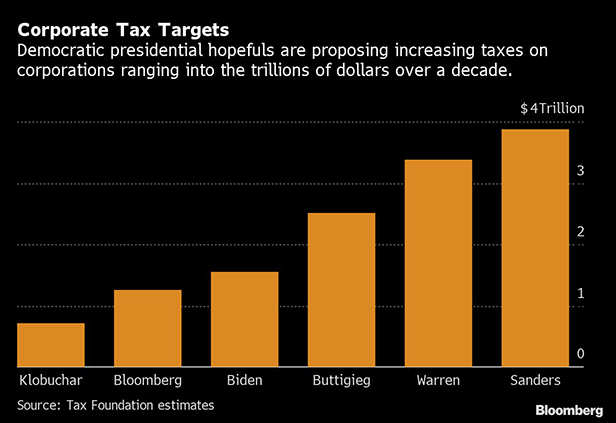

Bernie Sanders would raise taxes on corporations by almost $4 trillion; his plan would generate more revenue than any other Democratic presidential candidate's proposal, according to new estimates from the Tax Foundation.

The major Democratic presidential candidates all agree that the 2017 Republican-backed tax overhaul, which lowered the corporate rate to 21 percent, from 35 percent, went too far. They differ, however, on how much to raise the rate. Proposals range from 25 percent to 35 percent, plus additional surtaxes and reduced corporate tax breaks that add to the total levies companies would face.

Sanders is proposing a 35 percent corporate rate and economic depreciation for investments that would raise taxes on corporations by $3.87 trillion over a decade, according to the figures released Wednesday. At the bottom end of the spectrum, Amy Klobuchar's proposal would impose a 25 percent rate that would raise $716 billion over 10 years.

Here's how much revenue the Tax Foundation, a right-leaning policy institute, estimates the candidates' plans would raise over a decade:

Democratic presidential candidates will meet for their next debate tonight in Las Vegas. Nevada holds its caucuses on Saturday, and South Carolina has a primary on February 29.

(Disclaimer: Michael Bloomberg is seeking the Democratic presidential nomination. He is the founder and majority owner of Bloomberg LP, the parent company of Bloomberg News.)

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.