The global credit machine is grinding to a halt.

The US$2.6 trillion international bond market, where the world's biggest companies raise money to fund everything from acquisitions to factory upgrades, has come to a virtual standstill as the coronavirus spreads fear through company boardrooms.

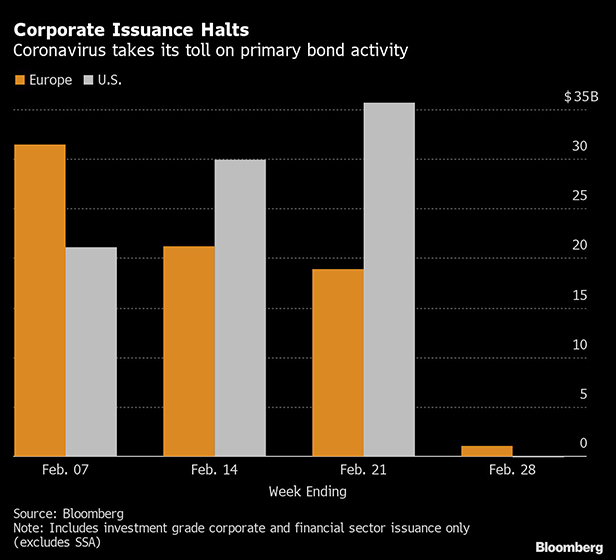

Today, Wall Street banks recorded their third straight day without any high-grade bond offerings—a rarity outside of holiday and seasonal slowdowns, and European debt bankers had their first day of 2020 without a deal. Bond issuance in Asia, where the virus first emerged, has slowed to a trickle.

This is a remarkable turn of events for a market where investors had been snapping up almost anything on offer amid a global dash for yield. Europe had been enjoying its strongest-ever start to a year for issuance, and sales of U.S. junk bonds have been on the busiest pace in at least a decade.

With so many borrowers having postponed their issuance plans, a calming in global markets could kickstart debt sales again. An informal survey of U.S. high-grade bond dealers today indicates that strong companies with good name recognition among investors may try to sell debt tomorrow if conditions improve. Buyers have been there all along and will be ready to digest the new supply if companies proceed, dealers said.

Credit investors have been rattled by the potential impact on company earnings from disruption caused by the virus, which has seen huge parts of global supply chains shutting down. While markets have yet to see any panic selling, a derivatives index that gauges credit market fear in the U.S. had its biggest jump in more than three years on Monday as investors rushed to hedge against a wider selloff.

"It's a coin toss as to what tomorrow will look like, or even the rest of today," said Tony Rodriguez, head of fixed income strategy at Nuveen. "You have to respect the fact that when you don't have an information advantage to not make any significant moves."

Honeywell International Inc., Virgin Money UK Plc, and Transport for London were among the European borrowers readying deals before financial markets turned hostile. Before the slowdown, Europe had seen 239 billion euros ($260 billion) of bonds sold in January alone.

The U.S. investment-grade market was expecting around $25 billion of sales this week before virus fears froze the market on Monday. Excluding the December holiday season and typical two-week summer hiatus in late August, there hasn't been that long of a break to start the week since July 2018.

Offerings also came to a halt in the U.S. junk-bond market, where $67 billion of sales had been running at the fastest pace since at least 2009, data compiled by Bloomberg show. Mining company Cleveland-Cliffs Inc. sought to break the issuance freeze late today, testing investor demand for a $950 million offering of secured and unsecured notes to refinance an acquisition target's debt. And the Canadian market remained open for business as utility company Hydro One Ltd. raised CAN$1.1 billion (US$827 million) in the largest Canadian dollar bond from a non-financial company this year.

It's a sharp turnaround for primary corporate bond markets around the world, where demand has triggered supply against the backdrop of $14 trillion of negative-yielding debt globally. In the U.S. investment-grade market, $220 billion had priced this year through last week, running about 19 percent ahead of last year's pace. Until this week, European issuers had brought at least 30 billion euros worth of sales for the past six weeks in a row.

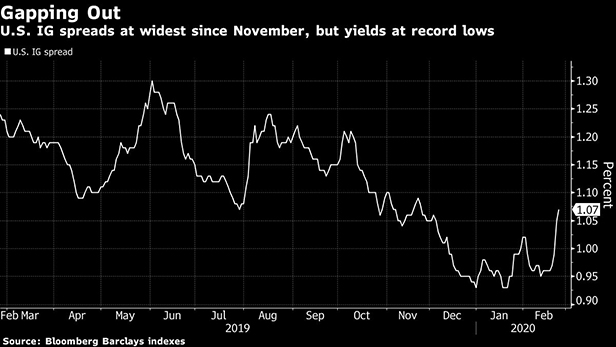

While a dearth of supply is usually a positive technical for the market, all else equal, spreads have widened as demand has fallen off as well. Borrowing premiums on euro-denominated debt jumped to 95 basis points more than government bonds this week, the highest in 2020, according to a Bloomberg Barclays index. The U.S. index climbed to 107 basis points, the most since November.

U.S. high-yield bonds haven't been this cheap on a spread basis since October, but they're still not an attractive buy, given caution on earnings calls, according to Citigroup strategists led by Michael Anderson. The market now trades at 417 basis points over Treasuries, more than a full percentage point wider than on January 13, according to Bloomberg Barclays indexes.

Overall borrowing costs remain very low, however. A rally in U.S. Treasuries has sent all-in yields on U.S. investment-grade debt to record lows. U.S. investment-grade funds have reaped near-record inflows each week this year, as investors seek high-quality income assets. High-yield and leveraged loan funds, however, have seen more outflows.

The number of coronavirus cases continues to climb, with the global death toll nearing 3,000. U.S. health officials have warned citizens to prepare for an outbreak, while South Korea has emerged as a hot spot, with more than 1,000 reported cases there.

The worsening crisis is already taking a toll on companies' balance sheets, with drinks maker Diageo Plc set to book as much as a 325 million-pound (US$422 million) hit to organic net sales. In the U.S., United Airlines Holdings Inc. withdrew its 2020 profit forecast Tuesday, as it can't guarantee its earlier earnings goal.

Some investors are already planning to put money to work once the market reopens, as any sign that the epidemic is stabilizing may prove a fillip for sales, according to Luke Hickmore, investment director at Aberdeen Standard Investments in Edinburgh. And many issuers had planned to tap the market before next week's Super Tuesday, in which several American states will host presidential primary elections and caucuses, so there still is the potential for new deals, said Carl Pappo, chief investment officer of U.S. fixed income at Allianz Global Investors.

"This will likely present some nice opportunities to put cash to work, as the market will demand concessions in this environment," Pappo said.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.