The global financial crisis may offer proper guidance on how currency volatility will play out beyond the current market turmoil, even though the two shocks are vastly different in nature.

What seems clear is that investors may need to say goodbye for the foreseeable future to the low-volatility regime in foreign exchange (FX), with hedging throughout 2020 likely to be costly, compared with recent experience.

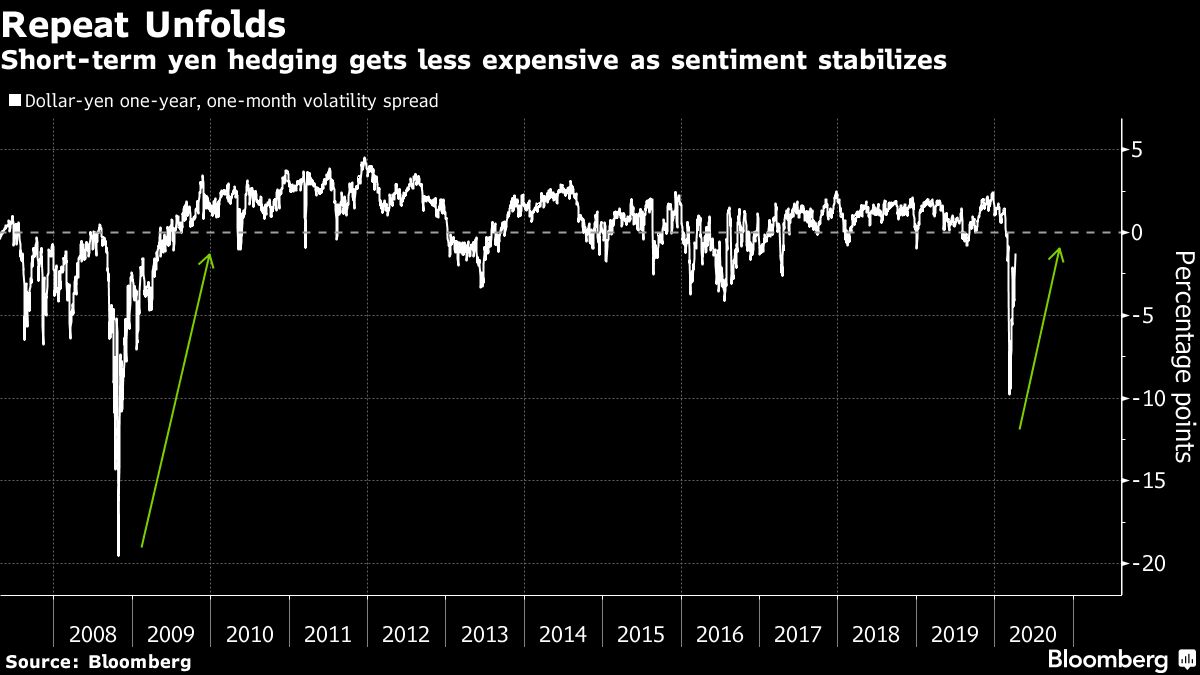

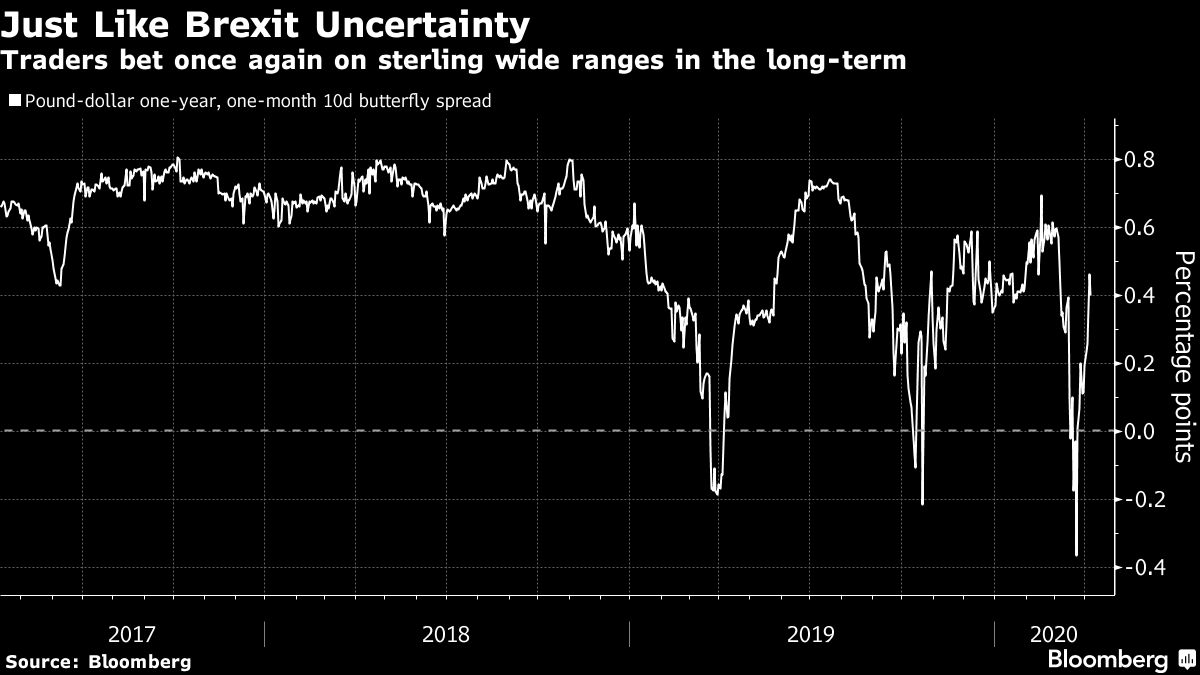

Long-term bets look set to turn more expensive compared with shorter-dated ones, due to the uncertainty surrounding the coronavirus pandemic endgame. That pattern will be reminiscent of the collapse of Lehman Brothers, one of the most emblematic moments of the 2008 crisis.

Once again, monetary and fiscal stimulus has been unleashed in unprecedented size and power. But just as in 2008 and 2009, there will be fear in the market that it may not be enough to alter the longer-term outlook. Investors will be on watch for lurking credit risks, and concerns over funding stresses will remain. Officials have managed to stabilize the markets—for now—yet the enhanced uncertainty creates unease on the outlook on conditions a year from now.

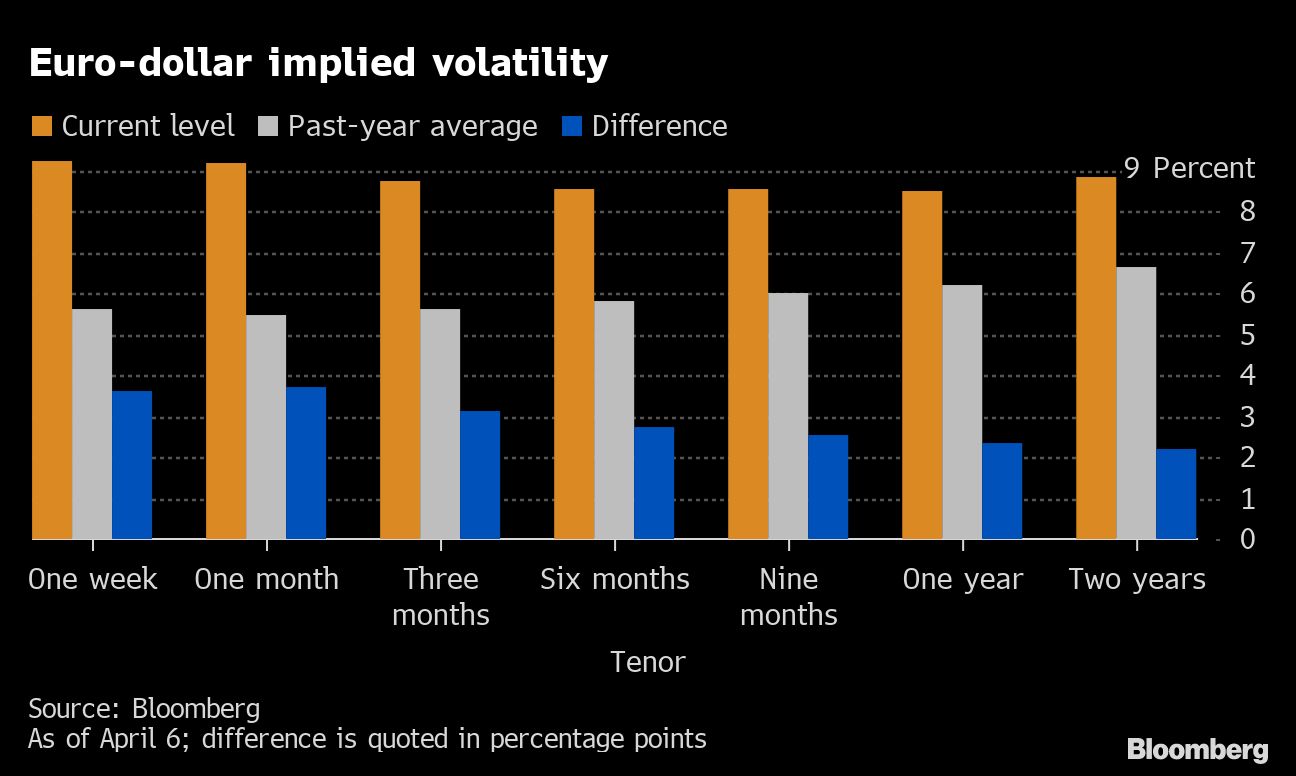

The abrupt shock in the currency volatility space last month resulted in record highs in euro gauges and has been followed by a deep selloff. It's been especially notable on options trades with an expiration date of one week up to one month. Comparing current volatility levels with past-year averages shows that there is still more room for the short-term hedging premium to narrow compared with longer-dated plays.

Already, the so-called inverted volatility term structure in the major currencies—essentially a curve that shows hedging is currently less expensive at longer tenors—has taken a hit. That's a sign investors are becoming less sensitive to coronavirus headlines and are shifting focus to upcoming meetings by policymakers.

Markets are more stable, having priced in the immediate impact of the pandemic. They must now assess how circumstances will change when countries begin to phase out their lockdowns. The risk of a second wave of infections in autumn will probably keep implied volatility in the major currencies higher than the levels seen last year.

That helps explain bets that ranges will widen more on a yearly basis compared with a monthly one, as shown by the pound chart below.

NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.