At least one group of investors has gone bargain hunting during the wildest stretch on Wall Street in over a decade.

Corporate executives and officers have been scooping up shares of their own companies at a breakneck pace in the first two weeks of March, exceeding the total of the prior two months. Insider buys are outstripping sales by the most since 2011, data compiled by The Washington Service showed.

"When insiders are buying, they think their companies are well undervalued," said Megan Horneman, director of portfolio strategy at Verdence Capital Advisors, which oversees about $2.5 billion. "It can be a good sign that we're trying to find a bottom around here—not necessarily that it is the bottom, but at least that we're trying to find the bottom here."

With the S&P 500 tumbling as much as 27 percent from its peak through Thursday, the increase in demand from companies' highest-ranking employees could be seen as a vote of confidence in a market that's rattled by fears over the spreading coronavirus. Companies from Apple Inc. to Microsoft Corp. and Mastercard Inc. have slashed their financial guidance, citing the virus outbreak.

At the same time, bargains seem to be emerging after $7 trillion were erased from equity values. At 14.5 times forecast earnings, the S&P 500 is trading at a 14 percent discount to the five-year average.

Just two weeks into this month, almost 1,400 corporate executives and officers have bought shares of their own companies, including Newell Brands Inc. CEO Ravi Saligram and Kinder Morgan Inc. Chairman Richard Kinder. Buyers outnumbered sellers by a ratio of 3-to-2.

After a selloff that sent stocks to the fastest bear market on record, the surging demand is likely soothing to investors who are seeking signs for stabilization. The last time insider buying spiked in this fashion, in July 2011, the S&P 500 was in the middle of a 19 percent retreat before staging a 10 percent rally in each of the next two quarters. Their rush into stocks also coincided with the market bottom in December 2018.

"To the extent that it's executives and board members putting their own money to work, that's encouraging," said Dan Russo, chief market strategist at Chaikin Analytics. "Who knows the company better than the people who run it?"

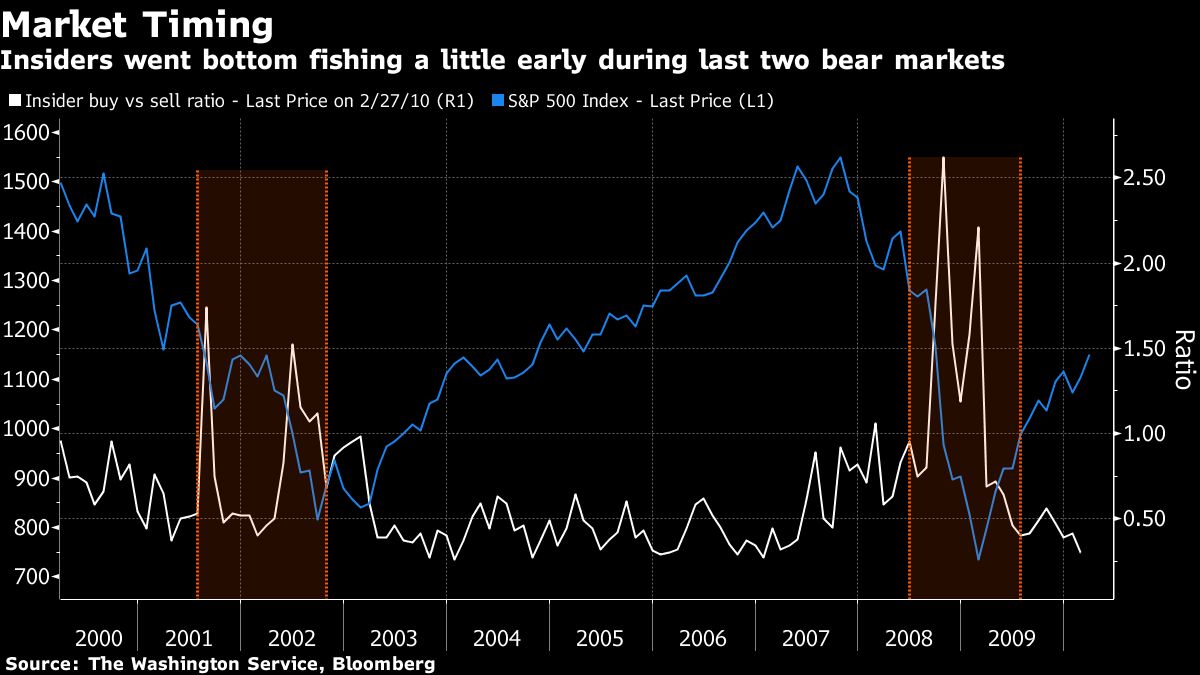

Of course, one could argue that the circumstances today are different because those episodes took place when the bull market was still alive. Look back to the last two market crashes, and insiders tended to be early in picking the bottom.

During the financial crisis, insider buying picked up in October 2008 and then receded while market losses kept piling up. Demand spiked again in February 2009. The next month, stocks started a rally that eventually lasted 11 years into the longest bull market in history.

A similar pattern occurred during the bursting of the internet bubble. The surge in insider buying in August 2001 was met with persistent selling, and they backed off. It's not until June 2002 that insider buying surged again. By then, it's already three months into a bull market.

"It does not tell you anything about the direction of the market because the market will overwhelm any insider buying based on the fear and optimism that swings markets in general every day," said Wayne Wicker, chief investment officer of Vantagepoint Investment Advisers, which had about $30 billion in assets under management as of December 31.

Still, "insiders are a reasonable barometer for the outlook of companies—who better to know what your future prospects may be than the guys that are trying to put together the strategic plan and watching current sales and inventories than senior management?"

–With assistance from Claire Ballentine.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.