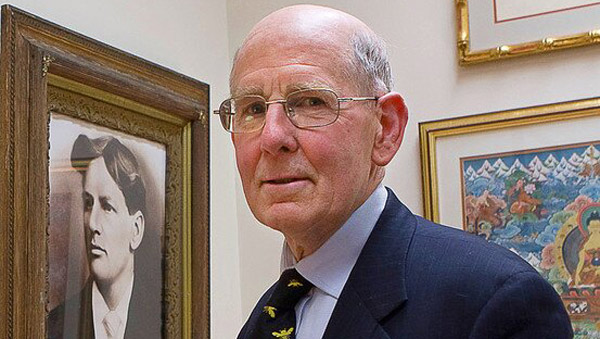

Gary Shilling.

Gary Shilling.

Economist and money manager Gary Shilling, who correctly forecast the global financial crisis of 2008 and the U.S. recession in the mid-1970s, now says the economic fallout from the coronavirus pandemic "all but assures a major global recession."

The global economy was already slowing before the coronavirus hit and now, weeks after economies in China, Iran, and Europe slumped because of its spread, U.S. consumer spending—"the only area of global economic strength"—is faltering due to "the virtual closing down" of many segments of the U.S. economy, writes Shilling in a note he published Monday.

"Weakening economies don't take much of a shock to push them into recession, and the coronavirus shock appears to have done so," writes Shilling. The rapid speed of the virus's spread and the extent of that spread—which remains unknown because millions of people have yet to be tested—"are inducing global panic," he writes.

Across the United States, and in Asia and Europe, daily life has been up-ended because of the pandemic. Schools, stores, restaurants, hotels, and sports arenas have closed. Hundreds of millions of workers, if not more, are working from home—all in an effort to slow the spread of the virus, known as Covid-19. In the U.S., the Centers for Disease Control and Prevention (CDC) has recommended against most gatherings of more than 50 people, and some cities have even imposed curfews.

The economy of China, where the virus originated, is experiencing a devastating decline, with retail sales plunging 20.5 percent during January and February compared with a year ago, industrial output down 13.5 percent, and fixed-asset investment falling nearly 25 percent, according to China's National Bureau of Statistics. Its impact on the global economy is substantial. China's economy now accounts for almost 16 percent of global GDP, about four times its share during the 2003 SARS epidemic, Shilling noted.

Even after the virus runs its course, Shilling says, consumer and business spending will likely remain depressed, in part because consumers who have hoarded food and other items will have to deplete those inventories before buying more.

Shilling expects Treasuries to rally further because of continued fears about the spreading virus and its impact, along with deflation, and he expects stocks will continue to fall. Stocks are "still expensive," based on cyclically adjusted price-to-earnings ratios, which are 46 percent above the long-term average, writes Shilling.

Their continued decline in the face of the Fed's Sunday 1 percent rate cut, pledge to purchase $700 billion worth of Treasuries and mortgage-backed securities, and announced "swap line arrangements" with other central banks "only confirmed the impotence of monetary policy," Shilling says.

From: ThinkAdvisor

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.