Toyota Motor Corp. is borrowing US$2.5 billion through its finance company to help support the sale of clean cars, marking the first U.S. corporate green bond deal this year.

Toyota Motor Credit Corp. is selling the debt in as many as three parts, according to a person with knowledge of the matter. Only the 10-year security will be green, and it will yield 65 basis points (bps) above Treasuries, after initially discussing in the high 70 bps range, the person said, asking not to be identified as the details are private. Toyota will cap the green portion of the deal at $750 million, the person said.

The proceeds of the other securities—a floating-rate note due 2021 and five-year fixed-rate bond—will be used for general corporate purposes, the person said.

Toyota has outlined a green bond program that will help finance new loans and lease contracts for eligible Toyota and Lexus vehicles, such as gasoline-electric hybrids like the Prius. Monday's issuance will add to the $5.3 billion of green bonds that Toyota Motor Credit had issued through the end of 2019.

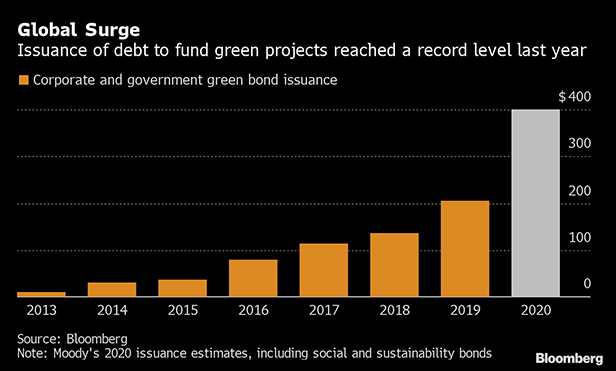

The deal marks the first U.S. corporate green bond of the year, according to data compiled by Bloomberg. Corporations and governments globally borrowed a record $204 billion worth of green bonds last year, from about $136 billion in 2018, the data show. Combined with sustainability debt, issuance is expected to climb to $400 billion this year, according to Moody's Investors Service.

BNP Paribas SA, Citigroup Inc., Credit Agricole SA, JPMorgan Chase & Co. and Mizuho Financial Group Inc. are managing Toyota Motor Credit's bond sale, the person said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.