Borrowing in Europe is so cheap that U.S. companies including Dow Chemical Co. are looking at selling bonds there for the first time in years, or even ever.

The chemical company began meeting with investors in Europe last week about a possible bond sale in as many as three parts, according to people with knowledge of the matter. Investors and strategists are trying to figure out which other corporations will follow suit.

Barclays believes that energy company Exxon Mobil Corp. and hard-drive maker Seagate Technology may be among the next borrowers. Exxon Mobil and Seagate declined to comment. Dow and its units haven't had euro-denominated debt outstanding since 2014, according to data compiled by Bloomberg.

Determining which companies are next can give investors a good payoff: When a corporation that doesn't have euro-denominated bonds outstanding decides to tap that market, risk premiums on its U.S. bonds will often shrink relative to the index, according to Barclays strategists. Money managers are paying attention.

"Any dollar of issuance that ends up in another currency obviously helps reduce supply of U.S. corporate debt," said Steven Boothe, a high-grade portfolio manager at T. Rowe Price, which oversees around $1.2 trillion in assets. "If the trend continues, that helps support returns in the U.S. market."

Companies are drawn to Europe's rock-bottom yields right now. The continent's central bank is vacuuming up corporate bonds to help stimulate the economy, having bought more than 1 billion euros (US$1.1 billion) of notes in three of the last four weeks. That's helped pull average yields on investment-grade euro-denominated corporate bonds down to around 0.36 percent, as of last Wednesday, according to Bloomberg Barclays index data—near record lows. In the United States, that figure was closer to 2.6 percent last Tuesday.

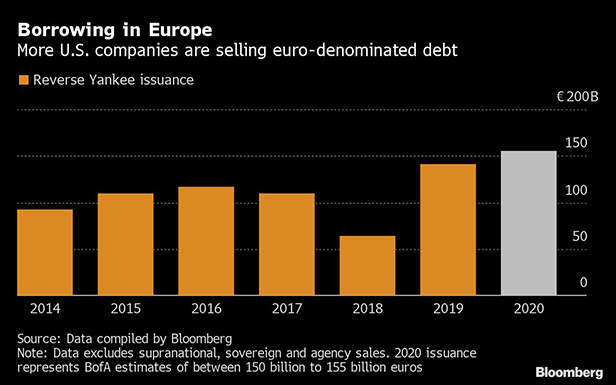

American corporations have been flocking to the euro market for months. U.S. companies sold 131 billion euros of the bonds known as "reverse Yankees" last year, the most on record, according to Bank of America Corp. That figure may jump to between 150 billion to 155 billion euros this year, the bank said.

International Business Machines Corp. last week brought a three-part jumbo deal to the euro investment-grade market, selling 3.75 billion euros ($4.1 billion) of notes total maturing in 8, 12, and 20 years. It borrowed relatively cheaply—the 0.3 percent coupon it paid on its eight-year euro notes is far less than the roughly 2.3 percent yield on older U.S. notes it has that mature in August 2027. The technology services company is a frequent borrower in euros.

The additional cash flow that corporations get from cheaper borrowing costs can be used to de-lever their balance sheets, according to Arvind Narayanan, senior portfolio manager on Vanguard's active investment-grade credit strategies. Vanguard oversees $6.2 trillion in assets.

"This is very constructive for the U.S. dollar corporate bond market, and we expect more and more of these," said Narayanan in a telephone interview.

'No-Brainer'

To find companies that might be next, Barclays looked at corporations with U.S. investment-grade notes outstanding, and some euro-denominated revenue, which gives them money to pay liabilities in the single currency. First-time issuers, which accounted for 20 percent of reverse-Yankee supply last year, are bringing larger deals than in the past, Barclays strategists led by Shobhit Gupta wrote in a report in late January.

Some companies are also borrowing for longer than they have historically. In 2019, the investment-grade euro-denominated market saw eight 30-year bonds, the first time companies have really been able to borrow for that long in the currency since 2015, Barclays wrote.

Comcast Corp. sold a five-part deal in euros and sterling last week. It borrowed for as long as 20 years. A "wide open" corporate debt market in Europe means the largest U.S. cable provider—which added $27 billion to its debt pile in 2018 when it took full control of British pay-TV Sky Plc after an intense bidding war—can get access to new sources of funding and liabilities to hedge its assets abroad, according to Hans Mikkelsen, head of high-grade credit strategy at Bank of America.

"It's really kind of a no-brainer for a lot of companies to do this," said Mikkelsen.

Luxury-goods giant and owner of American jeweler Tiffany, LVMH Moet Hennessy Louis Vuitton SE, last week sold its biggest euro bond in almost four years.

"If you had these bonds being issued in U.S. dollars, it might create some additional supply indigestion," said Barry McAlinden, senior fixed-income strategist for the Americas at UBS Global Wealth Management, overseeing $2.6 trillion in assets globally.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.