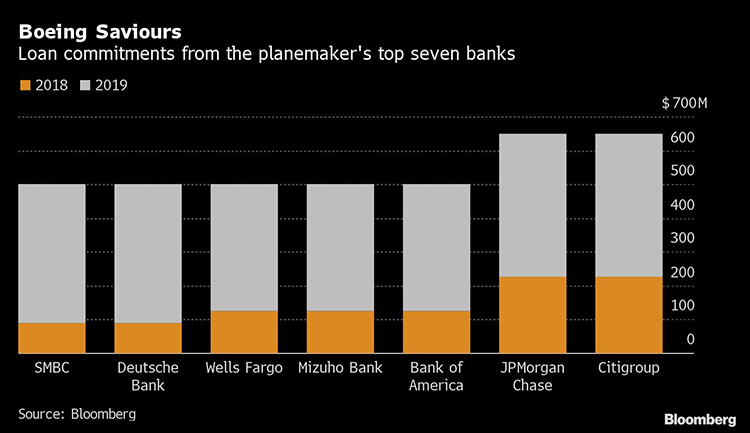

A representative for Citigroup Inc., which is leading the financing, declined to comment. A spokesperson for Boeing also declined to comment.

Boeing revealed on Wednesday that total costs for the grounded planes will surpass $18 billion when the tab for restarting production later this year is included. The company's taking a $2.6 billion pretax write-down to compensate airlines for ballooning losses from a global flying ban that's expected to stretch to midyear. Deferred production costs also grew by $2.6 billion, clipping the jet's long-term profit potential, Boeing said in a presentation Wednesday. That's on top of more than $9 billion in Max-related costs already disclosed.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.