The rapid onset of the Covid-19 crisis has refocused corporate treasurers on risk, which has become more top-of-mind than ever before. Indeed, the core functions of treasury—cash and liquidity management—are suddenly facing risks that were inconceivable just last quarter. As commerce grinds to a halt around the world because of measures taken to combat the pandemic, corporate treasurers are being asked to fund operations for an indeterminate period of time, with uncertain revenues facing customers, while also scrutinizing creditworthiness in the supply chain as never before.

It is not an exaggeration to say that the survival of many corporations will depend on decisions made by the person sitting in the treasurer's chair. In this environment, risk management poses a significant challenge. The demand shock resulting from shelter-in-place orders around the world may be affecting every business, but that does not mean every firm is equally well-positioned to deal with the challenge.

Companies differ substantially in how they define and manage risks. The risks to a particular organization depend on the nature of the business, its structure, and the preferences of its stakeholders. Public companies often make quarterly or annual public forecasts, and investors hold them accountable to their projections. The forecasts rest on assumptions that provide a benchmark for the treasurer, who may then manage risk to the forecasts. In the current environment, many companies may eschew guidance; nonetheless, their decisions around risk management will become matters of public record, as will the degree to which those decisions are successful. Thus, risk management may influence the company's share price and cost of capital—a major issue in the current environment.

Private companies can have longer time horizons, but their owners often have different sensitivities to risk. A private business owned by a financial firm that is primarily focused on return on equity will have entirely different risk preferences from a private firm owned by a founding family that is concerned primarily with preserving the business for future generations.

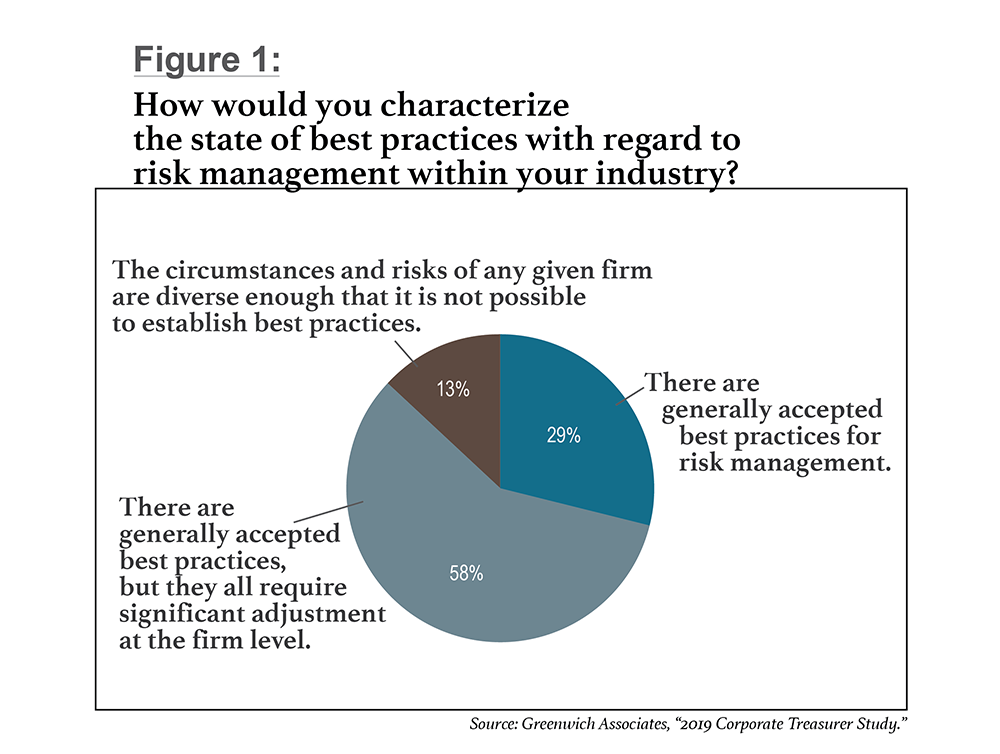

Recent research by Greenwich Associates illustrates that the majority of corporate treasurers believe a company's risk management approach needs to be tailored to its specific business needs—that one company's best practices are not necessarily effective for another business. (See Figure 1.) This lack of consensus on how to address risk management issues bedevils treasurers looking to systematize their operations. It speaks to the complexity of the task, which makes it difficult for external partners to develop solutions and often leaves treasurers to their own devices.

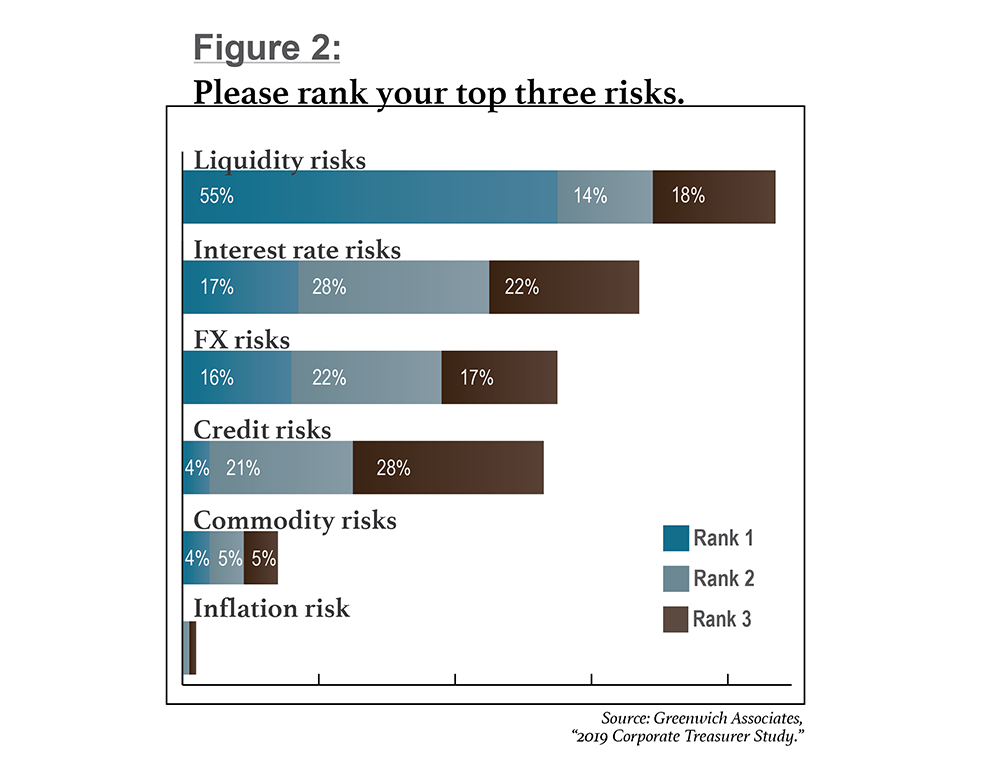

If an absence of universal standards poses corporate risk management challenges in a normal economy, the advent of Covid-19 has up-ended any belief in best practices that risk managers may previously have held. The sudden halt of economic activity throughout much of the United States has no historical precedent, much less best-practice guidelines. In the absence of clear standards for risk mitigation, treasurers must determine exactly what risks they face and what exposures they need to manage. (See Figure 2, below.)

All businesses face liquidity risks, and these have exploded in the wake of the crisis. So much so, in fact, that it could be argued liquidity management is the central risk facing most businesses today. Interest rate risks, which once varied significantly depending on the nature of a company's leverage, will soon become central to many organizations that want to fund operations by tapping debt markets.

Financial risk management concerns are also growing. In addition to the heightened strategic focus on liquidity, treasurers must also manage credit risk much more carefully now. They must be mindful of both credit they extend to their customers and the creditworthiness of their suppliers. Finally, companies that import or export goods, or those with international operations, may find foreign exchange (FX) to be a major source of risk, given the large moves in exchange rates as the world has sought out dollar funding.

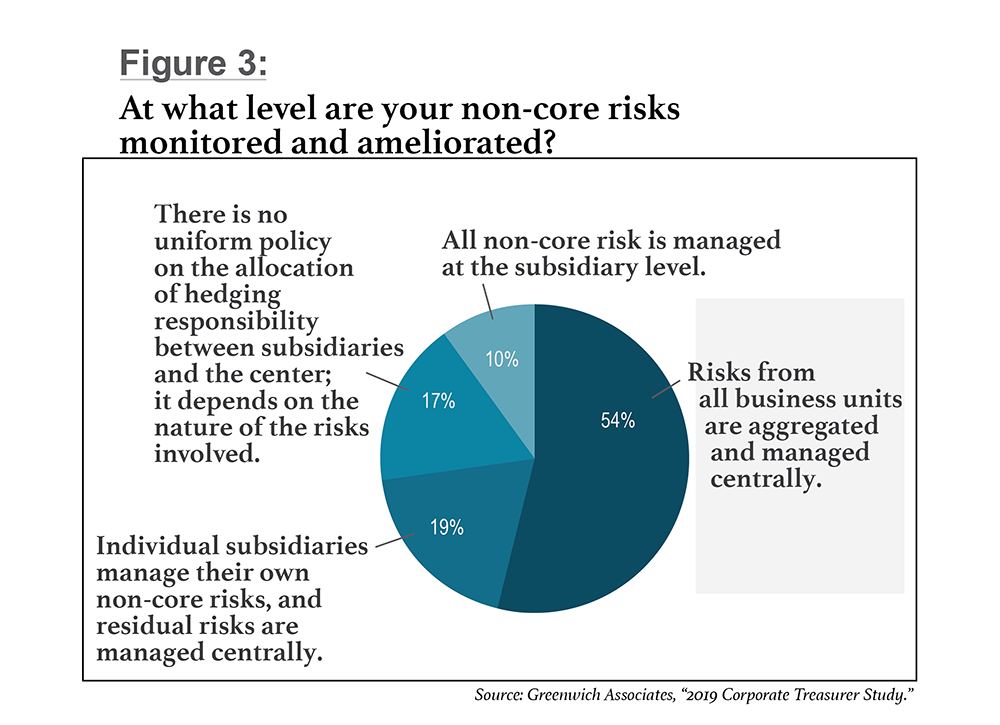

Treasurers also must weigh the structure of the business when thinking about risk. Many large companies separate lines of business into different operating units or subsidiaries. This can create operational efficiencies, but it can also complicate the risk management strategy. The treasurer must decide at what level in the corporate structure to address all the different risks faced by different parts of the company.

Some choose not to have a companywide policy; instead, they manage risks on a case-by-case basis as they arise. In our research, we found that this is the case for a surprisingly large 17 percent of respondents. (See Figure 3, below.)

Another 10 percent said they manage all their risks at the subsidiary level. This approach can make sense for conglomerates in which the different operating units have few synergies. Decentralization of risk management works for some companies, but it is a minority view. Most companies systematize and centralize at least some of their risks.

Just under 20 percent of the treasurers in our sample manage as much risk as possible at the subsidiary level, then pass residual risks on to the central treasury group to manage. This makes sense because there are economies of scale to achieve in risk management. Risks generated in different parts of the company may offset one another, and companies that aggregate risks can negotiate better terms with their trading counterparties. Presumably for these reasons, a slight majority of companies in our study aggregate their risks and manage them centrally.

However, this is not a panacea; centralization carries its own risks. For example, ensuring that data arrives from the subsidiaries on time can be extremely difficult. And if mismanaged, risk information received from far-flung business units can lead to errors. To achieve the scale and control that centralization can offer, businesses need to devote significant thought and resources to the process of centralization.

Companies can best understand the spectacular shock of Covid-19 in this context: There is no such thing as risk management "best practice." Each corporate treasurer is facing a similar external shock, but everyone has to manage that shock within the context of her own specific business and with regard to the desires of her stakeholders.

The coming quarters are going to press treasurers to their limits. Treasury groups are going to need to work more closely than ever before with both internal and external partners. Tapping into resources with deep risk management expertise can help a treasury team understand whether their risk management practices are truly the best choice, considering the unique characteristics and circumstances of their organization.

See also:

- How to Initiate a Risk-Hedging Program

- Covid-19 Supply-Chain Disruption

- Incorporating Expectations into Hedging Decisions

- Emerging Risks: Get Ahead of the Unexpected

- Assessing the Impact of the Fed's Interest Rate End Game

Kenneth Monahan is a senior analyst at Greenwich Associates.

Kenneth Monahan is a senior analyst at Greenwich Associates.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.